Over the past six months, International Paper’s shares (currently trading at $47.91) have posted a disappointing 15% loss while the S&P 500 was down 2.4%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy International Paper, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think International Paper Will Underperform?

Despite the more favorable entry price, we're swiping left on International Paper for now. Here are three reasons why you should be careful with IP and a stock we'd rather own.

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. International Paper struggled to consistently generate demand over the last five years as its sales dropped at a 2.1% annual rate. This was below our standards and signals it’s a low quality business.

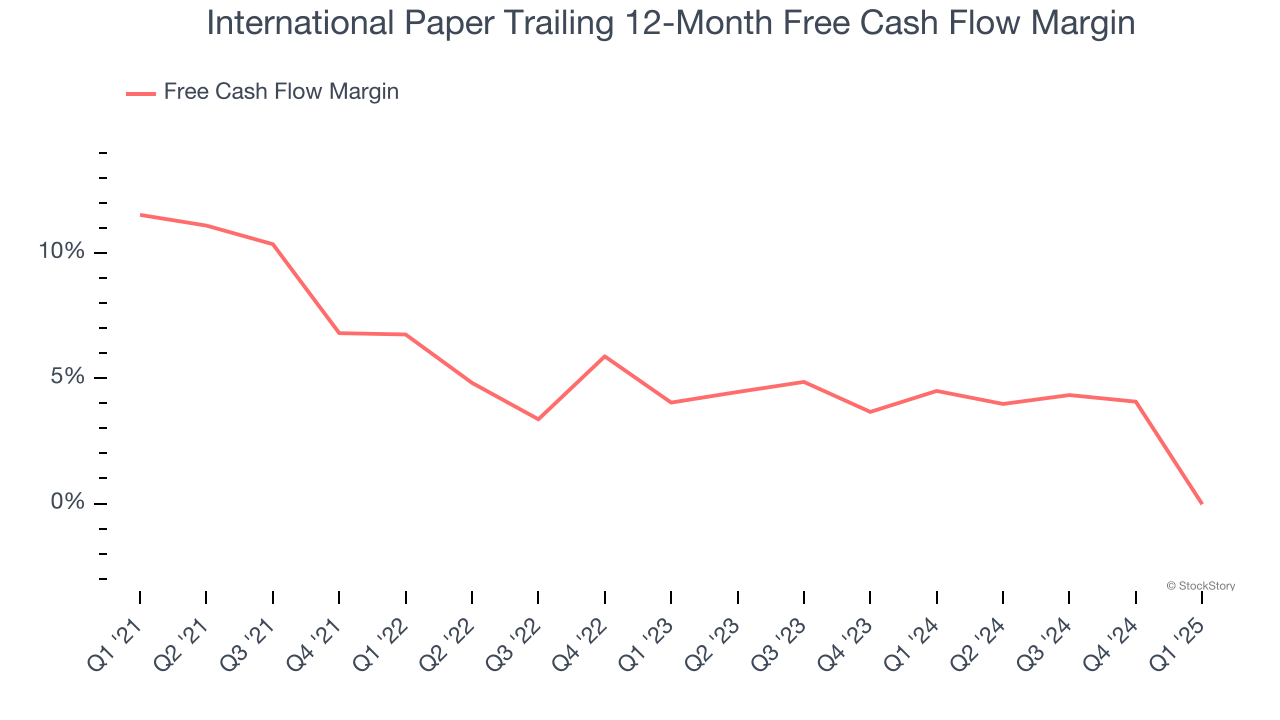

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, International Paper’s margin dropped by 11.5 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. International Paper’s free cash flow margin for the trailing 12 months was breakeven.

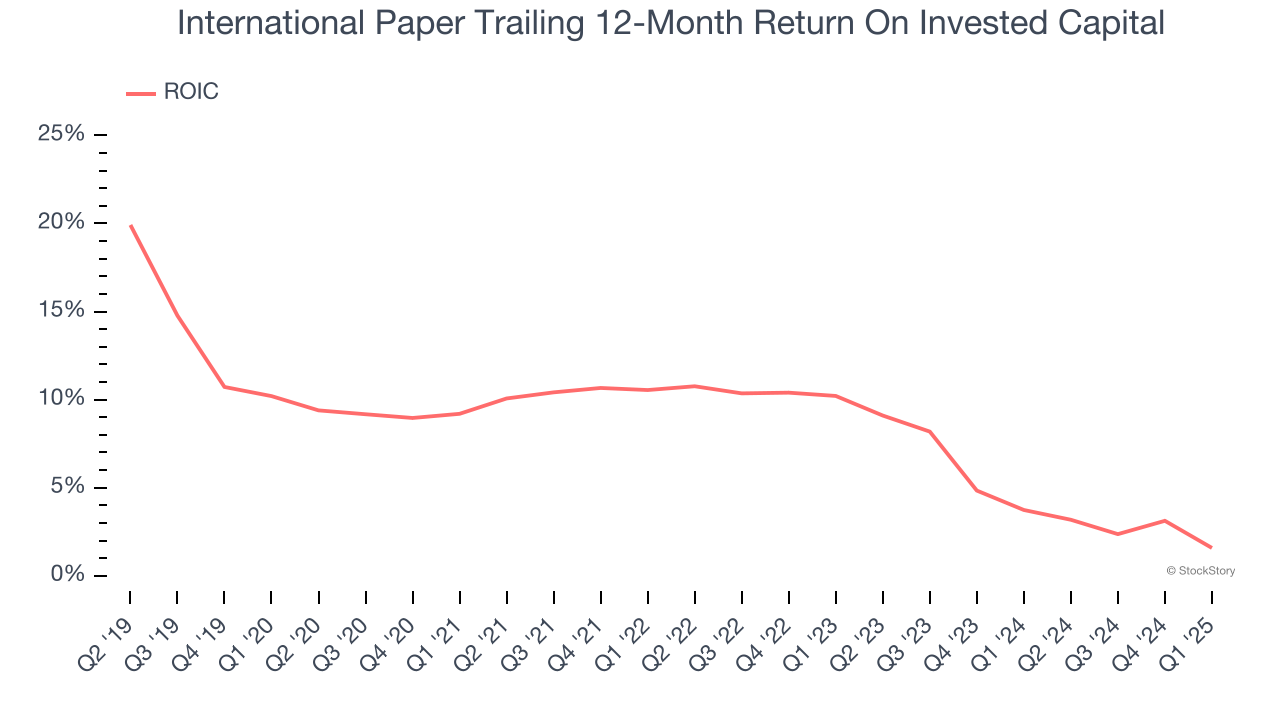

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, International Paper’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

International Paper falls short of our quality standards. Following the recent decline, the stock trades at 7.2× forward EV-to-EBITDA (or $47.91 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.