IT distribution giant Ingram Micro (NYSE: INGM) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 7.2% year on year to $12.6 billion. On top of that, next quarter’s revenue guidance ($14.18 billion at the midpoint) was surprisingly good and 3.6% above what analysts were expecting. Its GAAP profit of $0.42 per share was 5.1% below analysts’ consensus estimates.

Is now the time to buy Ingram Micro? Find out by accessing our full research report, it’s free for active Edge members.

Ingram Micro (INGM) Q3 CY2025 Highlights:

- Revenue: $12.6 billion vs analyst estimates of $12.24 billion (7.2% year-on-year growth, 3% beat)

- EPS (GAAP): $0.42 vs analyst expectations of $0.44 (5.1% miss)

- Adjusted EBITDA: $342.2 million vs analyst estimates of $320.2 million (2.7% margin, 6.9% beat)

- Revenue Guidance for Q4 CY2025 is $14.18 billion at the midpoint, above analyst estimates of $13.68 billion

- Operating Margin: 1.8%, in line with the same quarter last year

- Free Cash Flow was -$175 million compared to -$315 million in the same quarter last year

- Market Capitalization: $5.16 billion

Company Overview

Operating as the crucial link in the global technology supply chain with a presence in 57 countries, Ingram Micro (NYSE: INGM) is a global technology distributor that connects manufacturers with resellers, providing hardware, software, cloud services, and logistics expertise.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $51.02 billion in revenue over the past 12 months, Ingram Micro is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. For Ingram Micro to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

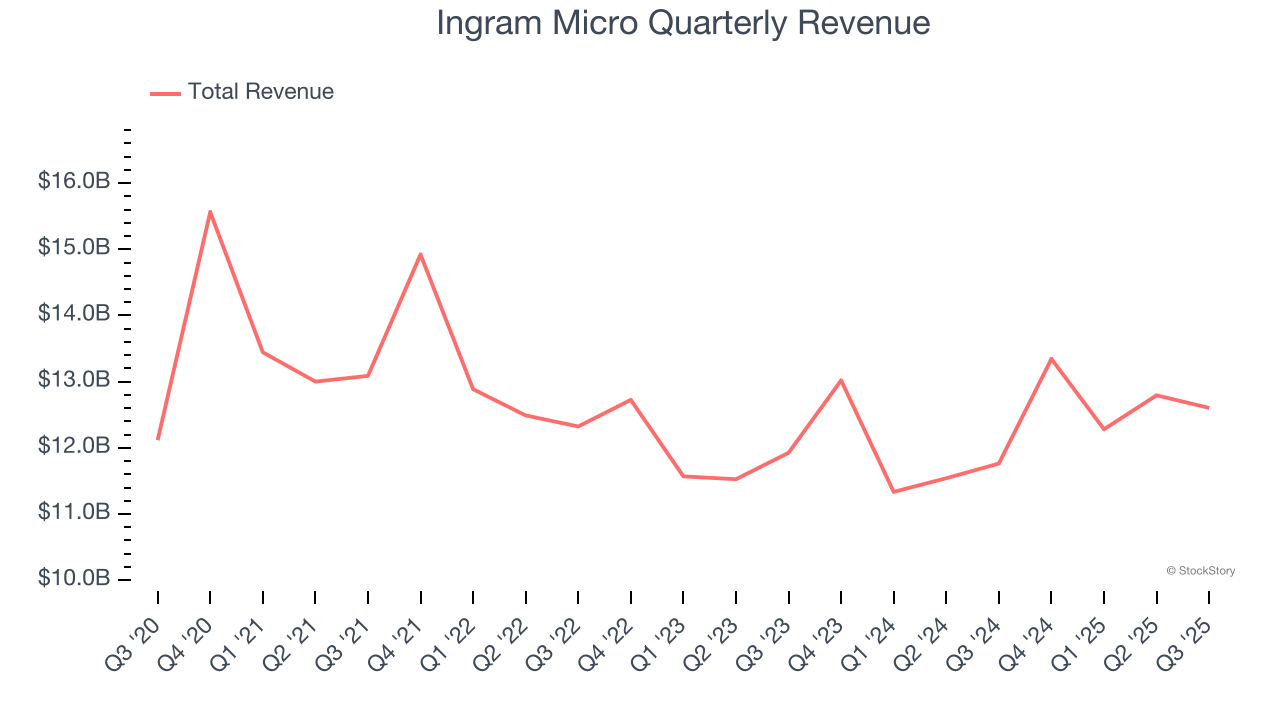

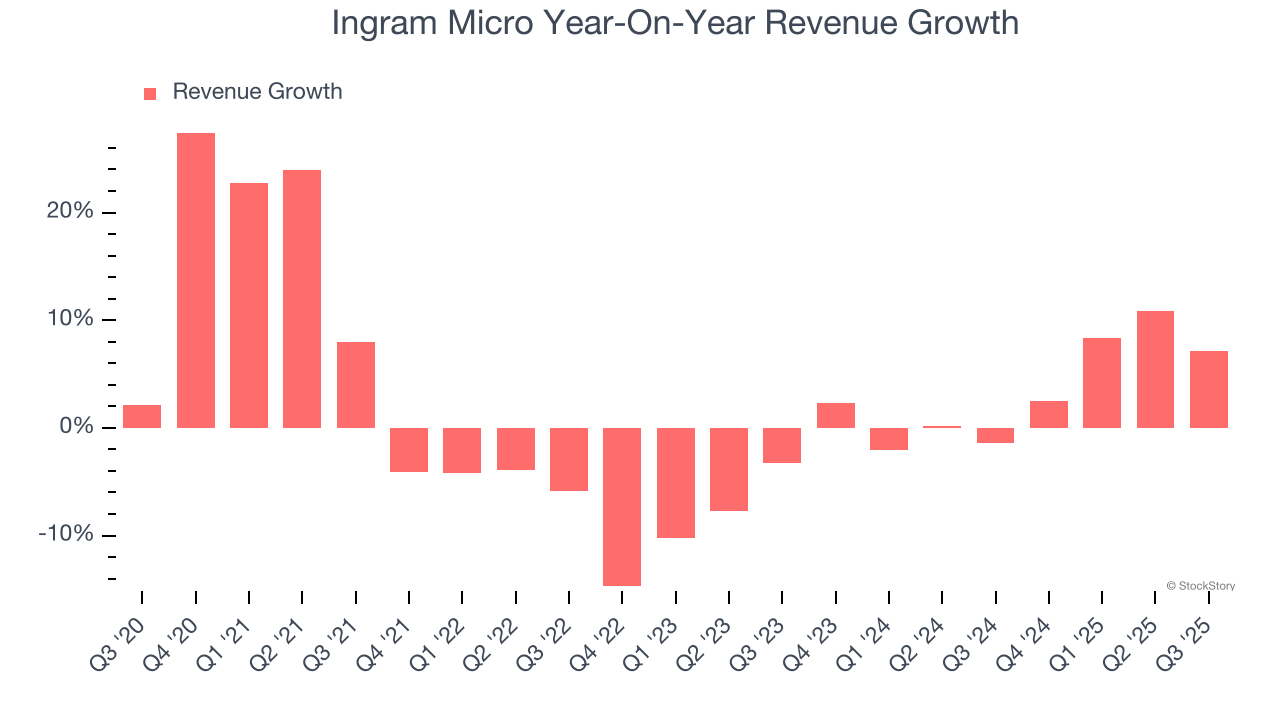

As you can see below, Ingram Micro’s 2.2% annualized revenue growth over the last five years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Ingram Micro’s annualized revenue growth of 3.4% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Ingram Micro reported year-on-year revenue growth of 7.2%, and its $12.6 billion of revenue exceeded Wall Street’s estimates by 3%. Company management is currently guiding for a 6.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

