Freight carrier Old Dominion (NASDAQ: ODFL) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 6.1% year on year to $1.41 billion. Its GAAP profit of $1.27 per share was 1.1% below analysts’ consensus estimates.

Is now the time to buy Old Dominion Freight Line? Find out by accessing our full research report, it’s free.

Old Dominion Freight Line (ODFL) Q2 CY2025 Highlights:

- Revenue: $1.41 billion vs analyst estimates of $1.42 billion (6.1% year-on-year decline, 0.7% miss)

- EPS (GAAP): $1.27 vs analyst expectations of $1.28 (1.1% miss)

- Adjusted EBITDA: $448.6 million vs analyst estimates of $451.9 million (31.9% margin, 0.7% miss)

- Operating Margin: 25.4%, down from 28.1% in the same quarter last year

- Free Cash Flow Margin: 33.6%, up from 10.2% in the same quarter last year

- Sales Volumes fell 7.3% year on year (3.1% in the same quarter last year)

- Market Capitalization: $34.26 billion

Marty Freeman, President and Chief Executive Officer of Old Dominion, commented, “Old Dominion’s financial results in the second quarter reflect the ongoing softness in the domestic economy. While the challenging macroeconomic backdrop created demand headwinds for our business during the quarter, our market share remained relatively consistent and our team continued to execute on our long-term strategic plan. The cornerstone of our plan remains our commitment to creating an unmatched value proposition for our customers by providing them with superior service at a fair price. As a result, we were pleased to once again achieve an on-time service performance of 99% and a cargo claims ratio of 0.1%.

Company Overview

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQ: ODFL) delivers less-than-truckload (LTL) and full-container load freight.

