Nicolet Bankshares currently trades at $122.16 per share and has shown little upside over the past six months, posting a small loss of 1.1%. The stock also fell short of the S&P 500’s 11.3% gain during that period.

Is now the time to buy NIC? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On NIC?

Starting as Green Bay Financial Corporation in 2000 before rebranding in 2002, Nicolet Bankshares (NYSE: NIC) is a regional bank holding company that provides commercial, agricultural, and consumer banking services primarily in Wisconsin, Michigan, and Minnesota.

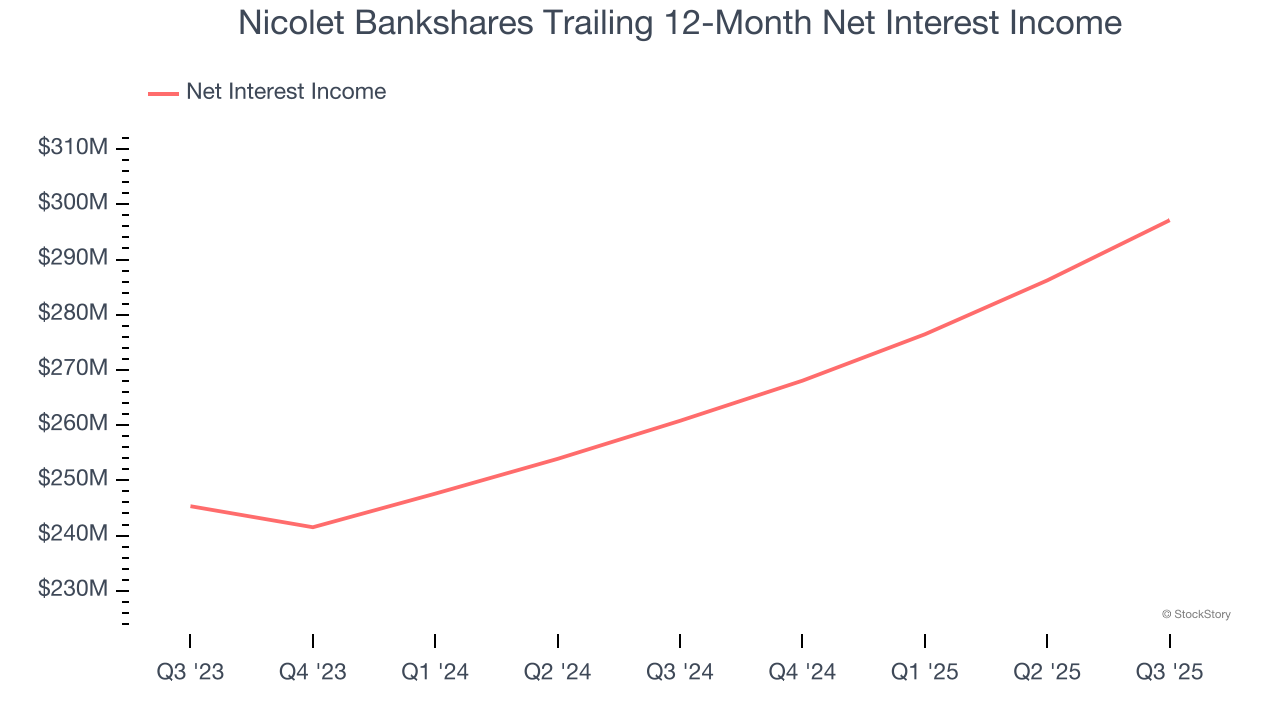

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Nicolet Bankshares’s net interest income has grown at a 18.8% annualized rate over the last five years, much better than the broader banking industry and faster than its total revenue.

2. Projected Net Interest Income Growth Is Remarkable

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Nicolet Bankshares’s net interest income to rise by 54.4%, an improvement versus its 10.1% annualized growth for the past two years.

3. Increasing Net Interest Margin Juices Financials

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, Nicolet Bankshares’s net interest margin averaged 3.6%, climbing by 65 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

Final Judgment

These are just a few reasons Nicolet Bankshares is a high-quality business worth owning. With its shares trailing the market in recent months, the stock trades at 1.5× forward P/B (or $122.16 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Nicolet Bankshares

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.