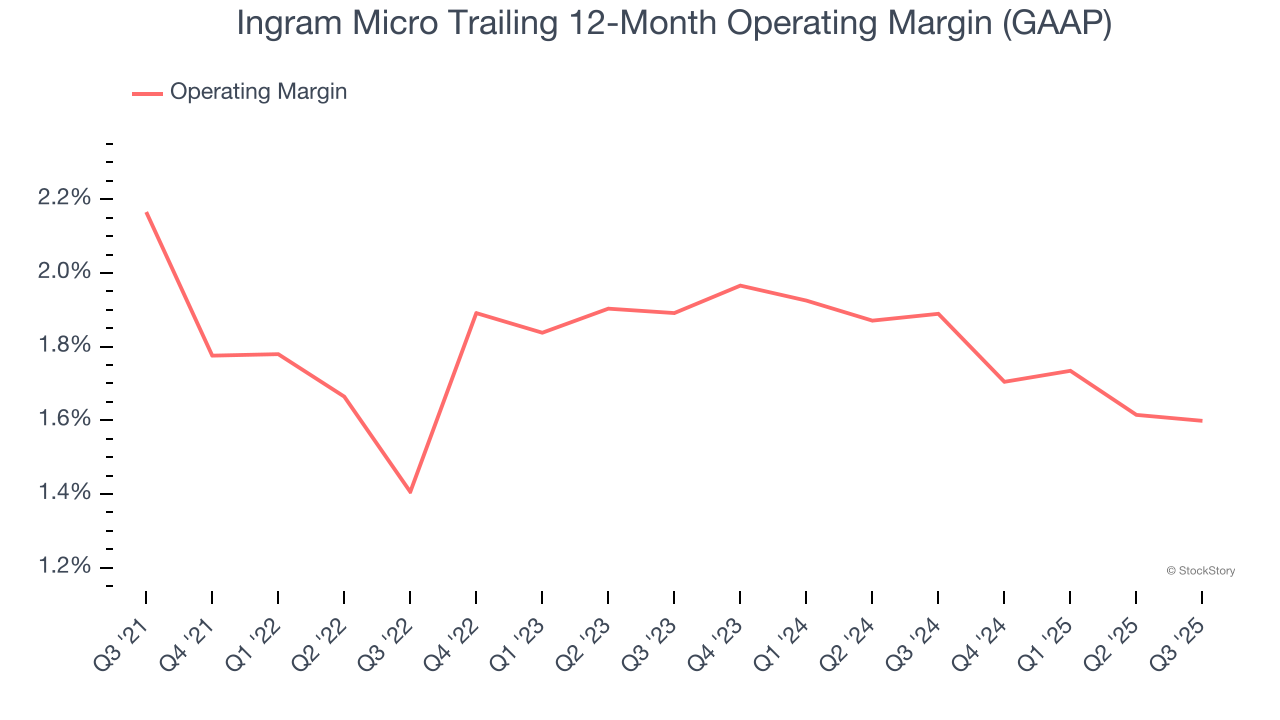

Ingram Micro’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 1.8% over the last five years. This profitability was inadequate for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Ingram Micro’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Ingram Micro generated an operating margin profit margin of 1.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

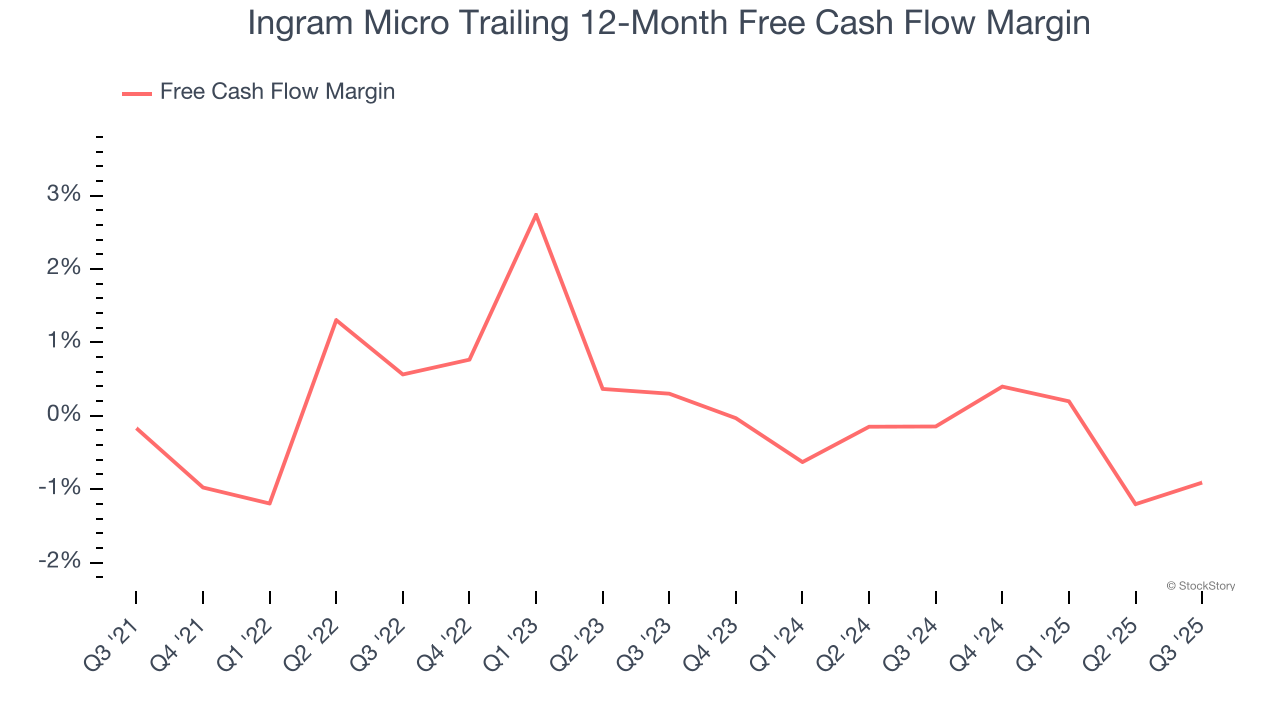

Ingram Micro broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Ingram Micro burned through $175 million of cash in Q3, equivalent to a negative 1.4% margin. The company’s cash burn slowed from $315 million of lost cash in the same quarter last year.

Key Takeaways from Ingram Micro’s Q3 Results

We were impressed by Ingram Micro’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock remained flat at $22.06 immediately following the results.

Is Ingram Micro an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.