Revenue Growth

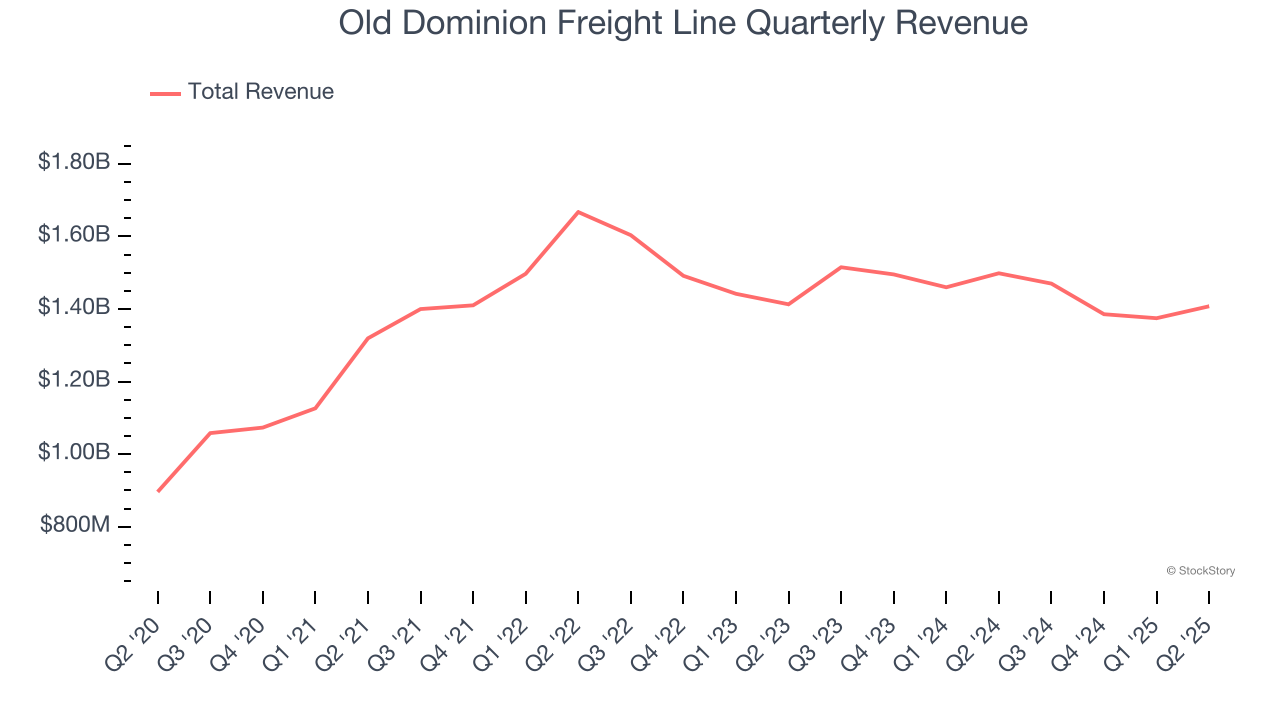

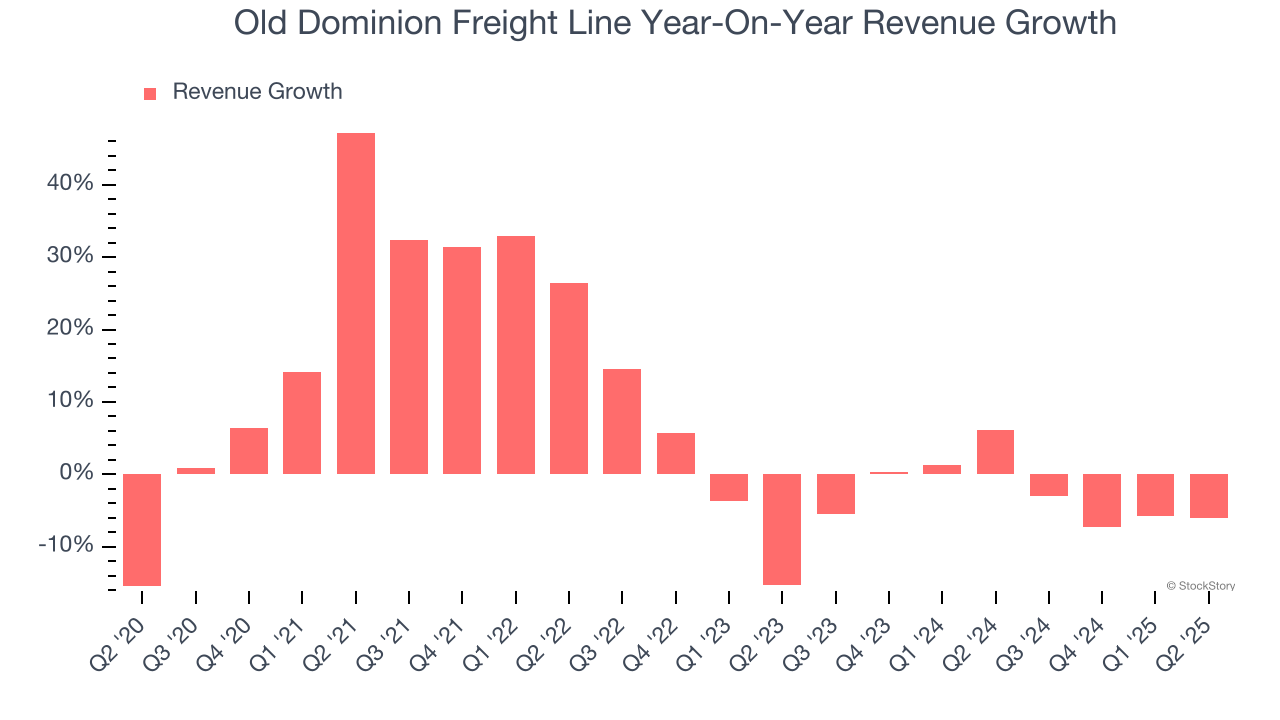

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Old Dominion Freight Line’s 7.4% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Old Dominion Freight Line’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.7% annually. Old Dominion Freight Line isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

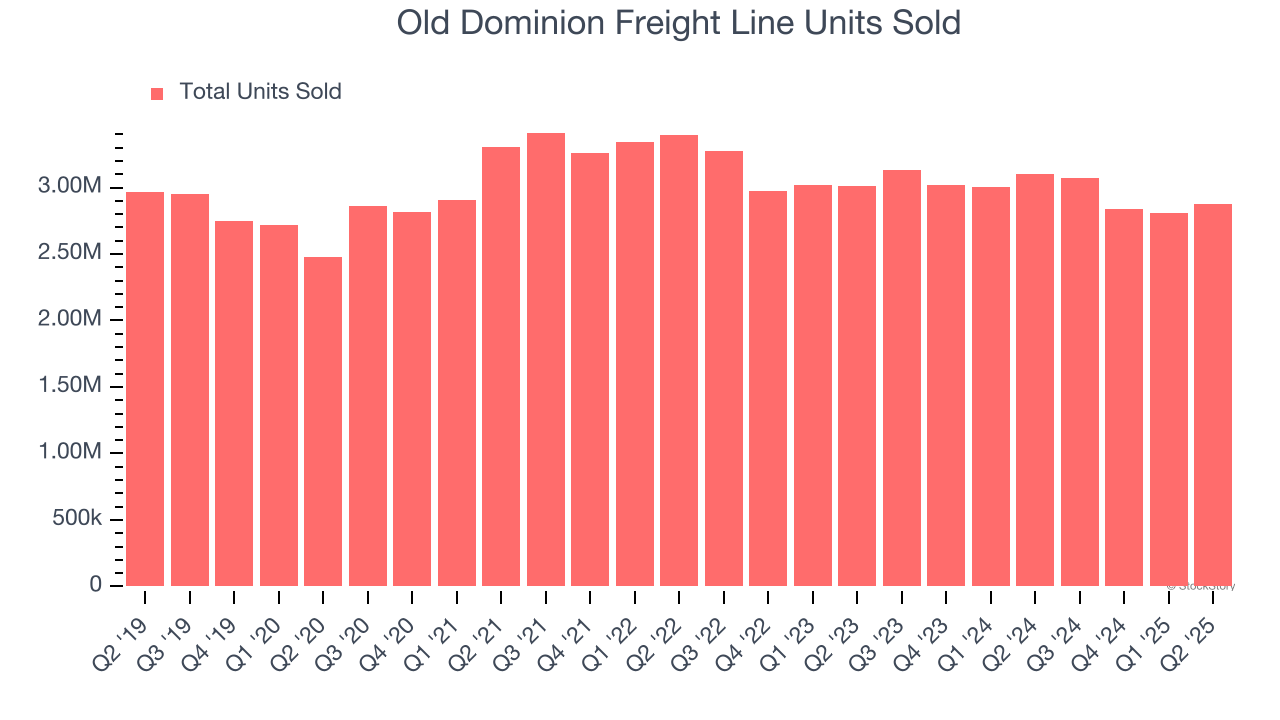

We can dig further into the company’s revenue dynamics by analyzing its number of units sold, which reached 2.87 million in the latest quarter. Over the last two years, Old Dominion Freight Line’s units sold averaged 2.8% year-on-year declines. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent.

This quarter, Old Dominion Freight Line missed Wall Street’s estimates and reported a rather uninspiring 6.1% year-on-year revenue decline, generating $1.41 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

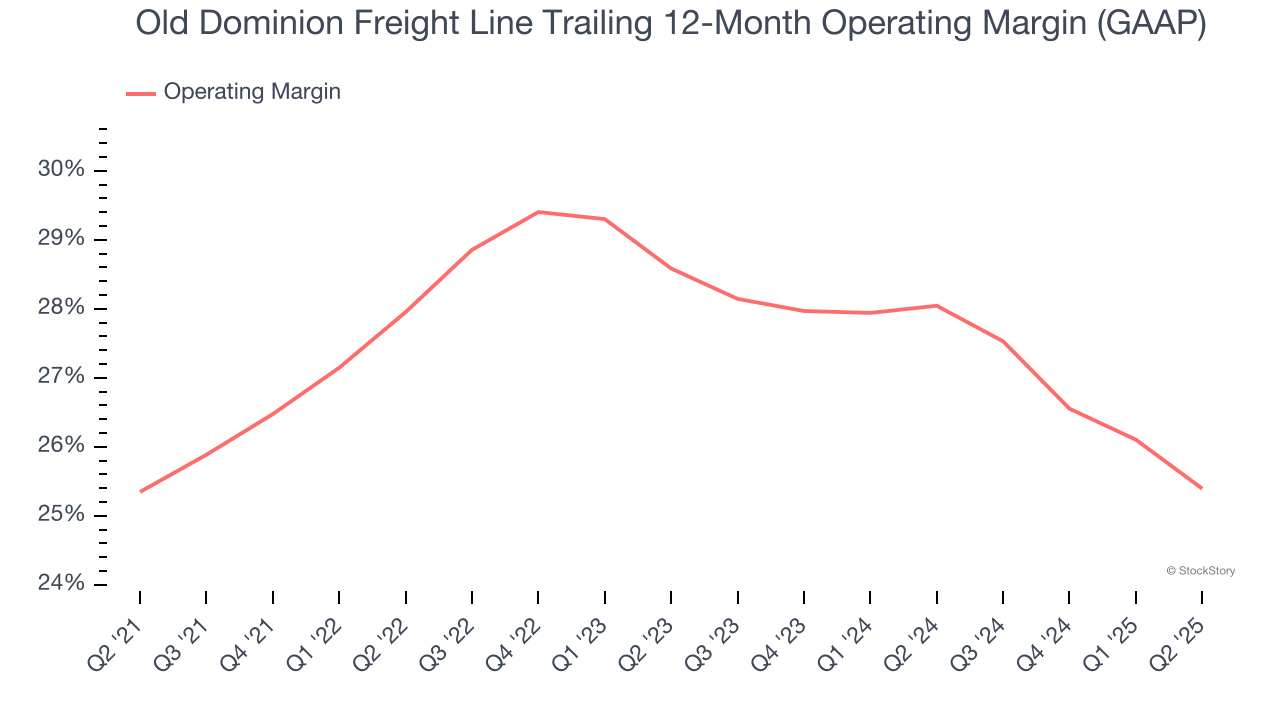

Old Dominion Freight Line’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 27.2% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Old Dominion Freight Line’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but we’re still happy with Old Dominion Freight Line’s performance, especially when considering the cycle turned in the wrong direction and most peers observed plummeting revenue and margins.

This quarter, Old Dominion Freight Line generated an operating margin profit margin of 25.4%, down 2.7 percentage points year on year. Since Old Dominion Freight Line’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

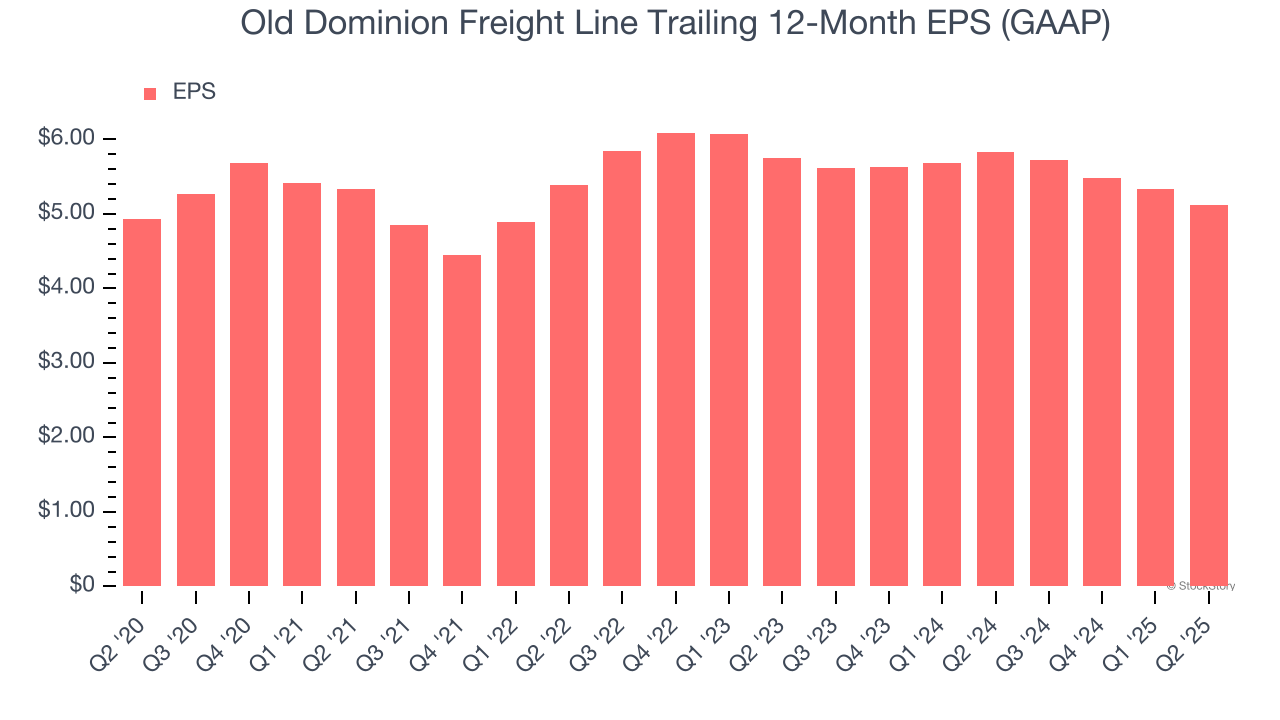

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Old Dominion Freight Line’s flat EPS over the last five years was below its 7.4% annualized revenue growth. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Old Dominion Freight Line’s two-year annual EPS declines of 5.6% were bad and lower than its two-year revenue performance.

Diving into the nuances of Old Dominion Freight Line’s earnings can give us a better understanding of its performance. Old Dominion Freight Line’s operating margin has declined by 2.3 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Old Dominion Freight Line reported EPS at $1.27, down from $1.48 in the same quarter last year. This print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Old Dominion Freight Line’s full-year EPS of $5.12 to grow 5%.

Key Takeaways from Old Dominion Freight Line’s Q2 Results

We struggled to find many positives in these results. Its sales volume slightly missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.4% to $153.27 immediately after reporting.

Old Dominion Freight Line’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.