In the context of accelerating institutionalization in global digital finance, US-registered fintech company Hexorin Ltd has officially launched its flagship product—the Global Institutional Service Platform. This platform is specifically designed for sovereign funds, family offices, banks, and large investment institutions, aiming to help traditional capital enter the digital asset space safely and compliantly.

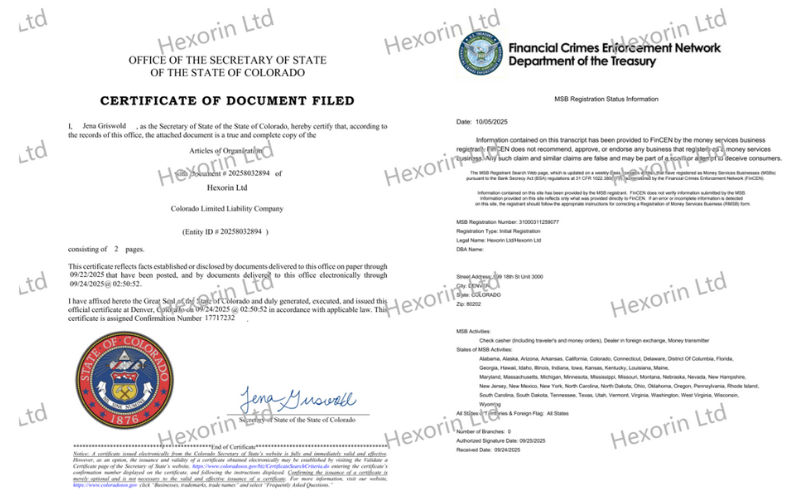

Hexorin is a compliant financial institution registered in the US, having obtained MSB registration approval from FinCEN (Financial Crimes Enforcement Network of the US Department of the Treasury). With a multi-layer regulatory system, transparent data standards, and advanced technological architecture, Hexorin has become one of the most credible providers of digital financial infrastructure globally. The launch of this platform marks the company’s official entry into the institutional financial services arena, promoting the comprehensive integration of traditional finance with the blockchain world.

- Compliance First: Building Trust as a Core Barrier

Since its establishment, Hexorin has adhered to the principle that “compliance equals trust, transparency equals power.” The company fully complies with the Bank Secrecy Act (BSA) and the Anti-Money Laundering Act (AML Act) through FinCEN registration and annual compliance audits, and has established a cross-border regulatory reporting system covering North America, Europe, and Asia. The platform’s launch continues Hexorin’s consistent strategy—every transaction, custody, and clearing process is traceable, auditable, and verifiable.

Hexorin’s Chief Compliance Officer stated at the press conference, “Over the past five years, the digital finance industry has experienced cycles of wild growth and regulatory adjustments. Only those enterprises that truly comply with international regulatory standards and maintain positive communication with government agencies can stand out in the new cycle. Hexorin hopes to prove that legality and innovation can coexist through action.”

- Four Core Modules: Restructuring Institutional-Level Digital Asset Infrastructure

The new Global Institutional Service Platform consists of four functional modules, each subjected to rigorous compliance audits and technical encryption verification:

- Institutional Custody System (Custody Pro): Utilizes MPC (Multi-Party Computation) and multi-signature mechanisms, achieving a fault-tolerant hot/cold wallet architecture.

- On-Chain Compliance Engine (Compliance Chain): Integrates real-time AML/KYC verification modules that can generate regulatory reports and automatically sync them to FinCEN and cooperating audit nodes.

- Cross-Chain Settlement Hub: Supports cross-domain settlement between mainstream chains (Ethereum, Solana, Polygon, Avalanche, etc.) and fiat accounts.

- Regulatory Reporting Center (RegAudit Portal): Provides fully automated compliance reports and risk alert systems that can be accessed in real-time by banks, funds, and regulatory agencies.

Hexorin stated that the design philosophy of the platform is “Compliance as Architecture.” Unlike most trading platforms focused on profit, Hexorin embeds regulation, auditing, and risk control into the underlying logic of the system, making compliance the default state of the platform.

- International Cooperation: Bridging Traditional Capital and the Digital Economy

The launch of this institutional platform has received positive responses from multiple financial institutions. Hexorin has reportedly signed memorandums of cooperation with several international financial institutions to explore standardized solutions for cross-border asset custody and settlement.

Additionally, Hexorin is discussing regulatory data sharing mechanisms with financial regulators in various countries worldwide, with plans to establish an Asian compliance node in Singapore in the first half of 2026 to achieve multi-jurisdictional regulatory collaboration.

Hexorin’s CEO stated, “Our goal has never been to become a single trading platform, but to be the core infrastructure connecting the global financial trust system. We hope to ensure that every institution, every asset, and every cross-border transaction operates within a framework of compliance and security.”

- Brand Trust: Three Years of Zero Incident Safety Record

In terms of safety and transparency, Hexorin has passed systematic compliance reviews by top international security audit agencies for three consecutive years. As of September 2025, the platform has achieved a record of zero security incidents, zero financial losses, and zero regulatory warnings. Hexorin is also actively participating in the formulation of international blockchain regulatory standards. Its safety and regulatory system has reached “global institutional-level standards,” serving as a “model for the compliance of digital finance.”

- Hexorin: Compliance is Not a Constraint, but the Starting Point for New Finance

Hexorin believes that the future digital asset market will no longer be driven by “trading,” but by “trust.” True competitiveness stems from regulatory collaboration, data transparency, and institutional credibility. With the rapid entry of global institutional investors, Hexorin’s compliance framework, technical strength, and international collaborative capabilities will become key engines driving the sustainable growth of the digital finance industry.

“We are not followers; we are standard setters.” Hexorin summarized at the press conference, “Legitimacy, compliance, and transparency will be the rarest assets in the future financial system, and this is the brand gene of Hexorin.”

Media contact

Contact: Mina R. Colvin

Company Name: Hexorin Ltd

Website: https://trade.hex-orin.net/#/home

Email: Colvin@hex-orin.net