Over the last six months, Lancaster Colony’s shares have sunk to $172.87, producing a disappointing 9.3% loss - a stark contrast to the S&P 500’s 5.3% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Lancaster Colony, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Lancaster Colony Not Exciting?

Even with the cheaper entry price, we don't have much confidence in Lancaster Colony. Here are three reasons why you should be careful with LANC and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

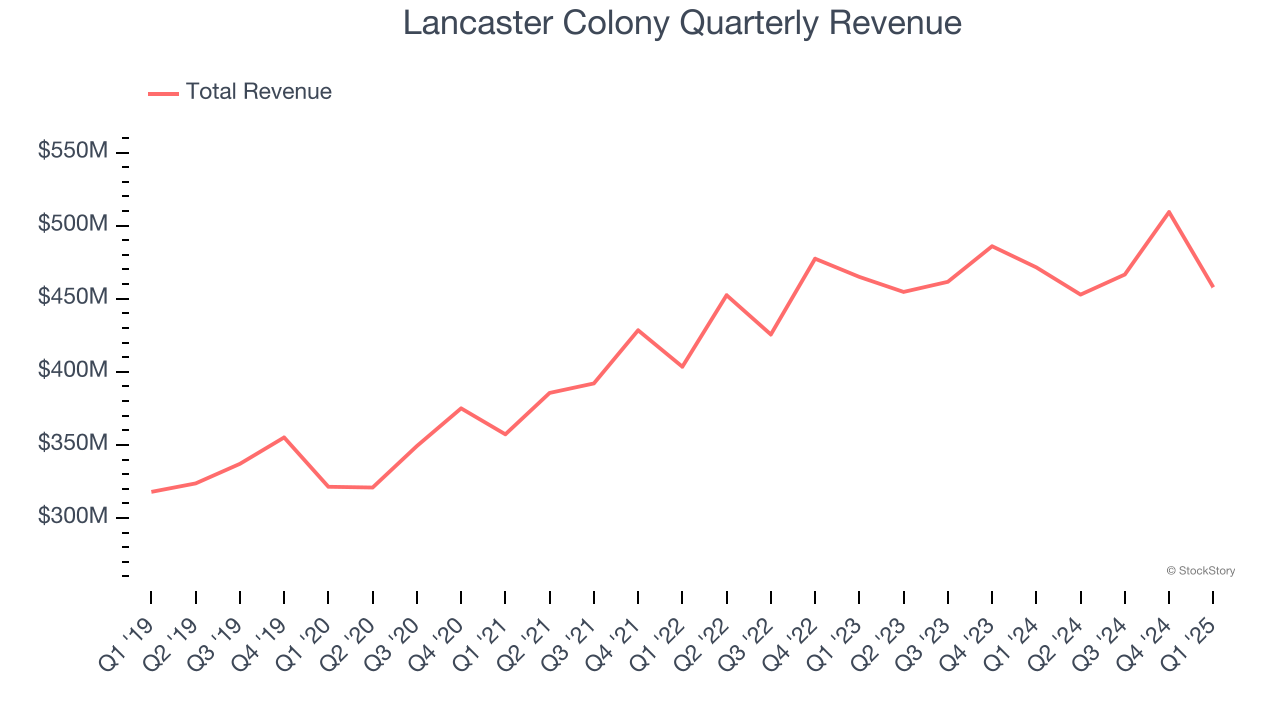

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Lancaster Colony’s 5.4% annualized revenue growth over the last three years was tepid. This fell short of our benchmark for the consumer staples sector.

2. Fewer Distribution Channels Limit its Ceiling

With $1.89 billion in revenue over the past 12 months, Lancaster Colony is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. Low Gross Margin Reveals Weak Structural Profitability

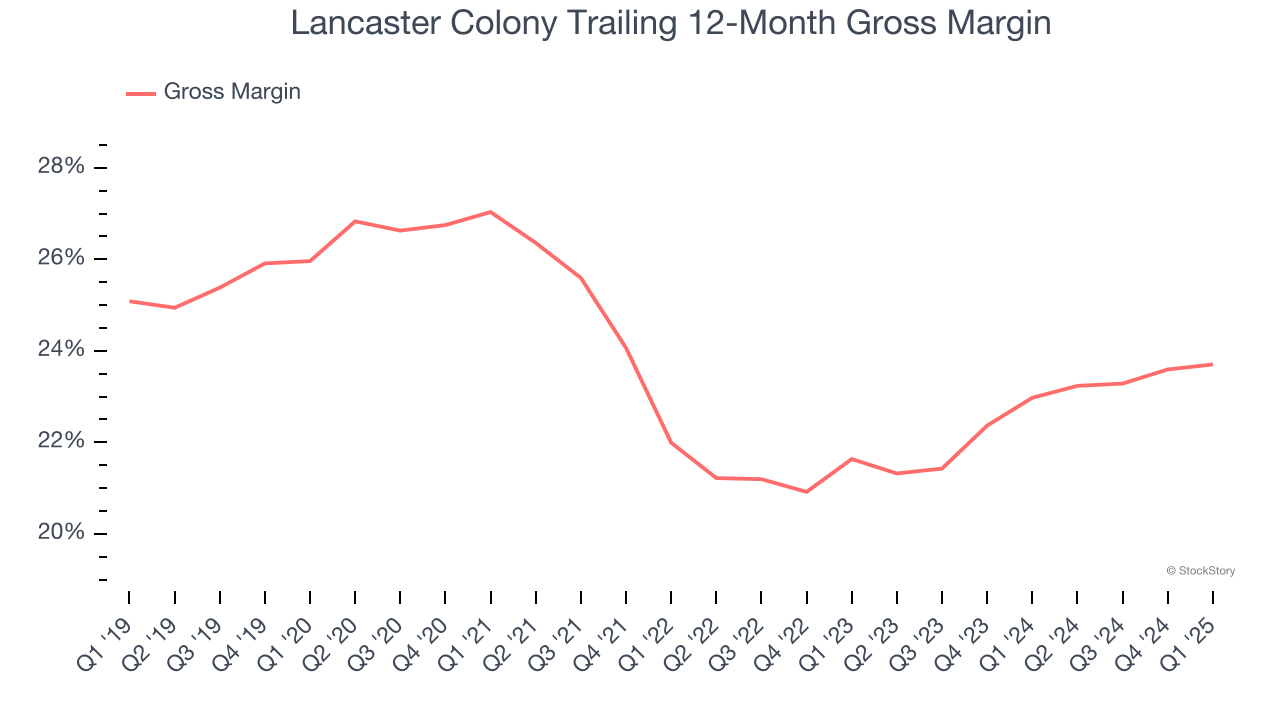

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Lancaster Colony has bad unit economics for a consumer staples company, giving it less room to reinvest and develop new products. As you can see below, it averaged a 23.3% gross margin over the last two years. That means Lancaster Colony paid its suppliers a lot of money ($76.66 for every $100 in revenue) to run its business.

Final Judgment

Lancaster Colony isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 24.4× forward P/E (or $172.87 per share). This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Lancaster Colony

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.