Investors are increasingly convinced that the cyclical and Great Rotation trade is very real and long-lasting (see Everything you need to know about the Great Rotation but were afraid to ask). That should be bullish for the S&P 500, right?

Well, sort of.

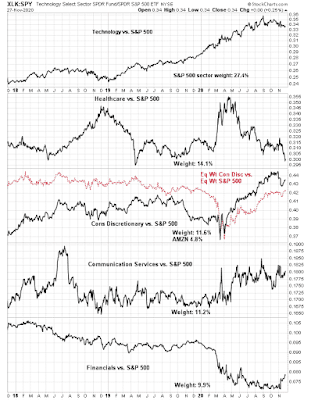

Despite the cyclical and reflationary tailwinds for stocks, the S&P 500 has a weighting problem. About 44% of its weight is concentrated in Big Tech (technology, communication services, and Amazon). The top five sectors comprise nearly 70% of index weight, and it would be difficult for the index to meaningfully advance without the participation of a majority of these sectors. However, an analysis of the relative performance of the top five sectors does not exactly inspire confidence as to the sustainability of an advance. Technology relative strength, which is the biggest sector, is rolling over. Healthcare is weak. Neither consumer discretionary nor communication services are showing any signs of leadership. Only financial stocks, which represent the smallest of the top five sectors, is exhibiting some emerging relative strength.

There are better investment opportunities, and investors can potentially outperform by a cumulative 50-250% over the next 2-3 years.

The full post can be found here.