Industrial giant Honeywell International (HON) has marched into 2026 with momentum, fueling investor excitement with a bold strategic reset. The industrial titan is gearing up for the much-anticipated initial public offering (IPO) of its majority-owned quantum computing arm, Quantinuum. It's a move that comes as companies race to scale quantum computing for breakthroughs in areas such as advanced materials and hydrogen fuel-cell technology.

Meanwhile, Honeywell is pressing ahead with plans to split its Automation and Aerospace businesses into two standalone public companies by the second half of 2026, a step aimed at sharpening focus and unlocking value. With its fundamentals holding firm and major value-unlocking moves underway, does Honeywell deserve a spot in your portfolio right now?

About Honeywell Stock

Founded in 1906, Honeywell has evolved from a small heating-specialty business into a global conglomerate. Today, the company sits at the forefront of innovation, delivering cutting-edge solutions across aerospace, building and industrial automation, energy transition, and safety technologies. Honeywell partners with organizations worldwide to tackle some of the most complex challenges in automation, the future of aviation, and sustainable energy.

Through its Aerospace Technologies, Building Automation, Process Automation & Technology (PA&T), and Industrial Automation segments, all powered by its advanced Honeywell Forge software, the company is driving smarter, safer, and more sustainable industries for the future. Currently standing at a market capitalization of about $139.3 billion, the company is off to a great start in 2026.

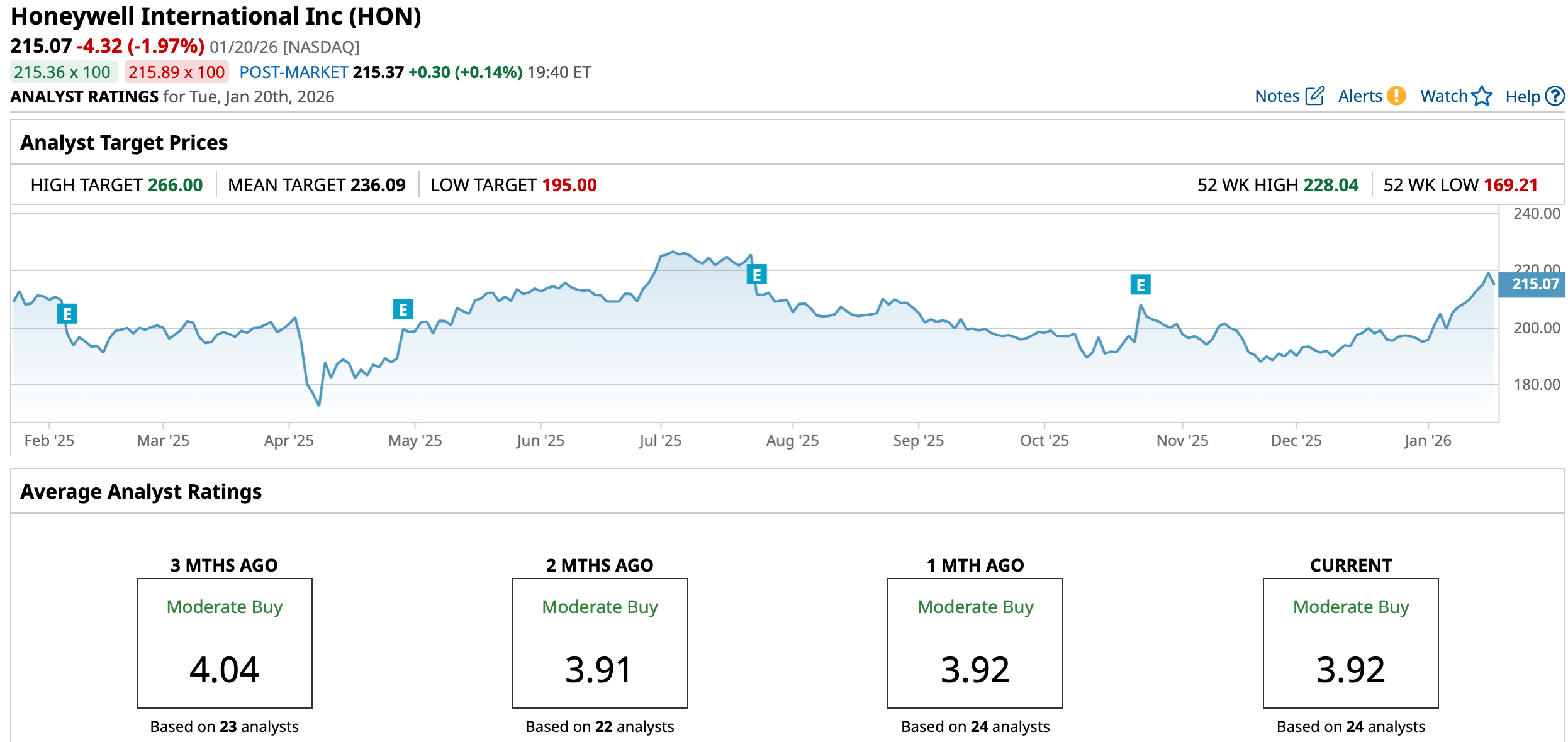

Honeywell wasted no time making its mark in 2026, surging over 11% in just the first few trading days of the year and easily leaving the broader S&P 500 Index ($SPX) in the dust, which gained a modest 1.4% over the same period. The stock touched a year-to-date (YTD) high of $220.63 on Jan. 16 and is still trading slightly below that peak, signaling strong early momentum.

Honeywell’s Q3 Earnings Snapshot

Honeywell turned in an impressive performance in its fiscal 2025 third-quarter earnings report last October, delivering results that topped Wall Street’s expectations across the board. The industrial powerhouse posted total sales of $10.4 billion, up 7% year-over-year (YOY), with organic growth of 6%, comfortably beating analysts’ forecast of $10.1 billion. The strong showing was powered largely by standout performances in its Aerospace Technologies and Building Automation businesses.

