Digital imaging and instrumentation provider Teledyne (NYSE: TDY) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.3% year on year to $1.61 billion. Its non-GAAP profit of $6.30 per share was 8% above analysts’ consensus estimates.

Is now the time to buy Teledyne? Find out by accessing our full research report, it’s free.

Teledyne (TDY) Q4 CY2025 Highlights:

- Revenue: $1.61 billion vs analyst estimates of $1.57 billion (7.3% year-on-year growth, 2.5% beat)

- Adjusted EPS: $6.30 vs analyst estimates of $5.83 (8% beat)

- Adjusted EBITDA: $423 million vs analyst estimates of $396.3 million (26.2% margin, 6.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $23.65 at the midpoint, in line with analyst estimates

- Operating Margin: 20.4%, up from 15.8% in the same quarter last year

- Free Cash Flow Margin: 21%, similar to the same quarter last year

- Market Capitalization: $26.59 billion

Company Overview

Playing a role in mapping the ocean floor as we know it today, Teledyne (NYSE: TDY) offers digital imaging and instrumentation products for various industries.

Revenue Growth

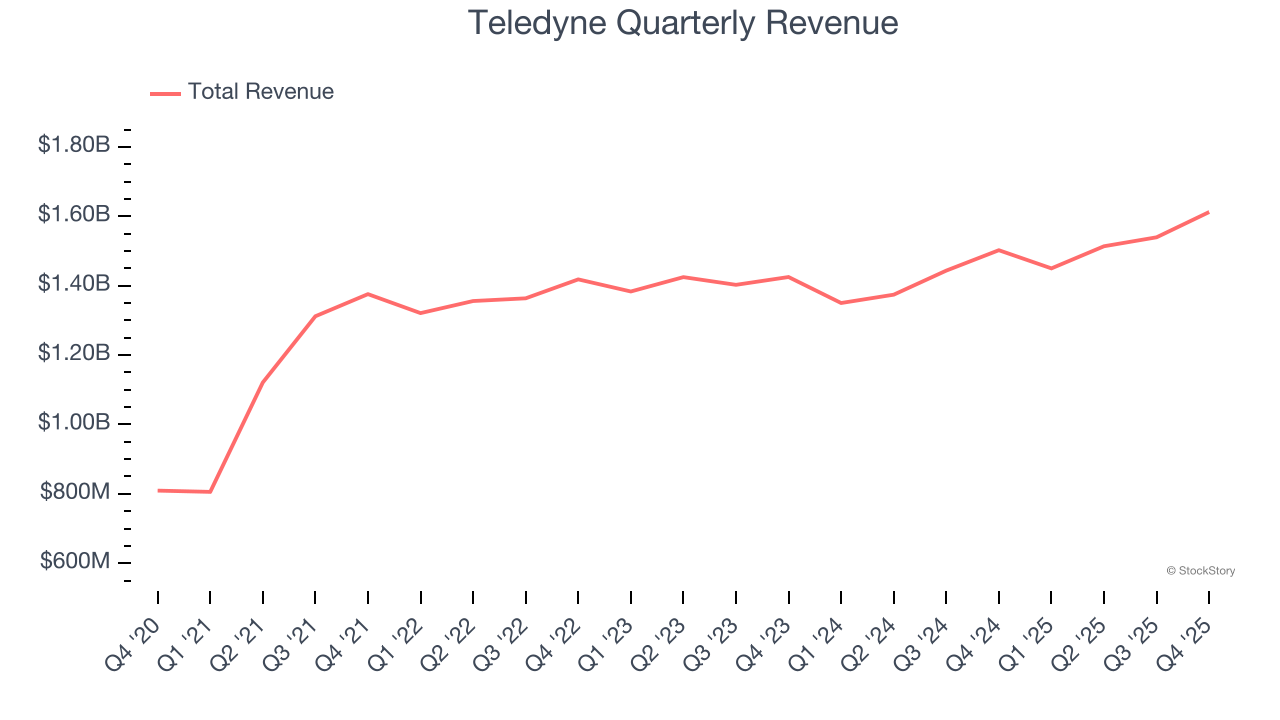

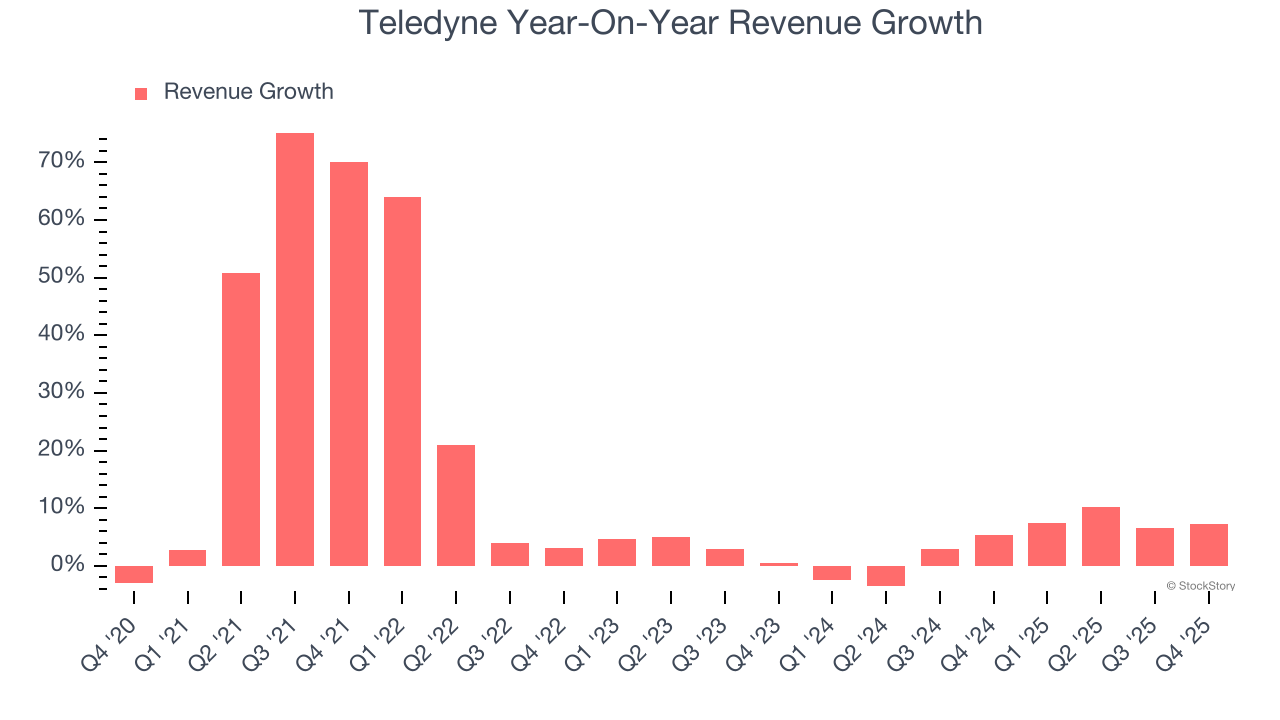

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Teledyne’s 14.7% annualized revenue growth over the last five years was exceptional. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Teledyne’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.2% over the last two years was well below its five-year trend.

This quarter, Teledyne reported year-on-year revenue growth of 7.3%, and its $1.61 billion of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

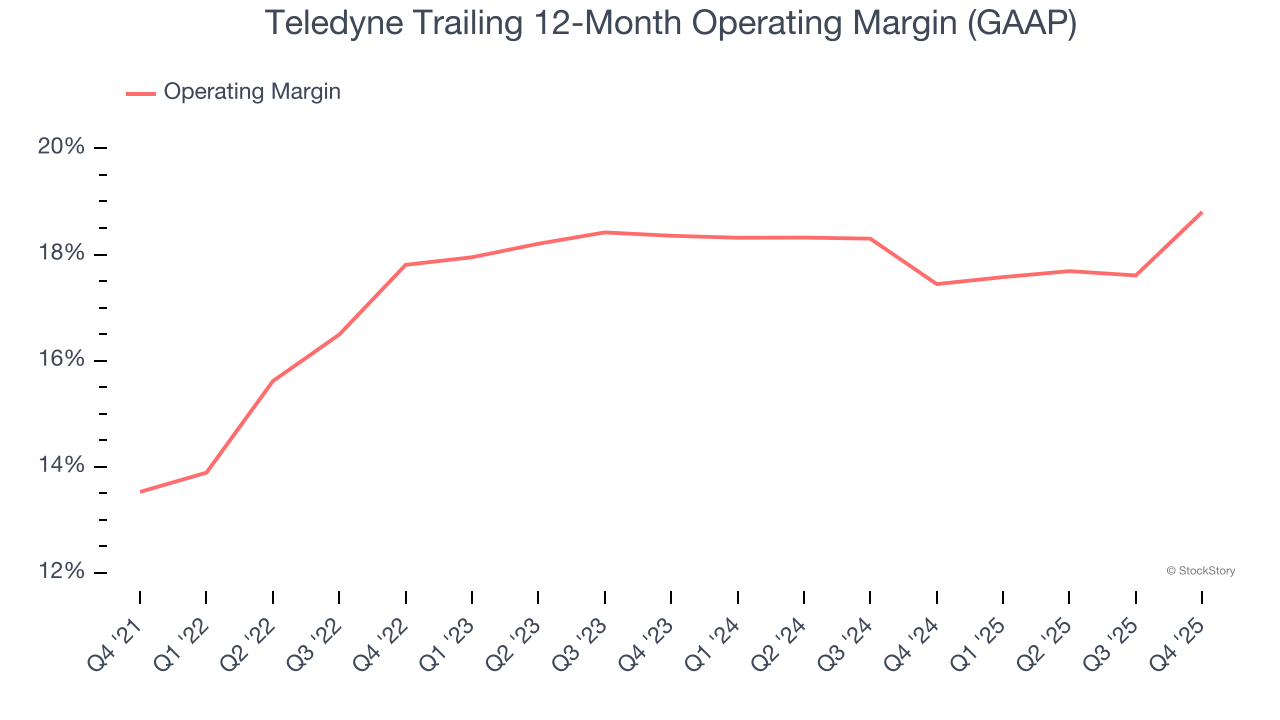

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Teledyne has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Teledyne’s operating margin rose by 5.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Teledyne generated an operating margin profit margin of 20.4%, up 4.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

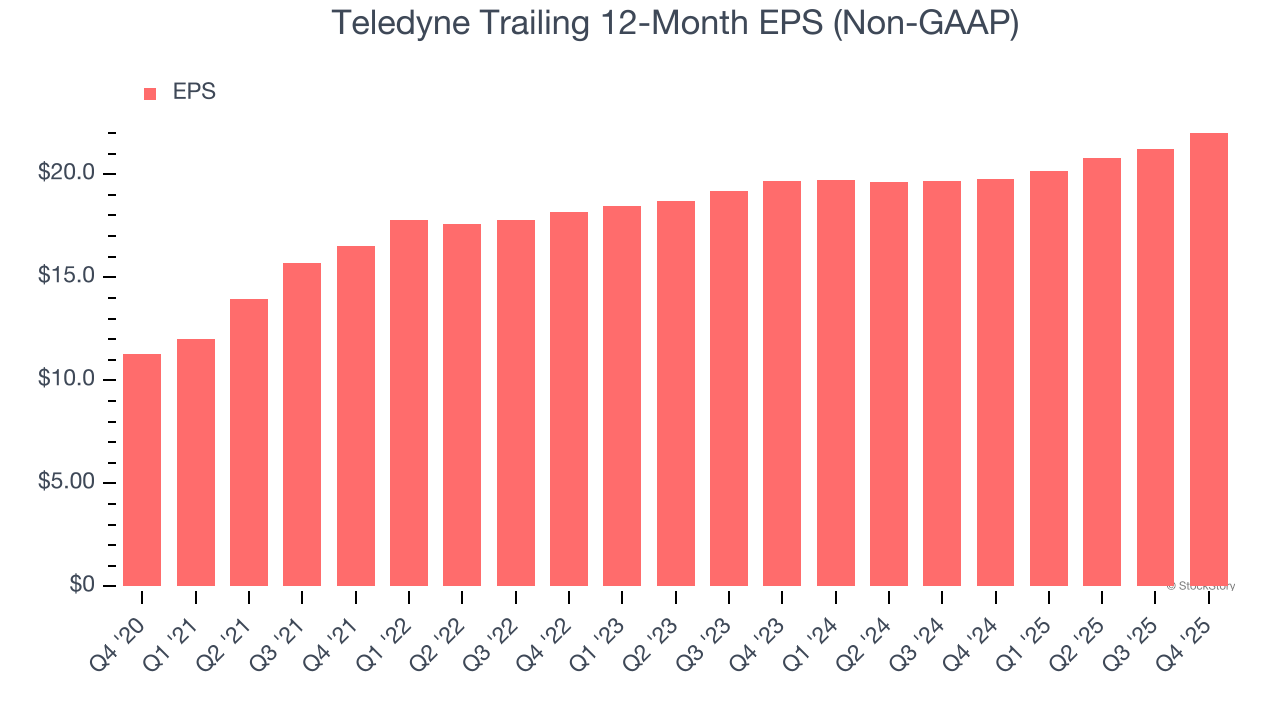

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Teledyne’s remarkable 14.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Teledyne, its two-year annual EPS growth of 5.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Teledyne reported adjusted EPS of $6.30, up from $5.52 in the same quarter last year. This print beat analysts’ estimates by 8%. Over the next 12 months, Wall Street expects Teledyne’s full-year EPS of $22.02 to grow 6.9%.

Key Takeaways from Teledyne’s Q4 Results

We enjoyed seeing Teledyne beat analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock remained flat at $568.96 immediately following the results.

Sure, Teledyne had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).