Wrapping up Q4 earnings, we look at the numbers and key takeaways for the air freight and logistics stocks, including GXO Logistics (NYSE: GXO) and its peers.

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 6 air freight and logistics stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 0.7%.

While some air freight and logistics stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.6% since the latest earnings results.

Weakest Q4: GXO Logistics (NYSE: GXO)

With notable customers such as Nike and Apple, GXO (NYSE: GXO) manages outsourced supply chains and warehousing for various companies.

GXO Logistics reported revenues of $3.25 billion, up 25.5% year on year. This print exceeded analysts’ expectations by 1.5%. Despite the top-line beat, it was still a slower quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

The stock is down 6.2% since reporting and currently trades at $40.12.

Read our full report on GXO Logistics here, it’s free.

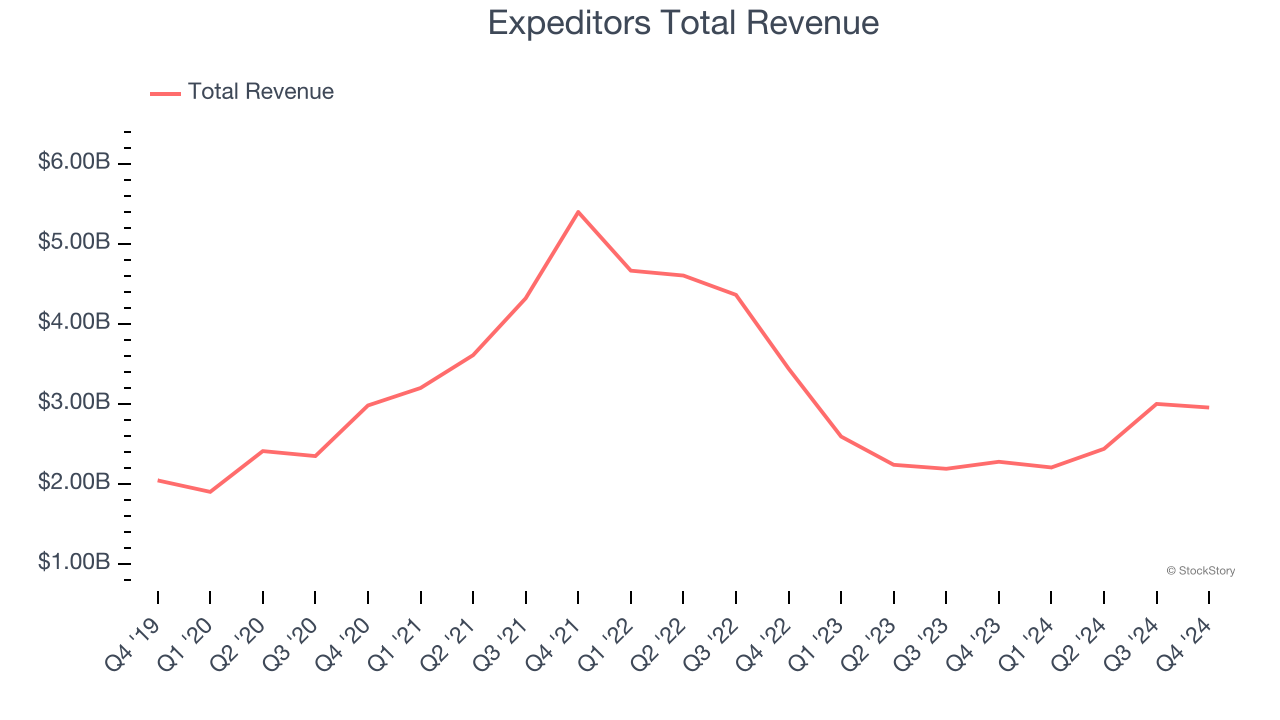

Best Q4: Expeditors (NYSE: EXPD)

Expeditors (NYSE: EXPD) offers air and ocean freight as well as brokerage services.

Expeditors reported revenues of $2.95 billion, up 29.7% year on year, outperforming analysts’ expectations by 4.3%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates.

Expeditors delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 3.1% since reporting. It currently trades at $117.26.

Is now the time to buy Expeditors? Access our full analysis of the earnings results here, it’s free.

Hub Group (NASDAQ: HUBG)

Started with $10,000, Hub Group (NASDAQ: HUBG) is a provider of intermodal, truck brokerage, and logistics services, facilitating transportation solutions for businesses worldwide.

Hub Group reported revenues of $973.5 million, down 1.2% year on year, falling short of analysts’ expectations by 3.2%. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

Hub Group delivered the highest full-year guidance raise but had the slowest revenue growth in the group. The stock is flat since the results and currently trades at $42.98.

Read our full analysis of Hub Group’s results here.

C.H. Robinson Worldwide (NASDAQ: CHRW)

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ: CHRW) offers freight transportation and logistics services.

C.H. Robinson Worldwide reported revenues of $4.18 billion, flat year on year. This print lagged analysts' expectations by 5.7%. Overall, it was a slower quarter as it also produced a miss of analysts’ North American surface transportation revenue estimates and a slight miss of analysts’ EBITDA estimates.

C.H. Robinson Worldwide had the weakest performance against analyst estimates among its peers. The stock is down 8% since reporting and currently trades at $99.37.

Read our full, actionable report on C.H. Robinson Worldwide here, it’s free.

FedEx (NYSE: FDX)

Sporting one of the largest air cargo fleets in the world, FedEx (NYSE: FDX) is a global provider of parcel and cargo delivery services.

FedEx reported revenues of $21.97 billion, flat year on year. This result came in 0.7% below analysts' expectations. All in all, it was a mixed quarter for the company.

The stock is down 3% since reporting and currently trades at $267.53.

Read our full, actionable report on FedEx here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.