Medical device company Artivion (NYSE: AORT) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 19.2% year on year to $116 million. On the other hand, the company’s full-year revenue guidance of $495 million at the midpoint came in 1% above analysts’ estimates. Its non-GAAP profit of $0.17 per share was in line with analysts’ consensus estimates.

Is now the time to buy Artivion? Find out by accessing our full research report, it’s free.

Artivion (AORT) Q4 CY2025 Highlights:

- Revenue: $116 million vs analyst estimates of $117 million (19.2% year-on-year growth, 0.8% miss)

- Adjusted EPS: $0.17 vs analyst estimates of $0.18 (in line)

- Adjusted EBITDA: $22.72 million vs analyst estimates of $22.67 million (19.6% margin, in line)

- EBITDA guidance for the upcoming financial year 2026 is $107.5 million at the midpoint, above analyst estimates of $106.5 million

- Operating Margin: 9.2%, up from 2.7% in the same quarter last year

- Free Cash Flow was -$7.95 million, down from $8.71 million in the same quarter last year

- Market Capitalization: $1.9 billion

"We are very pleased with our strong performance for the full year 2025 as we drove 13% adjusted constant currency revenue growth and 26% adjusted EBITDA growth, while making substantial progress in advancing our Aortic focused product development pipeline. Our success continued through the fourth quarter, during which revenue growth was driven by year-over-year growth in stent grafts of 44%, On-X of 25%, and preservation services of 6%, all compared to the fourth quarter of 2024. On an adjusted constant currency basis, fourth quarter year-over-year stent grafts, On-X, and preservation services, grew 36%, 24%, and 6% respectively," said Pat Mackin, Chairman, President, and Chief Executive Officer.

Company Overview

Formerly known as CryoLife until its 2022 rebranding, Artivion (NYSE: AORT) develops and manufactures medical devices and preserves human tissues used in cardiac and vascular surgical procedures for patients with aortic disease.

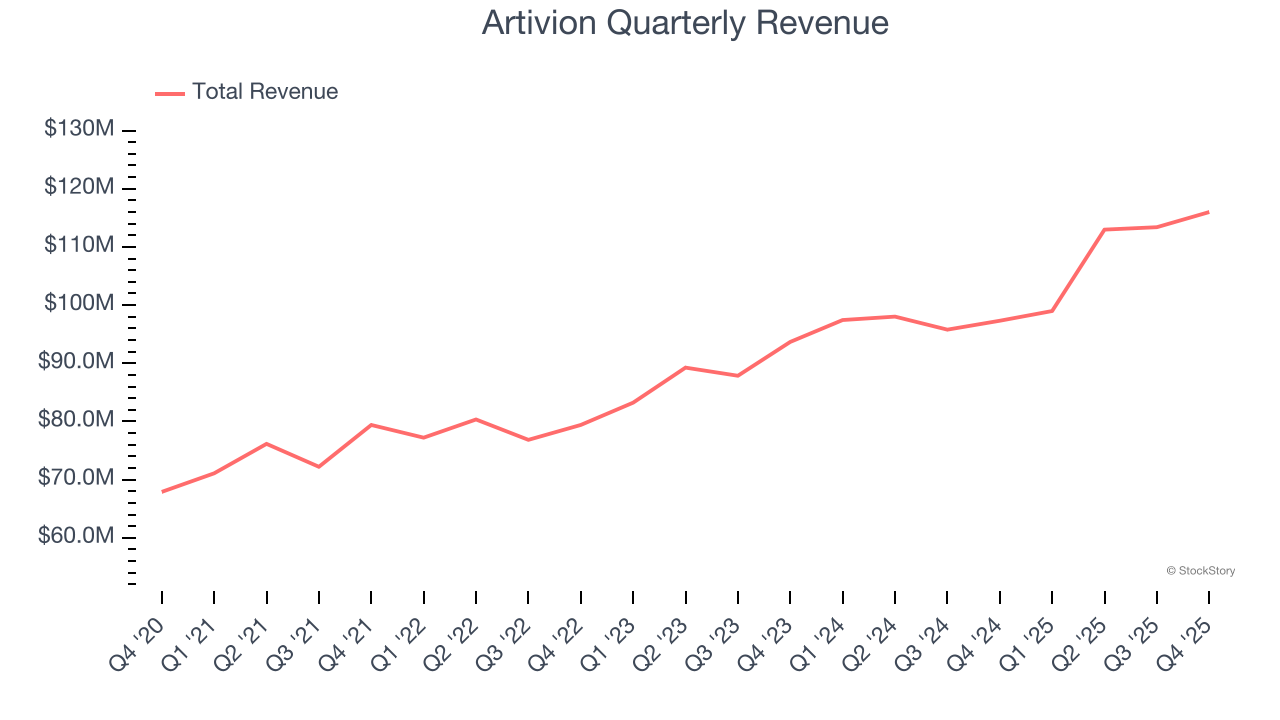

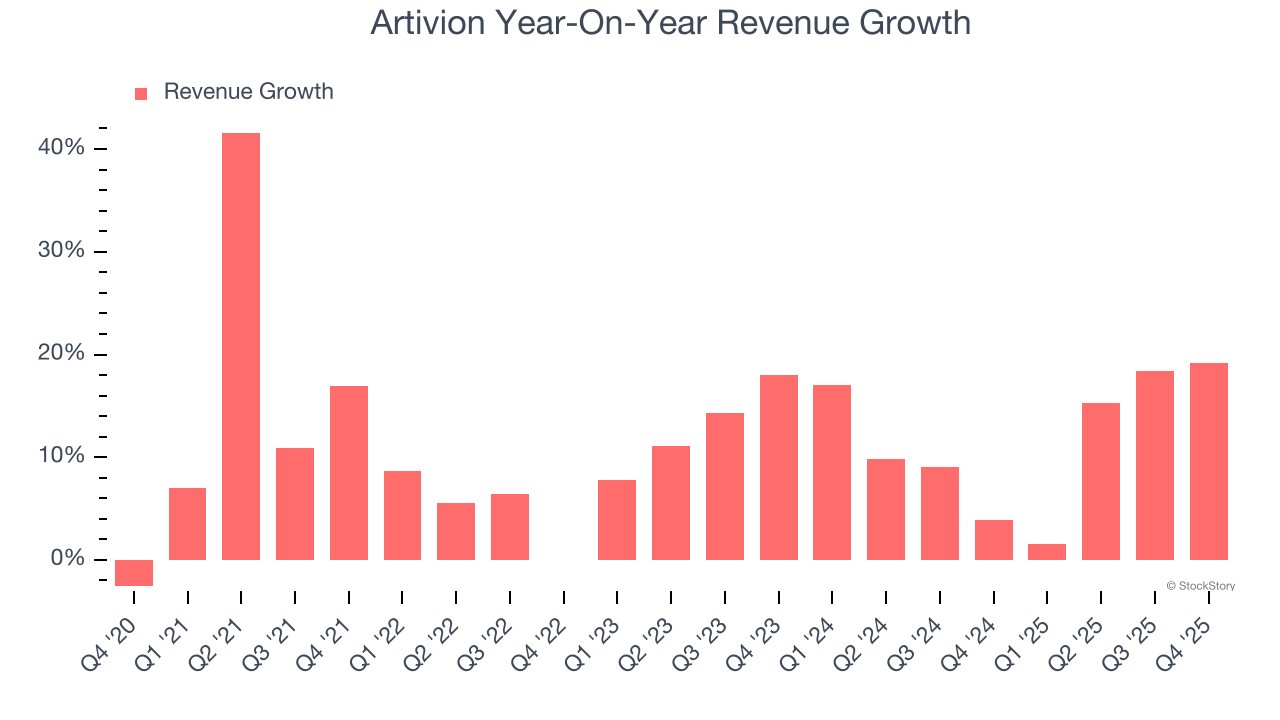

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Artivion grew its sales at a decent 11.8% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Artivion’s annualized revenue growth of 11.7% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, Artivion’s revenue grew by 19.2% year on year to $116 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.3% over the next 12 months, similar to its two-year rate. This projection is noteworthy and suggests the market is baking in success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

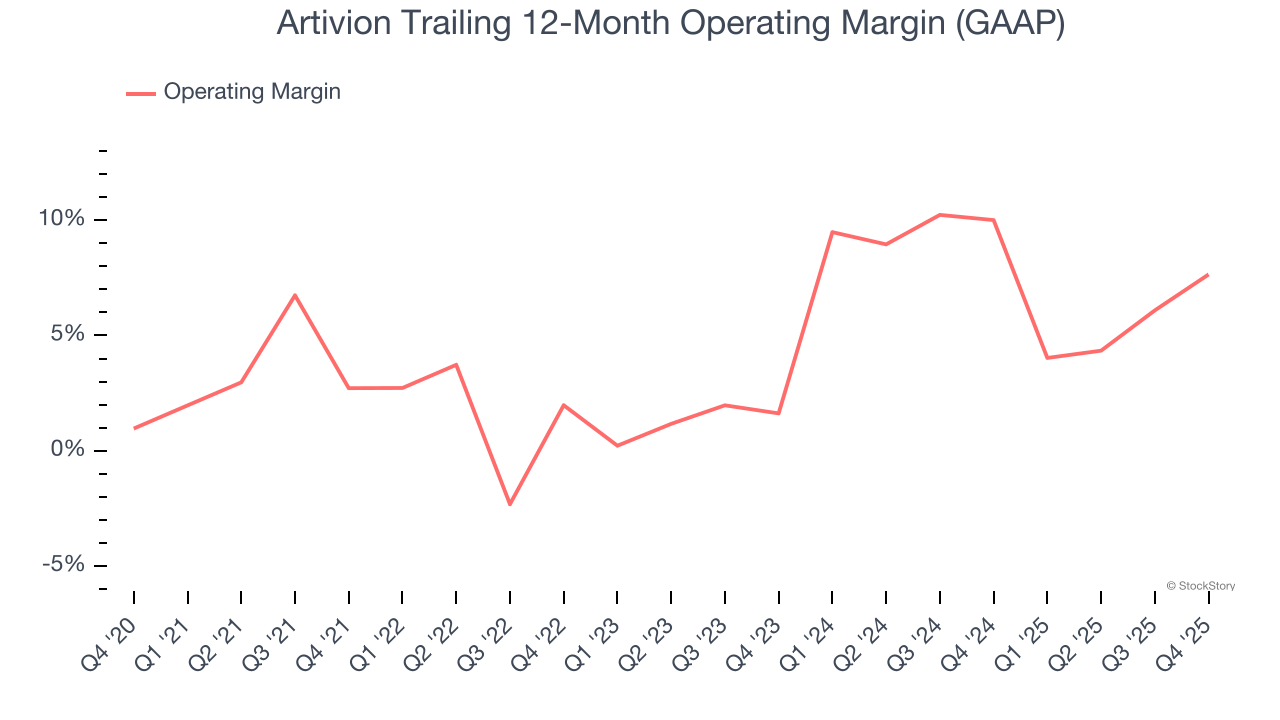

Operating Margin

Artivion was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.2% was weak for a healthcare business.

On the plus side, Artivion’s operating margin rose by 4.9 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 6 percentage points on a two-year basis.

In Q4, Artivion generated an operating margin profit margin of 9.2%, up 6.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

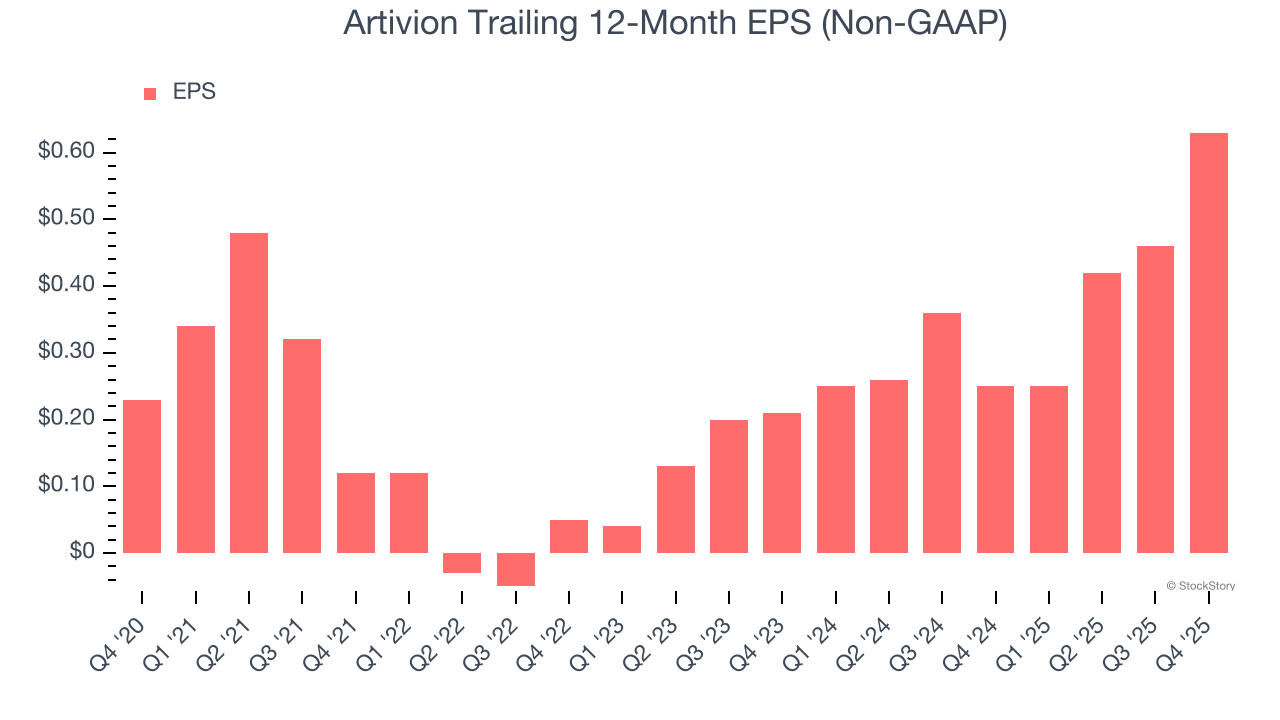

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Artivion’s EPS grew at an astounding 22.3% compounded annual growth rate over the last five years, higher than its 11.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Artivion’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Artivion’s operating margin expanded by 4.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Artivion reported adjusted EPS of $0.17, up from $0 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Artivion’s full-year EPS of $0.63 to grow 35.7%.

Key Takeaways from Artivion’s Q4 Results

It was good to see Artivion provide full-year revenue guidance that slightly beat analysts’ expectations. On the other hand, its EPS was in line and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.6% to $39.61 immediately following the results.

Artivion’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).