Meta Platforms (META) hasn’t exactly enjoyed the strongest performance recently. Though META stock has managed to avoid some of the disastrous incidents of volatility that have plagued the technology sector, the overall print has been frustrating. In the past six months, META has declined by more than 12%. Over the trailing 52 weeks, shareholders are in the red by 5%.

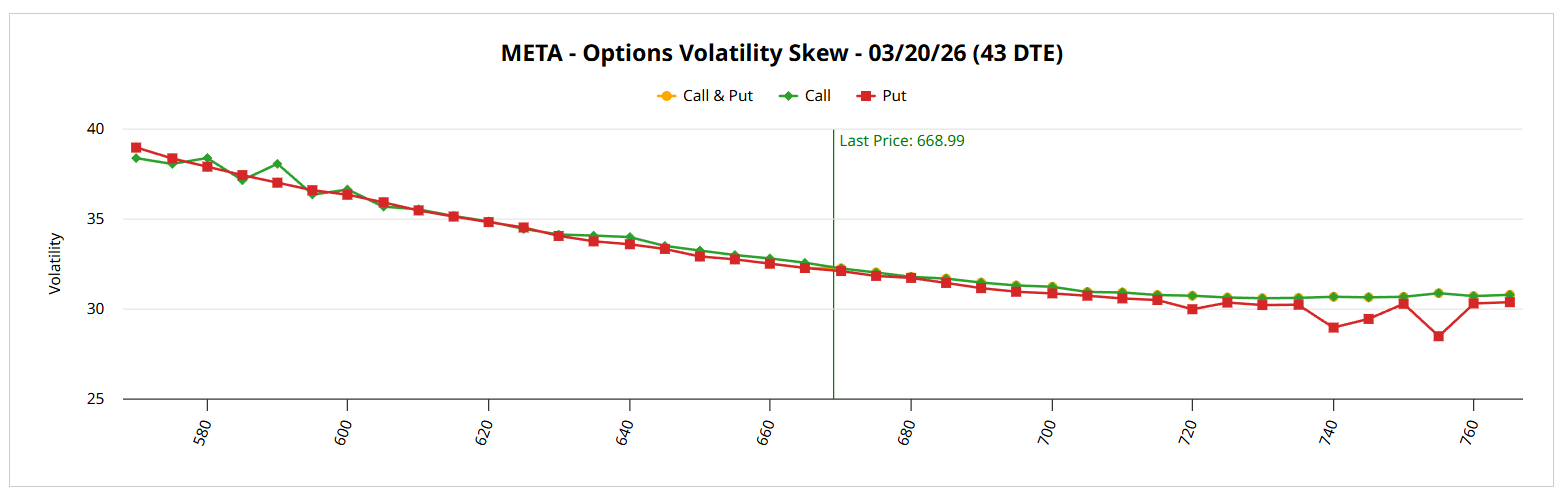

Still, the smart money doesn’t seem particularly worried — and that’s coming from Barchart’s screener for volatility skew. This indicator identifies implied volatility (IV) or a stock’s potential kinetic output across the strike price spectrum of a given options chain. For the March 20 expiration date for META stock, the overall posture appears relatively boring, which is a telling clue amid broader market chaos.

To be sure, smart money traders perceive downside risk for Meta Platforms; hence, the pricing for put IV rises for the lower strike prices. However, call IV also rises as the strike price fades — and generally, the spread between the two option categories is extremely tight. Therefore, we can say with reasonable confidence that downside insurance is respected, not necessarily prioritized.

In other words, the smart money views negative volatility as a non-trivial risk. However, it currently does not view such a scenario as an intensely probabilistic outcome. This assessment aligns with the Barchart Technical Opinion rating, which views META stock as a 40% Sell. We’re talking about garden-variety risk and the volatility skew is pricing the downside insurance premium as such.

Now, what’s really fascinating about the volatility skew is that there’s relatively little in the way of protecting against upside movements. While that term may sound confusing, the options market is agnostic to direction. It prices risk of movement, not belief about which way that movement must go.

Subsequently, those who want to express optimism through call options will find that, on a volatility basis, these derivatives are cheap. So, if there’s a legitimate reason to believe that META stock could go higher, it could conceivably be considered a discount.

Establishing the Parameters of the META Stock Battleground

While we may have an understanding of smart money sentiments through the volatility skew, we’re still at a loss to explain how this translates into actual outcomes. For that, we can turn to the Black-Scholes-derived Expected Move calculator. This model projects that for the March 20 expiration date, META stock may land between $617.99 and $719.99.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above forecast represents where META stock may symmetrically fall one standard deviation away from spot (while accounting for volatility and days to expiration).

For a quick cheat sheet, Black-Scholes is saying that in 68% of cases, we would expect META stock to trade between $618 and $720 when March 20 rolls around. This dispersion is insightful because it establishes the mathematical parameters of the likely trading battlefield. After all, it would take an extraordinary catalyst for META to trade materially beyond one standard deviation.

Still, the main challenge behind Black-Scholes is that it’s the equivalent of a search-and-rescue (SAR) team identifying a large patch of the Pacific Ocean as the search radius for shipwrecked survivors. However, institutions such as the U.S. Coast Guard operate in a world of limited resources (personnel, equipment, daylight, etc.). Given these restrictions, SAR teams have to be selective about resource expenditure.

Let me invite you into the problem. Imagine that META stock is a person lost at sea. What would you do to find this unfortunate soul? There’s really only one answer. You would use a mathematical model that not only accounts for basic drift patterns but also one that accounts for influencing factors like ocean currents and wind speed. This is exactly where the Markov property comes into full view.

Using Science to Trade Meta Platforms Stock

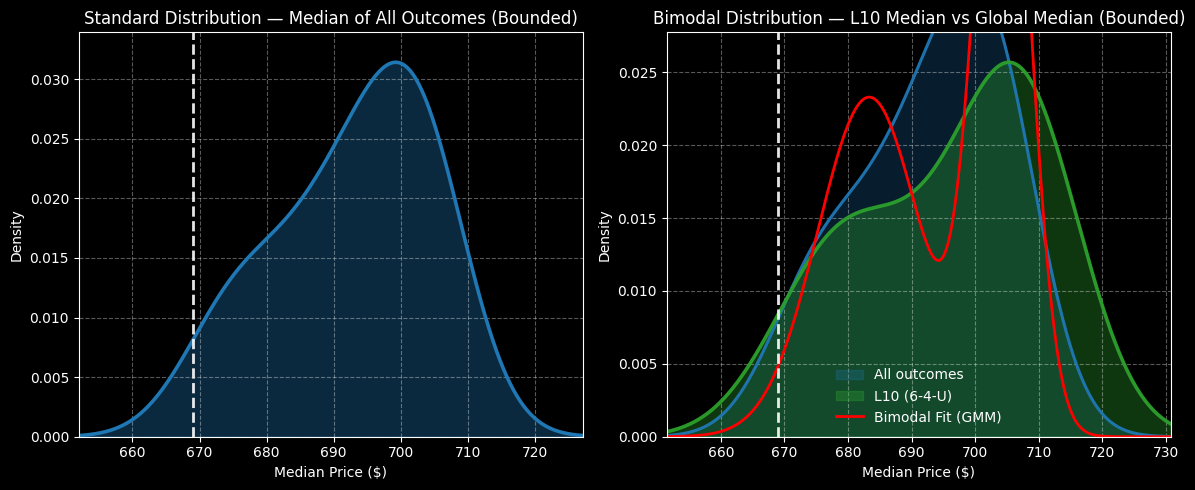

Under Markov, the future state of a system depends only on the present state. Stated differently, forward probabilities should not be calculated independently but be assessed in context. In the above SAR analogy, where the shipwrecked survivor may be found will depend heavily on ocean currents. Obviously, different current categories — such as choppy waters versus calm waters — will likely influence drift patterns.

In the last 10 weeks, META stock printed six up weeks, leading to an overall upward slope. There’s nothing special about this 6-4-U sequence, per se. But what we’re saying is that this sequence represents a specific type of ocean current and as such, META stock will likely drift in a particular manner.

Let me pause for a moment. Just like the stock market, the open water is an unforgiving place. Sometimes, survivors may be found well outside the calculated search area (if they’re found at all). There are no guarantees here. That said, we would expect that over many trials, enumerative induction and Bayesian-inspired inference represent the best tools for narrowing uncertainty in a complex and dynamic environment.

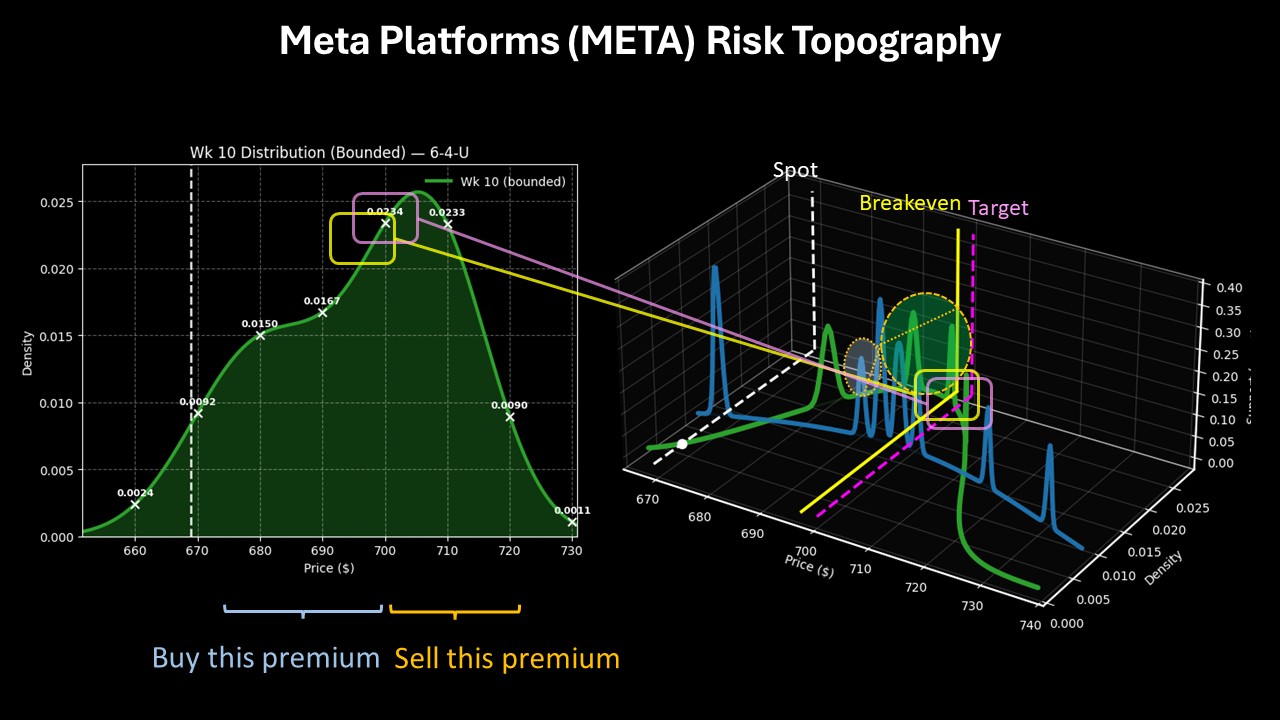

And what does the Coast Guard model tell us, for lack of a better phrase? Under 6-4-U conditions, we would expect META stock to drift between $650 and $740 over the next 10 weeks. However, probability density would likely peak near $705.

Statistical data shows that over the next five weeks, probability density would likely peak around $693. By the March 20 expiration date, an upside target of $700 wouldn’t be out of the question. Through this logic, I’m really liking the 695/700 bull call spread expiring March 20.

Nominally, the net debit is reasonable at $215. If META stock rises through the $700 strike at expiration, the maximum payout would be 132.56%. Breakeven lands at $697.15, adding to the trade’s probabilistic credibility.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Move in AMD Stock After Earnings Was Much Larger Than the Average. Why?

- As Oklo Stock Plunges, One Analyst Still Thinks It Can Gain 175%

- Get Into High-Conviction Stock Moves Early by Finding Breakaway Gaps on the Price Chart

- A ‘Boring’ Posture by the Smart Money Makes Meta Platforms (META) an Intriguing Discount