Aerospace Technologies stole the spotlight, racking up $4.51 billion in quarterly revenue, a robust 15% jump from a year earlier, while organic sales climbed 12%. Building Automation also gained traction, generating $1.88 billion in revenue, up 8% YOY. Meanwhile, Energy and Sustainability Solutions kept up the momentum with revenues rising 11% to $1.74 billion, underscoring broad strength across Honeywell’s portfolio.

On the earnings front, Honeywell delivered adjusted EPS of $2.82, a 9% YOY increase and well ahead of the consensus estimate of $2.56. The company ended the quarter with $12.9 billion in cash and cash equivalents, up from $10.6 billion at the end of December 2024. Free cash flow came in at $1.45 billion, down 16% from the year-ago period.

Looking ahead, Honeywell now expects full-year 2025 sales in the range of $40.7–$40.9 billion, slightly below its previous forecast of $40.8–$41.3 billion. Still, the company raised its organic sales growth outlook to about 6%, up from the earlier 4–5% projection. Segment margin guidance was trimmed slightly to 22.9%–23%, versus the prior 23%–23.2% range.

At the same time, adjusted EPS guidance was lifted to $10.60–$10.70, above the earlier $10.45 – $10.65 range, implying a 7% – 8% increase from last year. All eyes are now on Honeywell’s fiscal 2025 fourth-quarter earnings, which are set to be released before the market opens on Thursday, Jan. 29.

What Do Analysts Expect for Honeywell Stock?

Recently, JPMorgan has turned more bullish on Honeywell, upgrading the stock to “Overweight” and saying the market is undervaluing it ahead of the company’s breakup. The bank points to improving core growth, record backlogs, and a strong order book, particularly in Aerospace, which should drive better earnings and margins in 2026. While breakup-related costs are creating some near-term noise, JPMorgan believes Honeywell is cleaning this up faster than expected.

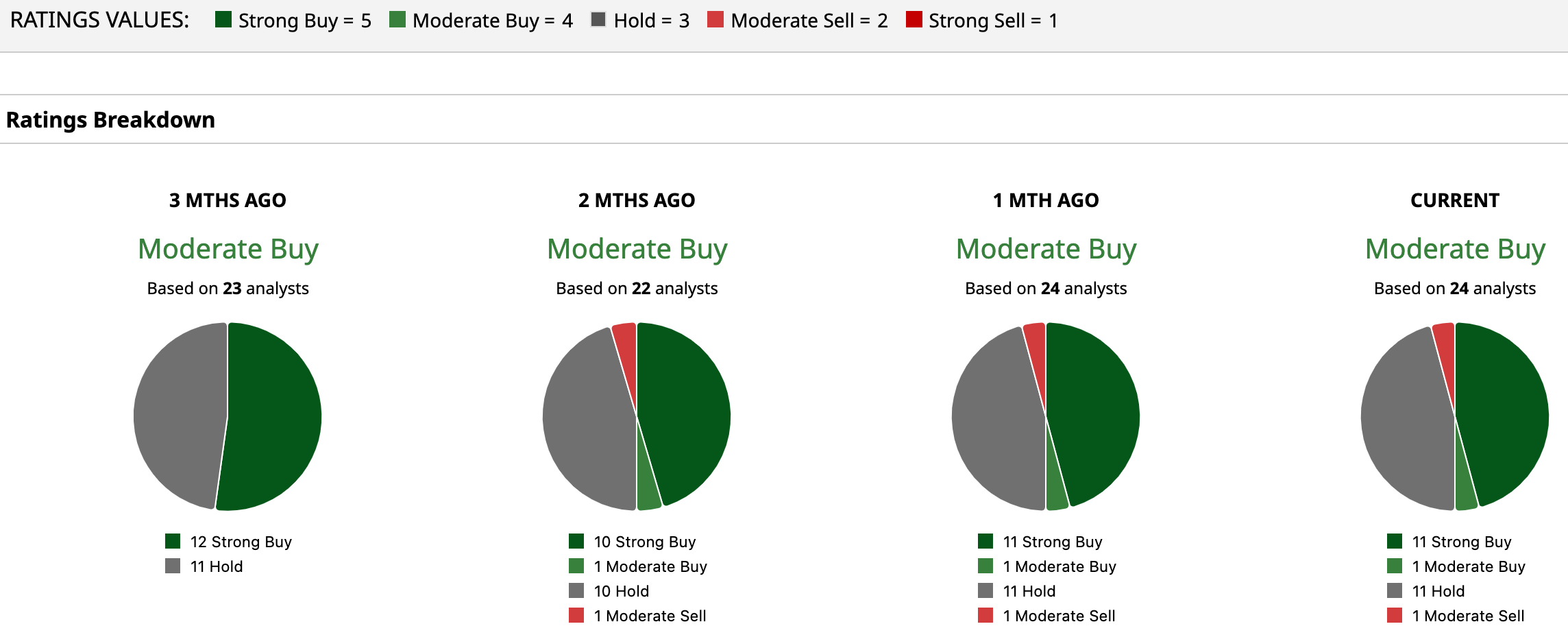

Overall, Honeywell continues to win favor on Wall Street, earning a consensus “Moderate Buy” rating from analysts. Of the 24 analysts covering the stock, 11 recommend “Strong Buy,” one says “Moderate Buy,” 11 suggest “Hold,” and just one advises “Moderate Sell.” The average price target of $236.09 implies about 9.8% upside, while the Street’s most bullish call at $266 points to potential gains of 23.68% from current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart