Valued at a market cap of $39.6 billion, American International Group, Inc. (AIG) is a New York–based insurance company and a leading provider of property and casualty insurance to commercial and institutional customers.

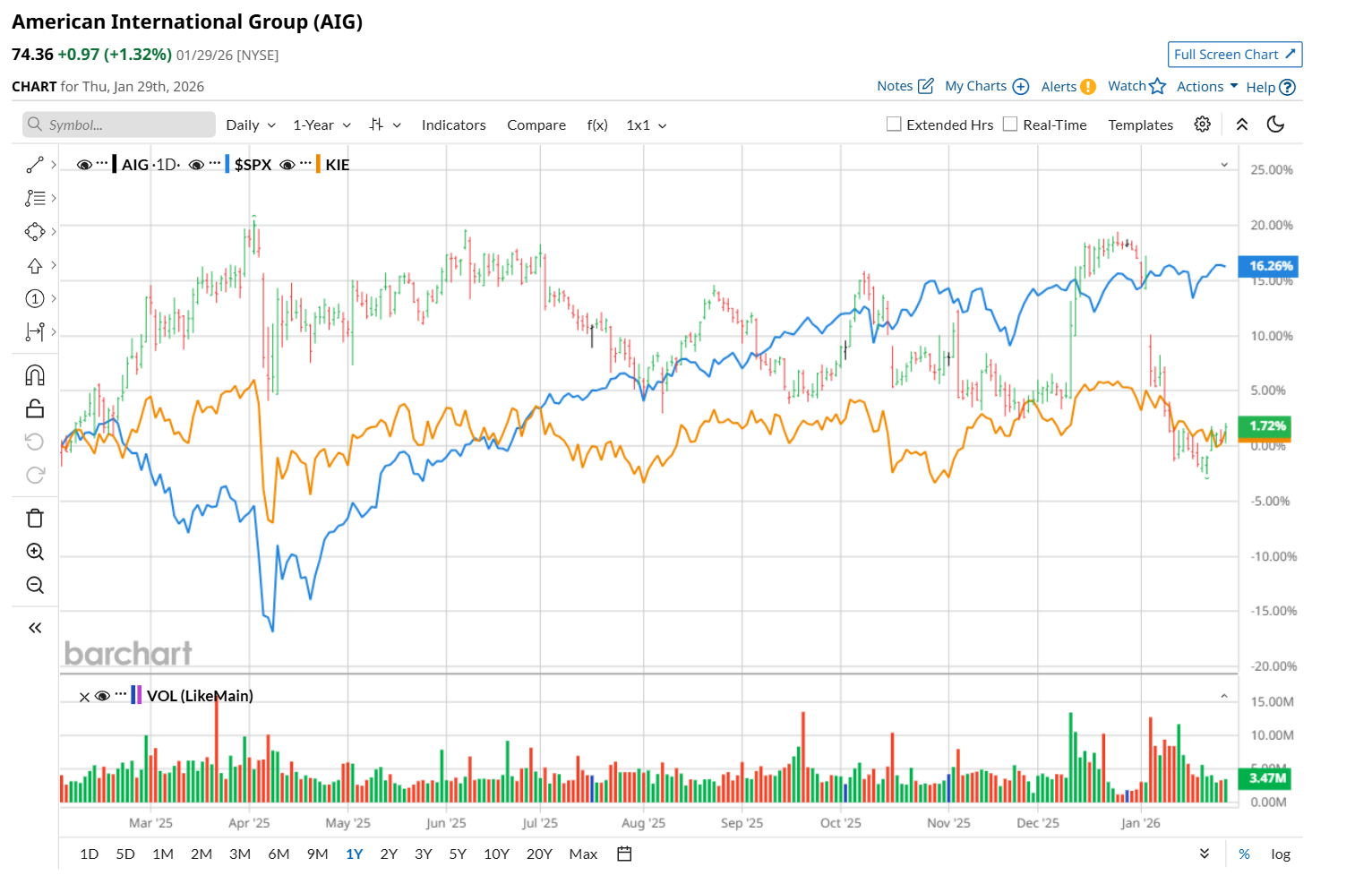

This insurance company has underperformed the broader market over the past 52 weeks. Shares of AIG have declined 1.4% over this time frame, while the broader S&P 500 Index ($SPX) has surged 15.4%. Moreover, on a YTD basis, the stock is down 13.1%, compared to SPX’s 1.8% return.

Narrowing the focus, AIG has also trailed behind the State Street SPDR S&P Insurance ETF (KIE), which rose marginally over the past 52 weeks and dropped 2.9% on a YTD basis.

On Jan. 6, shares of AIG tumbled 7.5% after the company announced that Chairman and CEO Peter Zaffino plans to step down as CEO by mid-year and move into the role of Executive Chairman. The abrupt timing of the announcement injected uncertainty, which markets were quick to price in, sending AIG shares down. AIG also disclosed that Eric Andersen, a seasoned industry leader from Aon, will join as President and CEO-elect on February 16, 2026. Still, investors reacted negatively, underscoring market unease around leadership changes.

For the current fiscal year, ending in December, analysts expect AIG’s EPS to grow 41.8% year over year to $7.02. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

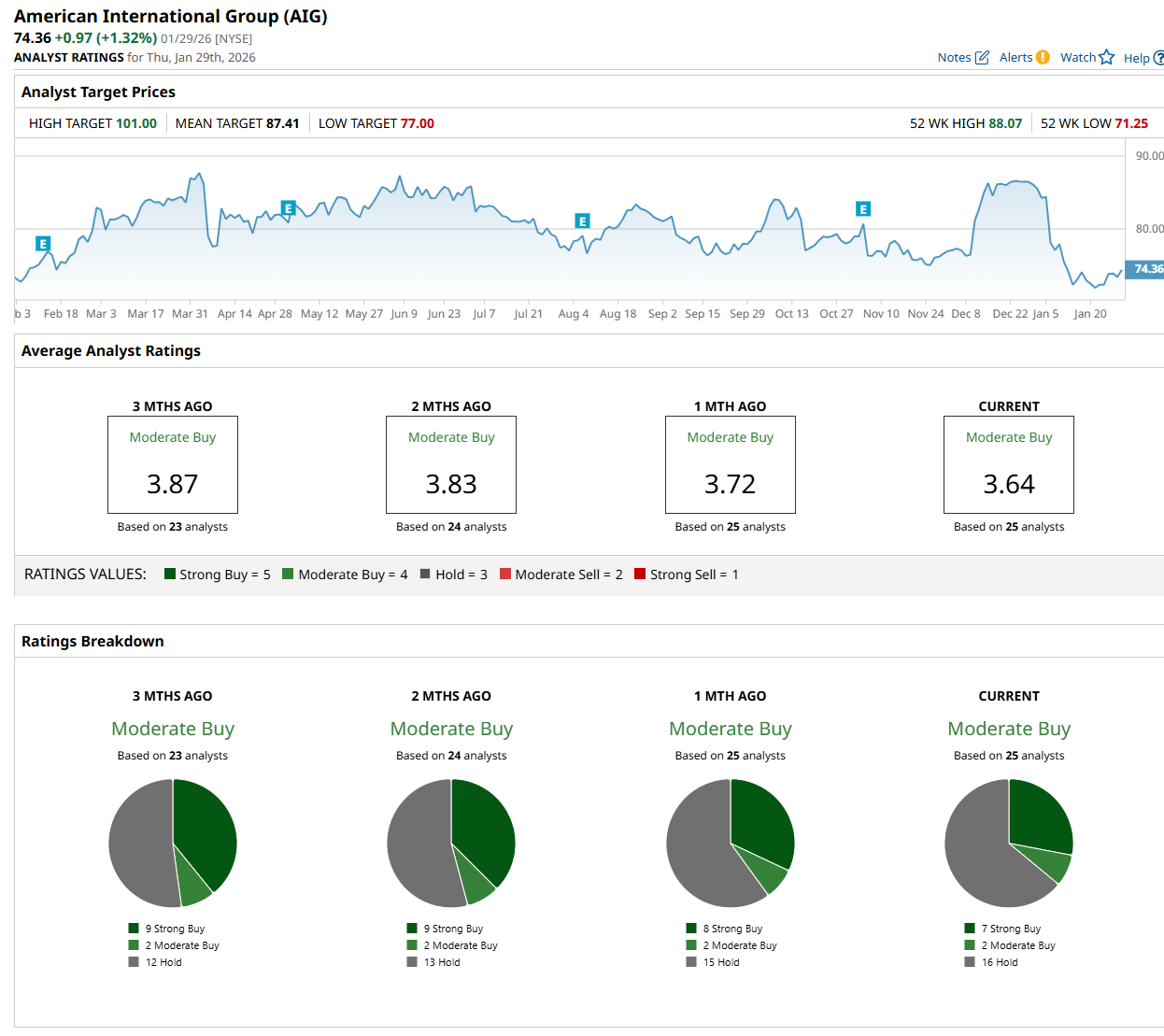

Among the 25 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” two "Moderate Buy,” and 16 “Hold” ratings.

The configuration is slightly less bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating.

On Jan. 16, RBC Capital analyst Rowland Mayor maintained a “Hold” rating on AIG and set a price target of $85, indicating a 14.3% potential upside from the current levels.

The mean price target of $87.41 represents a 17.5% premium from AIG’s current price levels, while the Street-high price target of $101 suggests a 35.8% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart