Fast-food chain Arcos Dorados (NYSE: ARCO) fell short of the market’s revenue expectations in Q1 CY2025, with sales flat year on year at $1.08 billion. Its GAAP profit of $0.07 per share was 30% below analysts’ consensus estimates.

Is now the time to buy Arcos Dorados? Find out by accessing our full research report, it’s free.

Arcos Dorados (ARCO) Q1 CY2025 Highlights:

- Revenue: $1.08 billion vs analyst estimates of $1.12 billion (flat year on year, 3.6% miss)

- EPS (GAAP): $0.07 vs analyst expectations of $0.10 ($0.03 miss)

- Adjusted EBITDA: $91.3 million vs analyst estimates of $91.25 million (8.5% margin, in line)

- Operating Margin: 4.2%, down from 6.2% in the same quarter last year

- Locations: 2,439 at quarter end, up from 2,381 in the same quarter last year

- Same-Store Sales rose 11.1% year on year (38.6% in the same quarter last year)

- Market Capitalization: $1.72 billion

Company Overview

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE: ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

Sales Growth

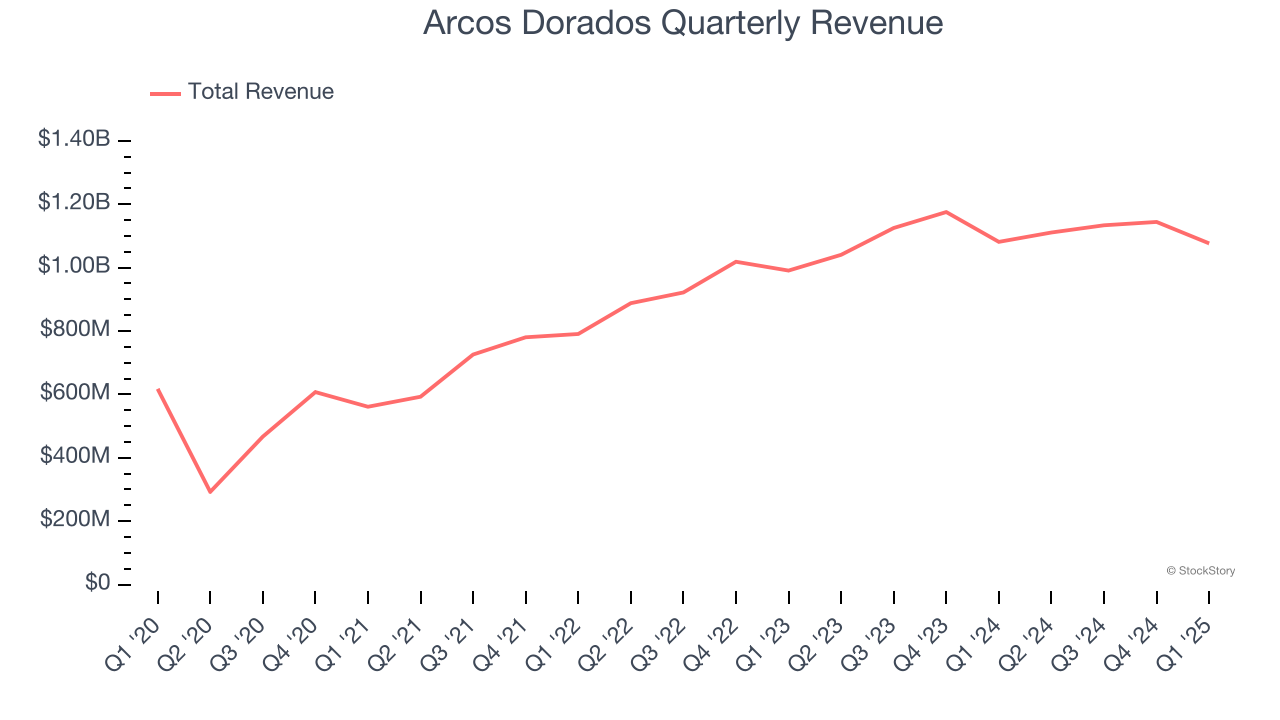

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.47 billion in revenue over the past 12 months, Arcos Dorados is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions.

As you can see below, Arcos Dorados’s sales grew at a decent 7.1% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Arcos Dorados missed Wall Street’s estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $1.08 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 10.4% over the next 12 months, an acceleration versus the last six years. This projection is commendable and implies its newer menu offerings will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Restaurant Performance

Number of Restaurants

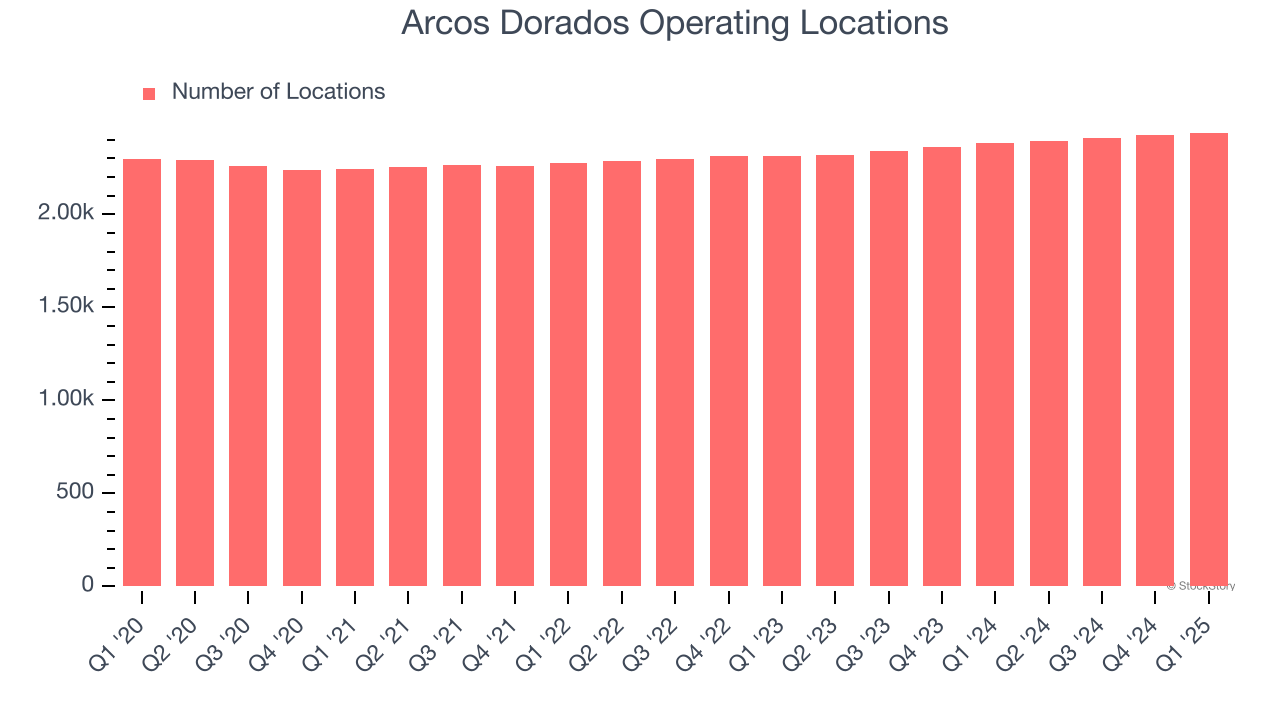

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Arcos Dorados sported 2,439 locations in the latest quarter. Over the last two years, it has opened new restaurants quickly, averaging 2.5% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

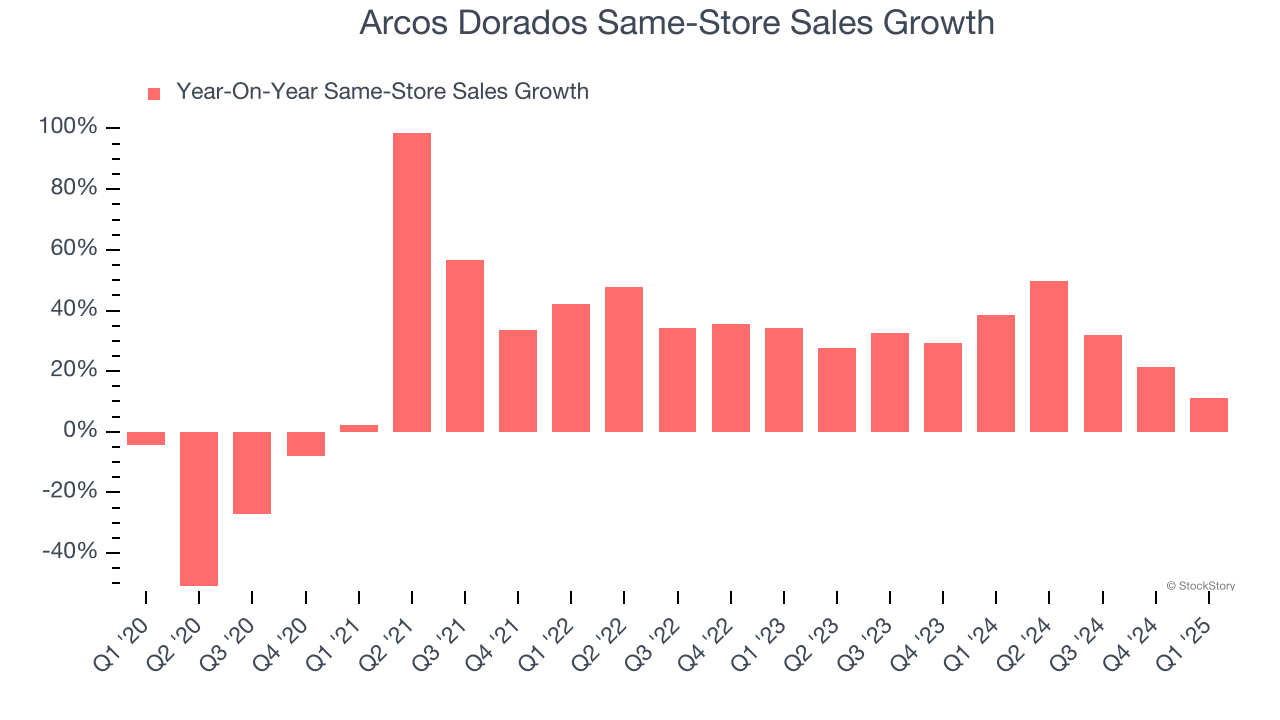

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Arcos Dorados has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 30.3%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Arcos Dorados multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Arcos Dorados’s same-store sales rose 11.1% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Arcos Dorados can reaccelerate growth.

Key Takeaways from Arcos Dorados’s Q1 Results

We struggled to find many positives in these results. Its same-store sales missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.6% to $7.87 immediately after reporting.

Arcos Dorados may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.