Palantir (PLTR) shares remain in focus today after a senior RBC Capital analyst issued a strongly bearish note on the artificial intelligence (AI)-enabled data analytics firm.

In a research report released today, Rishi Jaluria maintained his “Underperform” rating on PLTR, with a $50 price target indicating potential downside of an alarming 70% from here.

His dovish call is significant given Palantir stock has already lost more than 20% over the past two months.

Why RBC Capital Is Super Bearish on Palantir Stock

RBC recommends cutting exposure to PLTR stock primarily because its government data tracker suggests the giant is seeing a decline in both qualified contract value (QCV) and net annual contract value (ACV).

Even on the commercial front, things aren’t looking particularly exciting for Palantir Technologies, Jaluria told clients on Tuesday. According to him, recent checks confirm at least some customers are re-evaluating their long-term commitment to the PLTR ecosystem.

Note that Palantir’s standard relative strength index (14-day) sits at about 39 currently, reinforcing that the downward pressure may not be over just yet.

PLTR Shares Remains Significantly Overvalued in 2026

In his latest research note, Jaluria said Palantir shares’ risk-reward profile is “skewed to the downside” heading into the company’s earnings on Feb. 2.

Why? Because they’re trading at a forward price-to-earnings (P/E) ratio of more than 200x currently, which makes it one of the most expensive established AI names to own in 2026.

What’s also worth mentioning is that Palantir insiders have predominantly sold stock over the past six months, signaling those closest to the company perhaps view it as “overvalued” as well.

Moreover, the AI stock has tumbled below its 100-day moving average (MA) recently, indicating the dovish momentum could sustain in the near-term.

What’s the Consensus Rating on Palantir Technologies Inc

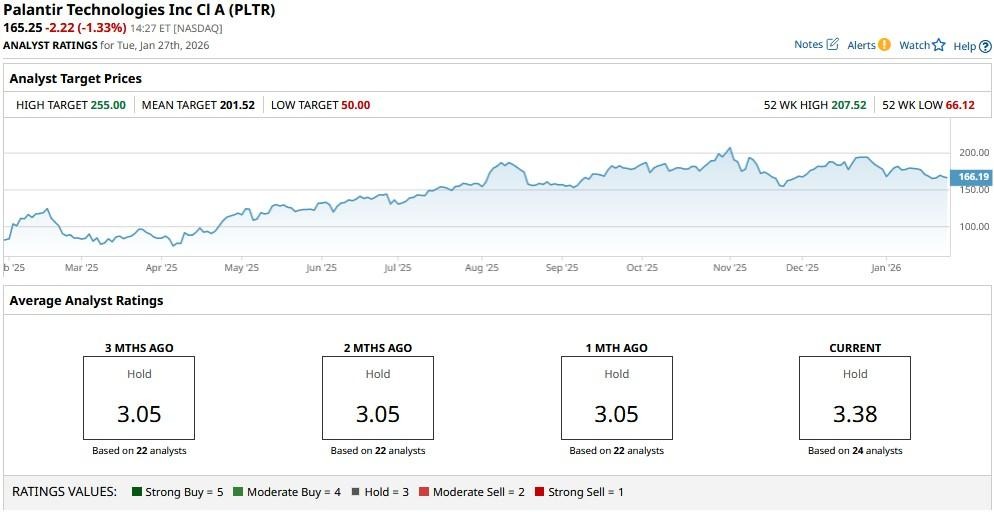

Other Wall Street analysts, however, do not agree with Jaluria on Palantir. According to Barchart, while the consensus rating on PLTR shares sits at a “Hold," the mean target of about $201 signals potential upside of more than 20% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- GameStop Stock Is Now in Overbought Territory as Michael Burry Buy Shares. Is It Too Late to Chase GME Stock Here?

- 2 ‘Strong Buy’ Growth Stocks With Upside of Around 200%

- This Analyst Warns Palantir Stock Could Plunge to $50. Should You Sell Shares Now?

- New Report Slams Ubiquiti for Products That Keep Showing Up on the Front Lines of the Russia-Ukraine War: What Investors Should Know