LegalZoom currently trades at $6.64 per share and has shown little upside over the past six months, posting a middling return of 2.2%. However, the stock is beating the S&P 500’s 14.2% decline during that period.

Is now the time to buy LegalZoom, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the strong relative performance, we're sitting this one out for now. Here are three reasons why we avoid LZ and a stock we'd rather own.

Why Is LegalZoom Not Exciting?

Founded by famous lawyer Robert Shapiro, LegalZoom (NASDAQ: LZ) offers online legal services and documentation assistance for individuals and businesses.

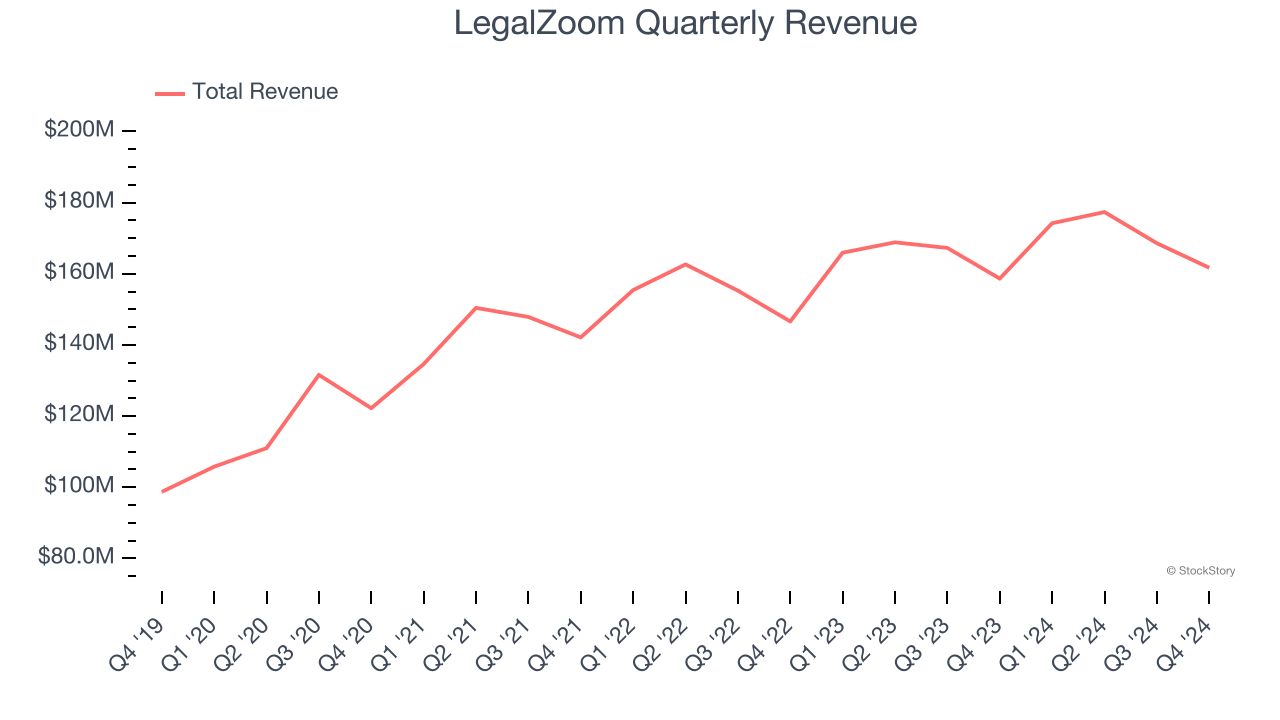

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, LegalZoom’s sales grew at a sluggish 5.8% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector.

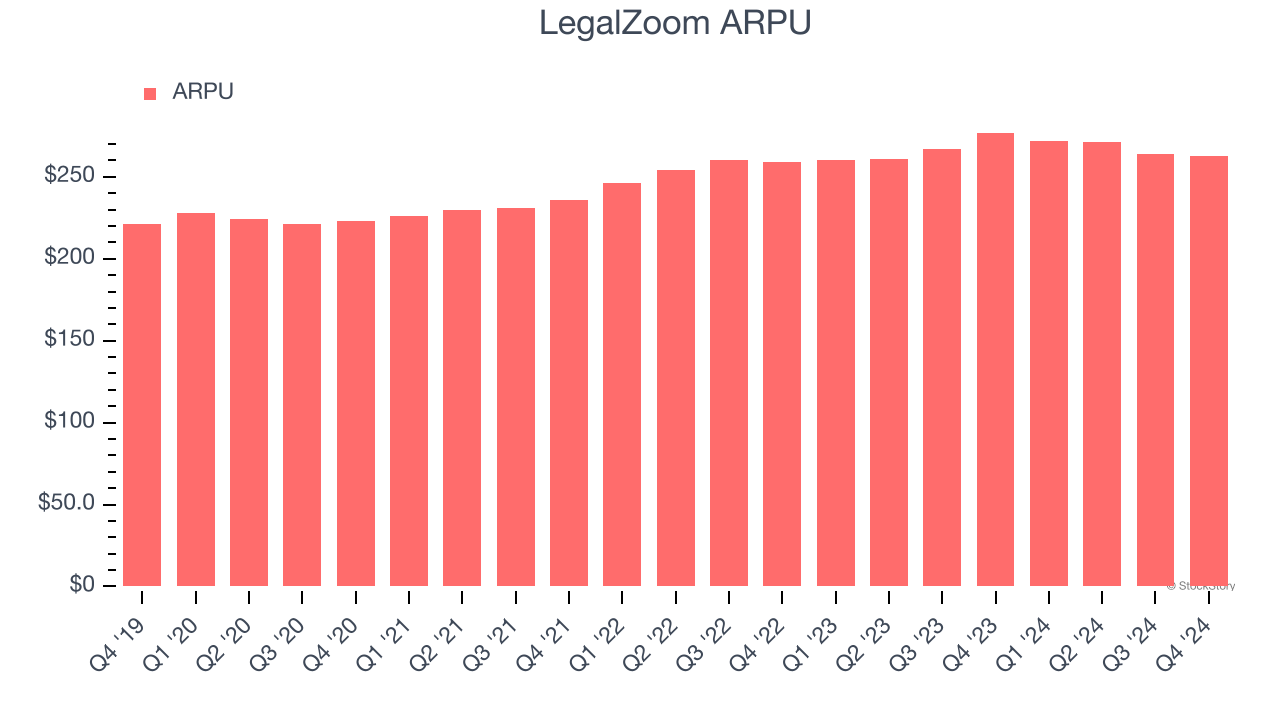

2. Growth in Customer Spending Lags Peers

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and LegalZoom’s take rate, or "cut", on each order.

LegalZoom’s ARPU growth has been subpar over the last two years, averaging 2.5%. This isn’t great, but the increase in subscription units is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if LegalZoom tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect LegalZoom’s revenue to rise by 4.8%, close to its 5.8% annualized growth for the past three years. This projection doesn't excite us and suggests its newer products and services will not lead to better top-line performance yet.

Final Judgment

LegalZoom’s business quality ultimately falls short of our standards. Following its recent outperformance in a weaker market environment, the stock trades at 9× forward EV-to-EBITDA (or $6.64 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of LegalZoom

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.