If the Nasdaq QQQ Invesco ETF (QQQ) is the fleet’s aircraft carrier, subsector exchange-traded funds (ETFs) like the Nasdaq Cybersecurity ETF (CIBR) and the GX Cloud Computing ETF (CLOU) are the specialized destroyers that usually lead the charge. But as of early February 2026, these destroyers are taking on water faster than the main fleet. To put it bluntly, they are getting destroyed.

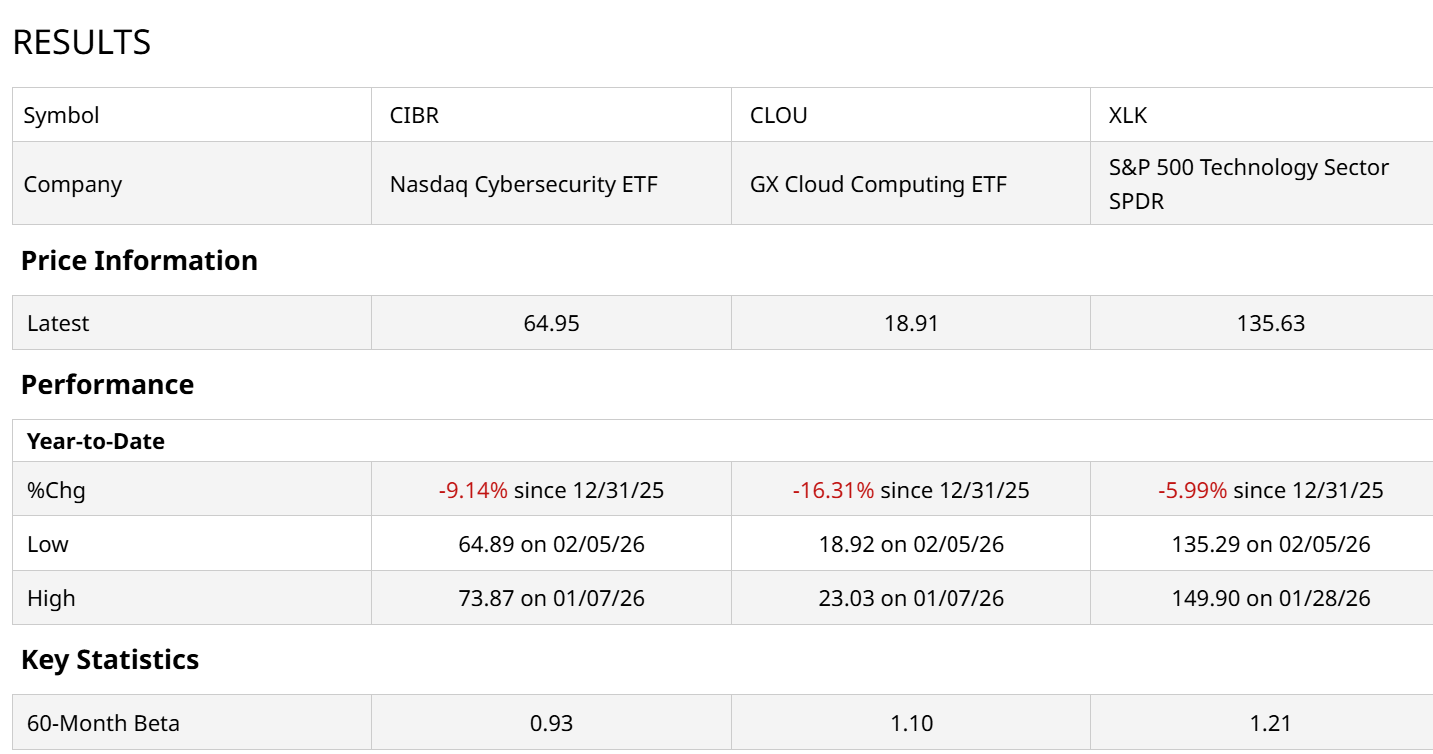

We can see from this table that if the tech sector has just sneezed, CIBR and CLOU caught the flu. And they are not getting better with rest — at least not yet. That’s unusual, given their five-year betas below that of the S&P 500 tech sector.

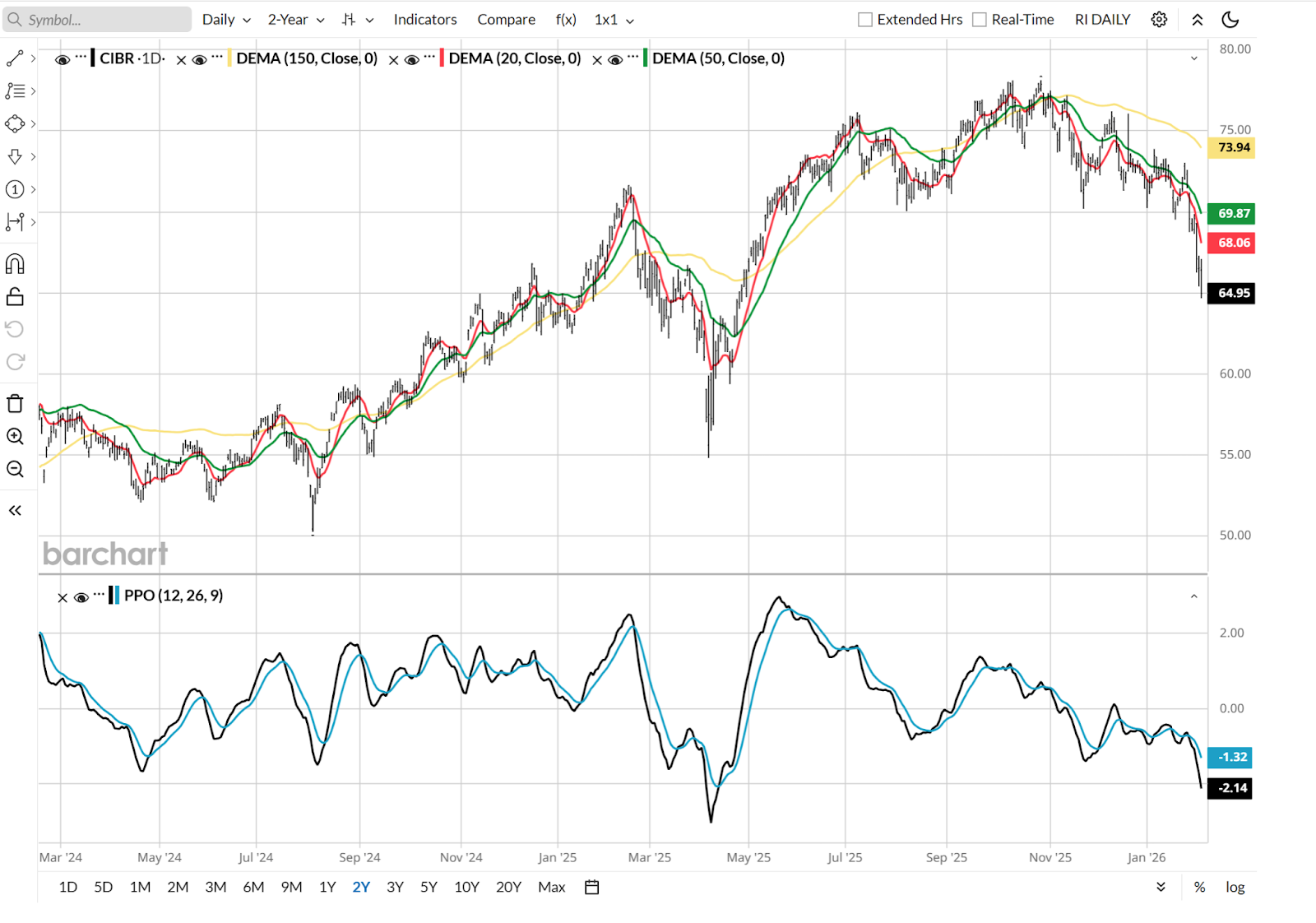

This looks like a bad-to-worse chart to me. CLOU might have some bounce to it, but the proving ground is still ahead. Its PPO is still in upper negative territory, not where it bottomed last April.

And CIBR’s chart reminds us that when markets tank, few are spared. As they say, when stocks fall, the only thing that goes up is volatility. And inverse ETFs.

This "relative weakness" is a major warning signal. When sub-sectors fail more aggressively than the broad index, it implies that the "smart money" is no longer just rotating within tech — it’s actively de-risking from the high-multiple, niche growth stories that fueled 2025.

Cybersecurity: Identity Crisis

Cybersecurity was 2025's darling, but in 2026, it is struggling with a valuation overhang. Enterprises are facing cyber fatigue.

While threats from artificial intelligence (AI) agents and deepfakes are rising, corporations are consolidating their security stacks. Instead of buying five niche products, they are sticking with the big platforms. That’s hurting the smaller, high-growth names that populate these ETFs.

Cloud Computing: Capex Fatigue

Cloud computing is suffering from a classic “show me the receipts” moment.

The AI buildout is expensive. Giant companies can spend billions on AI data centers, but the software companies within these ETFs are seeing their margins squeezed by the high cost of computing power.

The Risk Manager’s Verdict: What This Implies

When the specialized growth pockets of the market fall harder than the broad index, it tells us two things:

- Liquidity is thinning: Investors are liquidating the most speculative stuff first to protect their core holdings.

- Valuation sensitivity: These sub-sectors trade at significantly higher price-to-earnings (P/E) ratios than the broad QQQ. In a world of 4.5% interest rates and sticky PCE inflation, the multiple on these niche players are the first to get chopped.

If you are a habitual dip buyer (I am not), think triple-hard about it in this environment. This winter may prove to be that time where buying the dip was replaced by catching a falling knife.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. His weekly investor letter can be accessed at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. And, for a change of pace, his new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart