If you think the silver (SIH26) market is acting “normal” right now, you haven’t checked the lease rates or the London vaults lately. We are witnessing a historic de-coupling where physical silver is trading at 50% to 80% premiums over the official paper spot price. In early 2026, the metal has already blasted past its 1980 record of $53.40, hitting intraday highs that remind me of that scene from the classic comedy movie Airplane. Silver, now arriving at $80, $90, $100…

But this isn’t just a speculative cornering of the market. This is a structural physical squeeze meeting AI-industrial desperation.

What’s Different Now Than in 1980?

When the Hunt brothers tried to corner silver, they were fought by the exchanges and eventually crushed by a wave of new supply. In 2026, the short sellers are the ones getting crushed. Why?

- Silver is no longer just “poor man’s gold.” It is an industrial necessity for AI data centers, electric vehicles, and solar panels. Manufacturers must have silver to keep production lines running, regardless of the cost. This is not a luxury now.

- The market has been in deep “backwardation,” meaning spot prices were higher than futures. That implies investors and industries are so desperate for the metal, they are willing to pay massively more to bypass the paper contracts.

- As of January 2026, China has tightened export licenses for silver, effectively choking off a major global supply artery just as the West needs it most.

How I’m Playing the ‘Silver Bullet’

As a risk manager, I treat a parabolic move like a live wire — it can provide immense power, but it will burn you if you don’t use insulation.

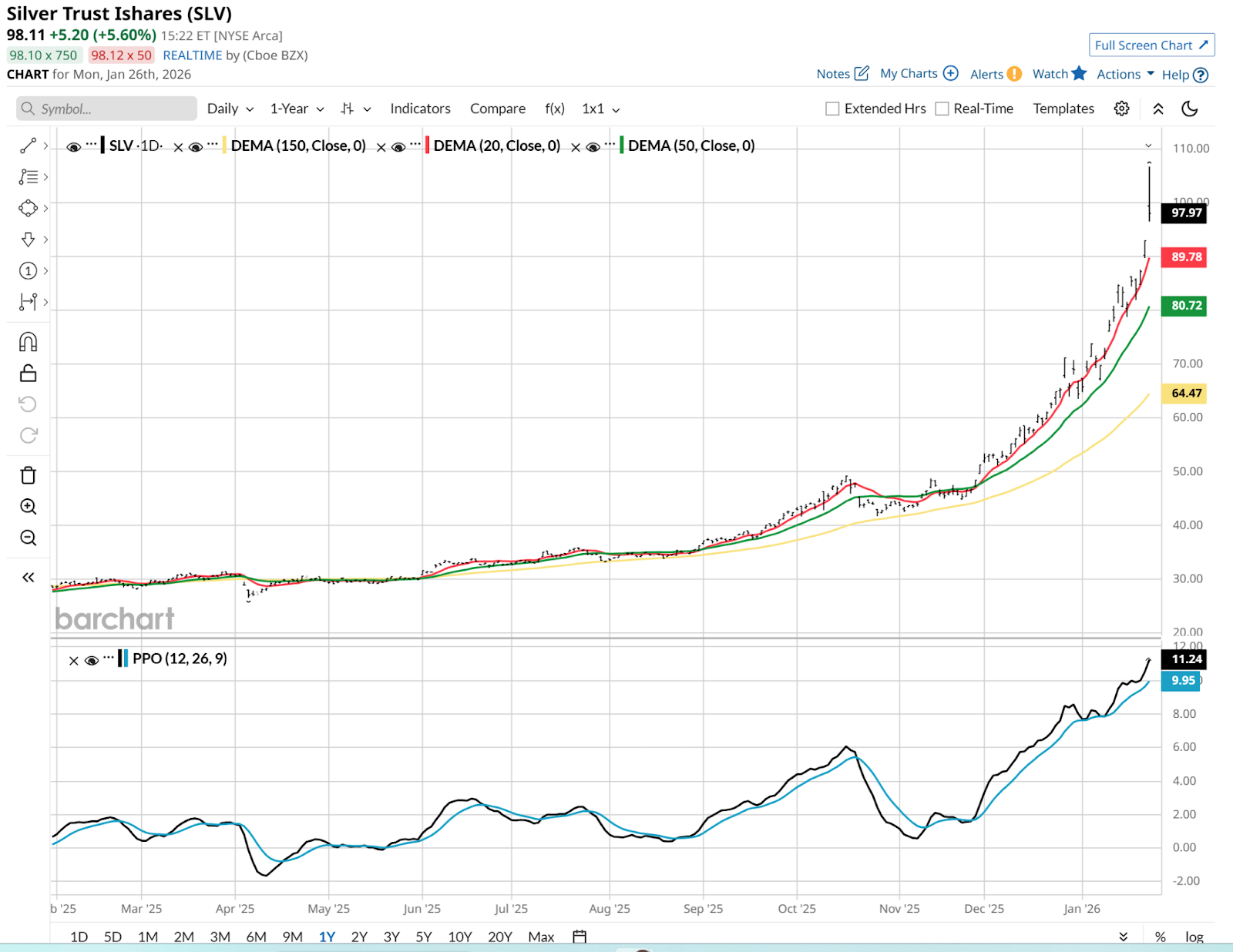

The iShares Silver Trust ETF (SLV) has been my vehicle of choice. I’ve traded it on and off, but exited the share position. I wrote about it here a few weeks ago.

I still hold some way out-of-the-money puts and calls, which are not at all cheap. But the way this thing has moved, I at least have some curiosity, and there is a chance it can recapture its recent highs. Or drop to where it was a month ago, 50% lower. Either scenario to me is worth keeping a tiny position out there for a bit longer. The tail end of what was once a bigger, collared position.

The Bottom Line

A few final thoughts for those who are still silver-curious.

First, avoid the FOMO. Silver prices can always go higher, but chasing the precious metal here is exit liquidity for some big money folks. My puts are struck at $90-$75, and only out 2-3 weeks. And I’m only holding them because the profit on my core position did well enough to allow me to risk a small portion of it. A bit of “go for it” money, so to speak.

Second, the gold-silver ratio has collapsed from about 100:1 to closer to 50:1. History suggests that when this ratio hits such extremes, a violent snap-back is coming. And the wildcard here is if COMEX raises margin requirements to force liquidations. The last thing anyone wants is to be forced to do anything as an investor.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts had a position in: SLV . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart