Waste Management has been treading water for the past six months, recording a small return of 4% while holding steady at $235.87.

Given the underwhelming price action, is now a good time to buy WM? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does Waste Management Spark Debate?

Headquartered in Houston, Waste Management (NYSE: WM) is a provider of comprehensive waste management services in North America.

Two Positive Attributes:

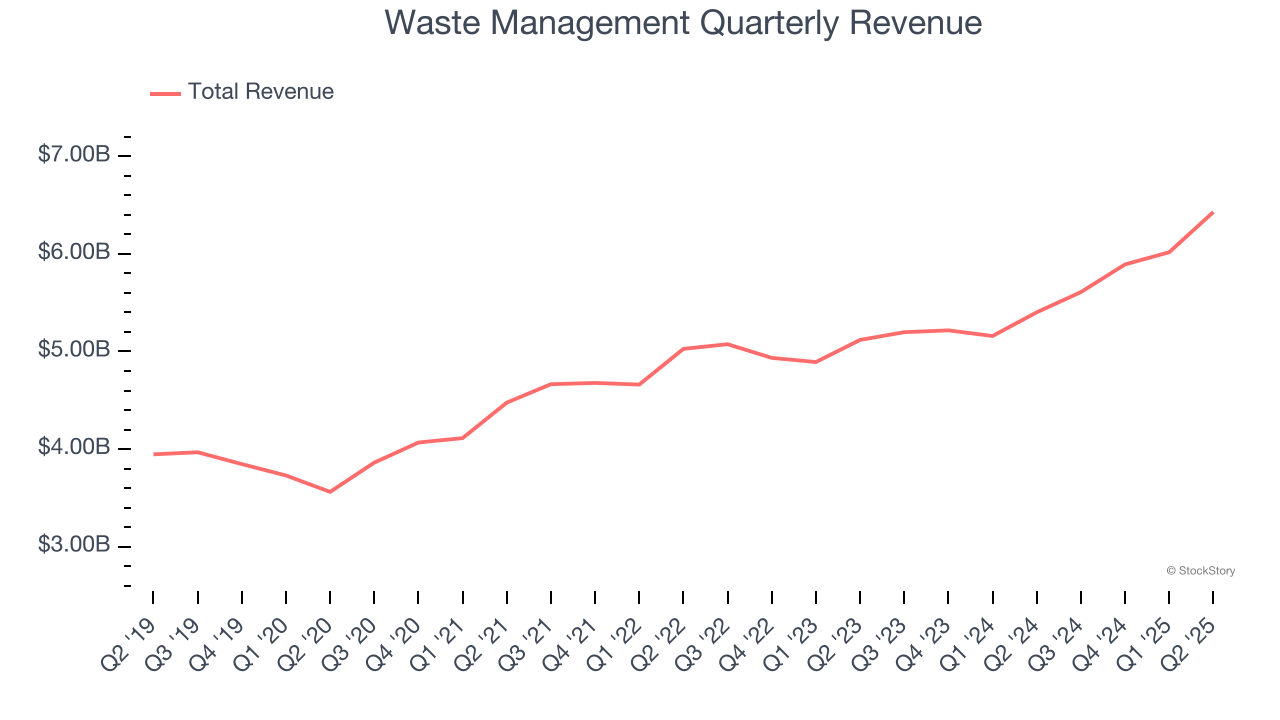

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Waste Management’s 9.7% annualized revenue growth over the last five years was solid. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

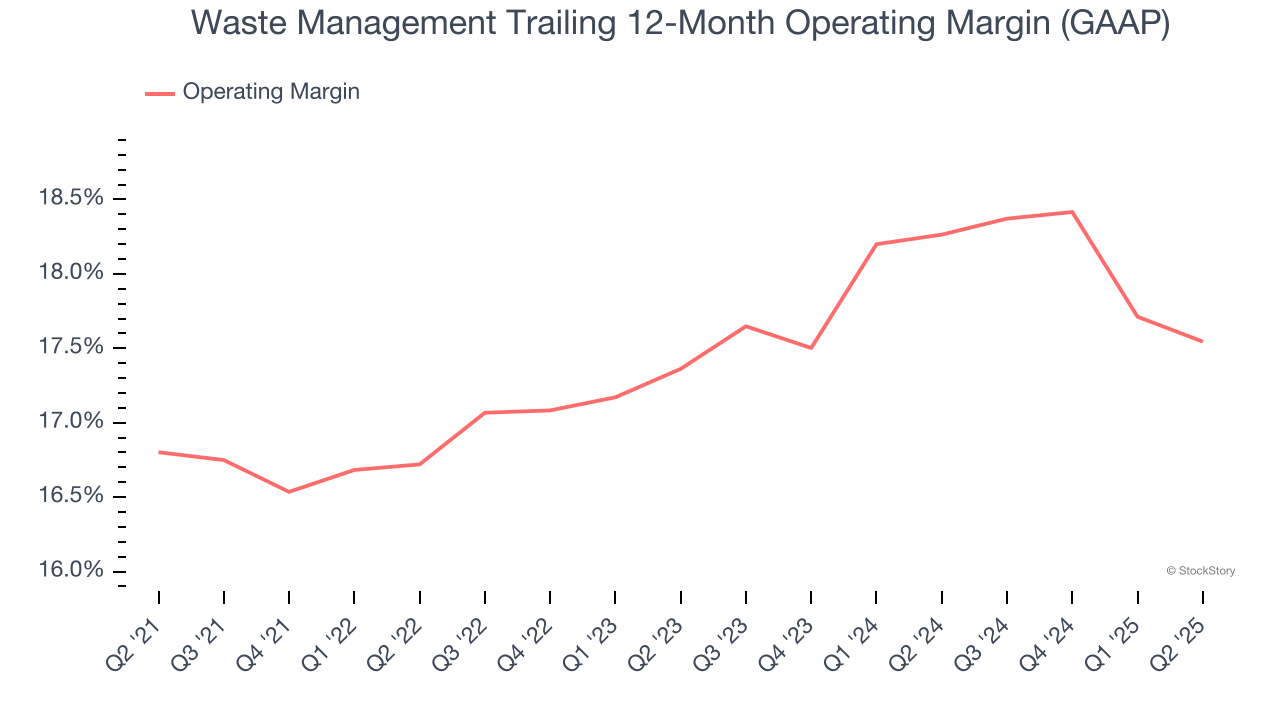

2. Operating Margin Reveals a Well-Run Organization

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Waste Management’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 17.4% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

One Reason to be Careful:

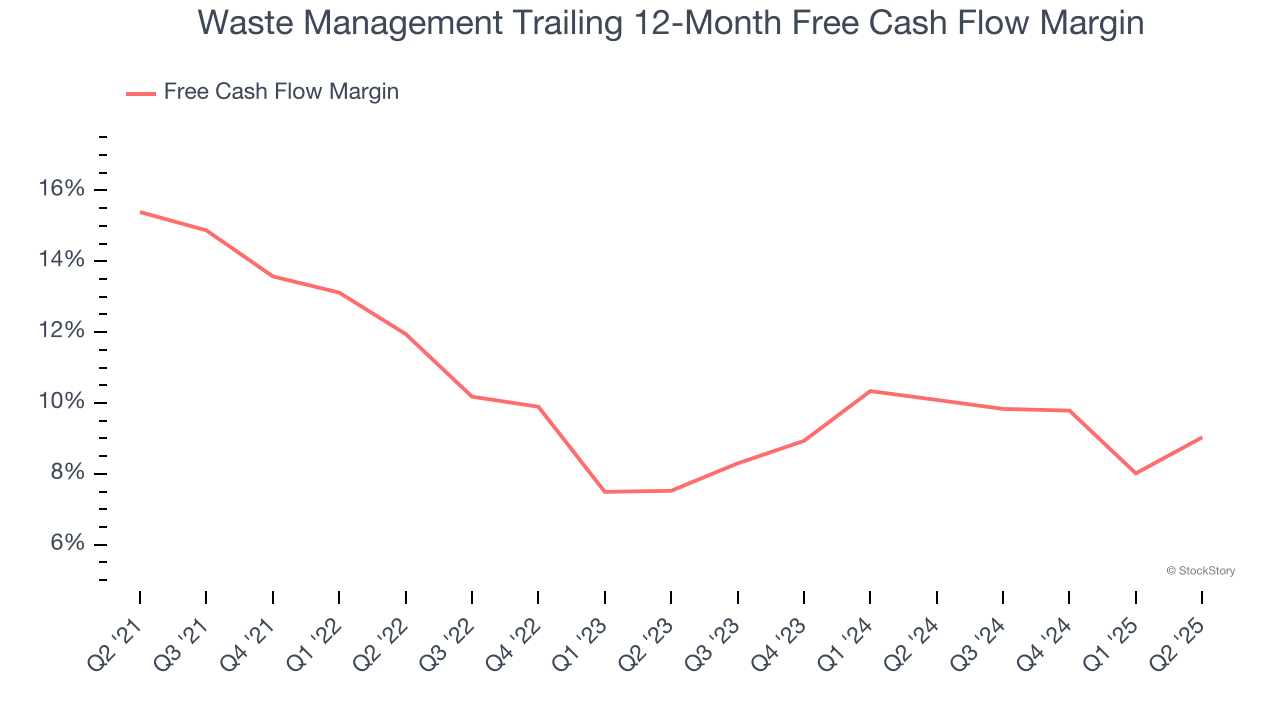

Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Waste Management’s margin dropped by 6.4 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Waste Management’s free cash flow margin for the trailing 12 months was 9%.

Final Judgment

Waste Management’s positive characteristics outweigh the negatives, but at $235.87 per share (or 29× forward P/E), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Waste Management

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.