Coconut water company The Vita Coco Company (NASDAQ: COCO) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 17.1% year on year to $168.8 million. On the other hand, the company’s full-year revenue guidance of $572.5 million at the midpoint came in 0.6% below analysts’ estimates. Its GAAP profit of $0.38 per share was 7.3% above analysts’ consensus estimates.

Is now the time to buy Vita Coco? Find out by accessing our full research report, it’s free.

Vita Coco (COCO) Q2 CY2025 Highlights:

- Revenue: $168.8 million vs analyst estimates of $161.3 million (17.1% year-on-year growth, 4.6% beat)

- EPS (GAAP): $0.38 vs analyst estimates of $0.35 (7.3% beat)

- Adjusted EBITDA: $29.24 million vs analyst estimates of $28.52 million (17.3% margin, 2.5% beat)

- The company lifted its revenue guidance for the full year to $572.5 million at the midpoint from $562.5 million, a 1.8% increase

- EBITDA guidance for the full year is $89 million at the midpoint, below analyst estimates of $90.76 million

- Operating Margin: 14.9%, down from 20.8% in the same quarter last year

- Free Cash Flow Margin: 12.4%, down from 18.5% in the same quarter last year

- Sales Volumes rose 14.1% year on year (4% in the same quarter last year)

- Market Capitalization: $2.09 billion

Company Overview

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $559.9 million in revenue over the past 12 months, Vita Coco is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

As you can see below, Vita Coco’s sales grew at a decent 10.6% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Vita Coco reported year-on-year revenue growth of 17.1%, and its $168.8 million of revenue exceeded Wall Street’s estimates by 4.6%.

Looking ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, a slight deceleration versus the last three years. Still, this projection is noteworthy and indicates the market is forecasting success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Volume Growth

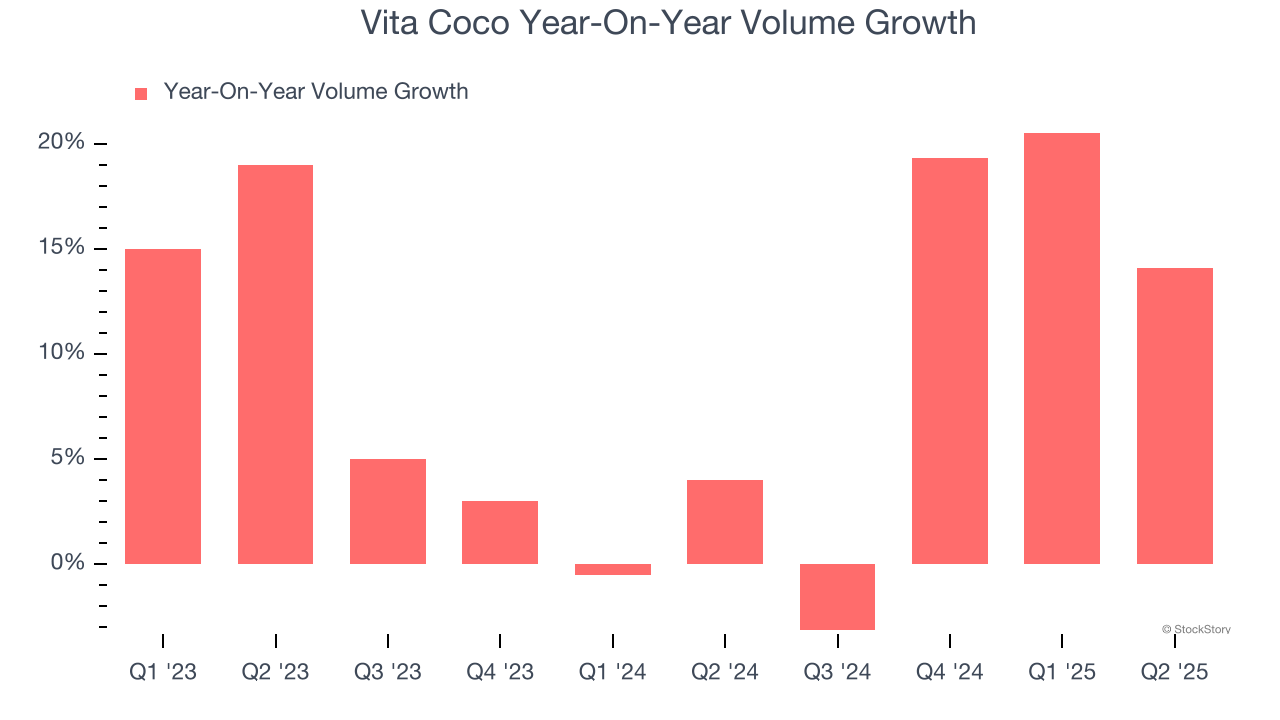

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Vita Coco’s average quarterly volume growth was a robust 7.8% over the last two years. This is good because meaningful volume growth is hard to come by in the stable consumer staples sector.

In Vita Coco’s Q2 2025, sales volumes jumped 14.1% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from Vita Coco’s Q2 Results

We enjoyed seeing Vita Coco beat analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this print was mixed with guidance as the key area of weakness. The stock remained flat at $36.89 immediately following the results.

So should you invest in Vita Coco right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.