The landscape of political forecasting has shifted beneath the feet of Washington insiders and retail traders alike. As of February 2026, the "Grand Relaunch" of PredictIt has officially transformed the platform from an embattled academic experiment into a fully regulated powerhouse known as the Aristotle Exchange. By shedding its restrictive "no-action" status and adopting a Designated Contract Market (DCM) framework, PredictIt has effectively reset the terms of engagement for political handicappers heading into the critical 2026 midterms.

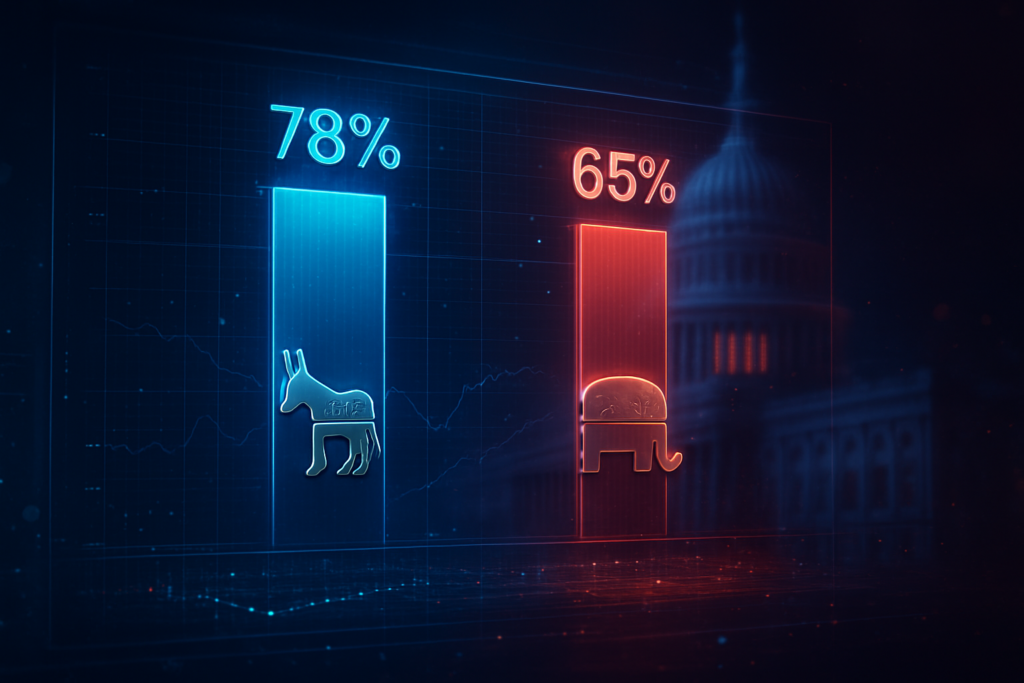

Currently, the markets are flashing a clear, if divided, signal for the upcoming elections: a 78% probability that Democrats will reclaim the House of Representatives, contrasted with a 65% chance that Republicans will maintain their grip on the Senate. This divergence is driving record-breaking volume to the newly revamped platform, as traders move quickly to capitalize on the highest investment limits in PredictIt’s history. The platform’s transition marks a new era where political sentiment is not just polled, but priced with professional-grade precision.

The Market: What's Being Predicted

The centerpiece of the "Grand Relaunch" is the move to the Aristotle Exchange, a transition that has fundamentally altered the mechanics of political betting. For years, PredictIt was hamstrung by an $850 individual investment limit and a 5,000-trader cap per contract—rules that often led to "sold out" markets and distorted prices. Under the new DCM status, the investment limit has been quadrupled to $3,500, and the trader cap has been abolished entirely. This allows for deeper liquidity and ensures that prices more accurately reflect the aggregate wisdom of the crowd rather than just the first few thousand people to the gate.

To handle this influx of capital, the exchange has integrated the Eqlipse Clearing technology from Nasdaq (NASDAQ: NDAQ), providing a level of institutional reliability previously unseen in the political prediction space. The 2026 midterm contracts are the first major test of this infrastructure. Currently, the "Party Control of the House" market is trading at 78 cents for Democratic control, while the "Senate Majority" market remains more competitive, with Republican shares hovering at 65 cents. These contracts are set to resolve following the certification of the November 2026 election results, providing a multi-billion dollar real-time barometer of the national mood.

Why Traders Are Betting

The surge in activity is driven by a combination of regulatory certainty and the historic stakes of the 2026 cycle. Previously, many large-scale traders avoided PredictIt due to the legal "gray area" created by its long-running battle with the CFTC. Now, with a permanent license in hand, "whales" who previously occupied the shadows are entering the fray. The $3,500 limit, while still retail-focused compared to traditional futures markets, is enough to allow sophisticated handicappers to build meaningful positions across dozens of individual race markets.

Traders are currently leaning heavily into the "House Flip" narrative, largely based on the historical precedent that the president's party almost always faces setbacks in the first midterm of a second term (or the second midterm of a long tenure). However, the 65% odds for a Republican Senate suggest that the "GOP Firewall" in key states like Texas and Iowa remains formidable. Strategists are using these markets to hedge against potential policy shifts, as a divided government would likely stall any major legislative agendas regarding tax reform or climate spending through 2028.

Broader Context and Implications

PredictIt’s evolution is part of a broader "Prediction Market Arms Race." While PredictIt has captured the traditionalist and academic crowd, it faces stiff competition from Kalshi, which has marketed itself as the "Wall Street" of events, and Polymarket, which recently secured a massive $2 billion investment from the Intercontinental Exchange (NYSE: ICE). The fact that the parent company of the New York Stock Exchange is now backing a primary competitor highlights how mainstream this asset class has become.

Beyond the numbers, these markets reveal a deepening skepticism toward traditional polling. In the 2024 cycle, prediction markets famously front-ran polling shifts in swing states, a trend that traders expect to continue in 2026. The move to a DCM model also brings PredictIt under stricter oversight, requiring enhanced transparency and anti-manipulation protocols. This regulatory "clean-up" is essential for the industry's survival, as it positions prediction markets as a legitimate financial tool rather than a niche gambling product.

What to Watch Next

As we move deeper into the 2026 primary season, several key milestones will likely trigger volatility in the House and Senate markets. First, the filing deadlines in March and April will clarify the candidate fields, particularly in "toss-up" districts where incumbent retirements could cause double-digit swings in the odds. Any movement in the 78% House probability will likely be tied to these candidate quality assessments.

Furthermore, economic indicators—specifically inflation data and consumer sentiment—will serve as the primary "macro" drivers for the midterm markets. If the Federal Reserve continues its current path of interest rate stabilization, the 65% Republican Senate lead may soften as the "incumbent penalty" decreases. Conversely, any economic shock would likely solidify the Democratic House advantage. Traders should also watch for the launch of "Individual Seat" markets, which will offer the granular data that professional political consultants now rely on more than internal polling.

Bottom Line

The "Grand Relaunch" has successfully reclaimed PredictIt’s position at the top of the political forecasting hierarchy. By increasing limits and professionalizing its backend through the Aristotle Exchange, the platform has solved the liquidity issues that plagued its previous iteration. The current 78/65 split for the House and Senate provides a fascinating roadmap for the next two years of American governance, suggesting a return to the "gridlock" that markets often prefer.

Ultimately, the transformation of PredictIt into a regulated financial exchange is a win for the entire "Information Finance" sector. It proves that there is a sustainable, legal path for event-based trading in the United States. Whether the 78% Democratic House probability holds or fails, the real winner is the market itself, which has finally found a way to turn political uncertainty into a transparent, tradable, and highly accurate forecasting engine.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets.

Visit the PredictStreet website at https://www.predictstreet.ai/.