Novo Nordisk A/S (NVO) kicked off 2026 with a major milestone: the U.S. launch of the Wegovy weight-loss pill. This marks the first oral GLP-1 therapy, which was approved by the Food and Drug Administration (FDA) in late December. And this wasn’t just another product rollout. It signaled a strategic shift in the way obesity treatment is delivered.

Where injectable GLP-1 drugs require in-office or self-administered shots, a daily pill dramatically lowers the barrier to treatment for millions of patients who prefer a familiar, convenient option.

Early traction has been encouraging, with the first few days on the market showing the Wegovy pill amassing over 3,000 retail prescriptions. Further, that figure doesn’t include online pharmacy data, which is believed to push the actual total even higher. Investors took notice, driving the company’s shares up sharply following the launch.

However, with fierce competition brewing, will the recent momentum be sustainable?

About Novo Nordisk Stock

Headquartered in Denmark, multinational pharmaceutical and healthcare company Novo Nordisk continues to be a leader in chronic disease treatment since its founding in 1923. Best known for its diabetes and obesity care products, including blockbuster medicines such as Ozempic, Rybelsus, and the recently launched Wegovy weight-loss pill, it also develops treatments for cardiovascular disease and rare disorders. Novo Nordisk is a heavyweight in the global healthcare sector with a market cap of $270.9 billion.

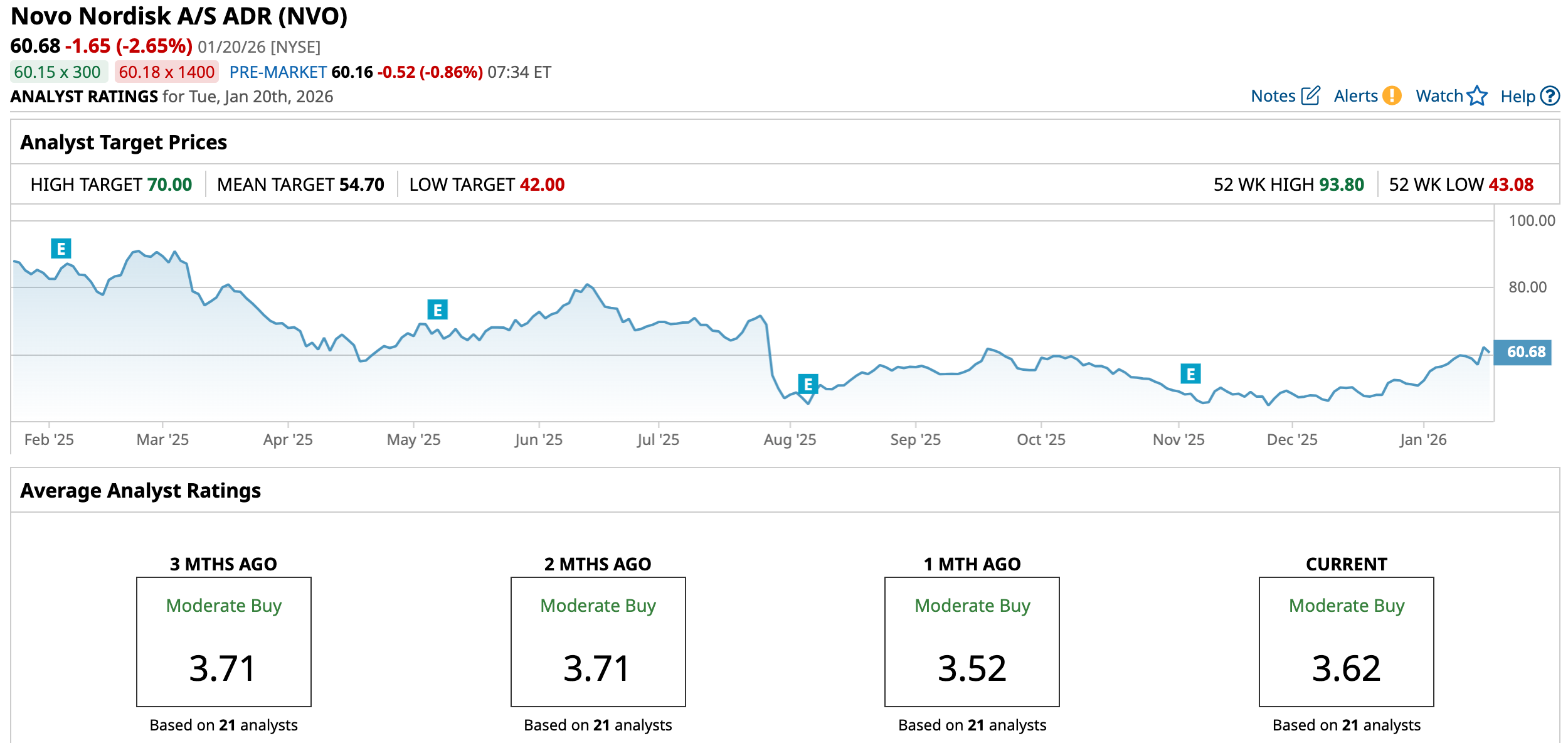

Over recent weeks, Novo Nordisk’s stock performance has shifted from muted to noticeably stronger, driven largely by renewed enthusiasm around its newly launched Wegovy weight-loss pill. After a challenging stretch last year, with the share price under pressure, the 52-week performance was at -22.89%.

The narrative changed in late December when the FDA's approval of its pill sparked a rally, with shares jumping as much as 7.3% on Dec. 23 as investors priced in the potential of the first-of-its-kind oral GLP-1 therapy. But the official U.S. launch earlier this month prompted investors to continue to bid up the stock. Novo shares climbed 5.2% on Jan. 5, following the launch announcement.

Furthermore, the stock registered intraday gains of 9.1% on Jan. 16, on the back of encouraging early U.S. prescription data for the pill. The stock is already up by 19.26% this year.

Early numbers suggest impressive momentum. According to Leerink Partners, about 3,100 prescriptions were filled in the first week, based on IQVIA data. But separate data from Symphony, cited via Bloomberg, showed even stronger uptake, with roughly 4,290 prescriptions in the first full week.

The early traction strengthens Novo Nordisk’s effort to regain market share from rival Eli Lilly and Company (LLY), which dominated much of the obesity drug market in early 2025.

The broader trend shows a clear rebound in investor sentiment, particularly tied to tangible evidence that Wegovy’s oral form could drive growth and help the company regain ground against competitors. Yet, it remains to be seen whether this momentum can be sustained through Q1 and beyond, considering a backdrop where demand could shift once Lilly’s own oral obesity drug comes to market.

The stock is currently trading at a discount compared to the sector median and own historical average at 17.73 times forward earnings.

Modest Financial Performance

On Nov. 5, 2025, Novo Nordisk reported its financial results for the nine months ended Sept. 30. Net sales increased to DKK 229.9 billion ($35.8 billion) in the first nine months of 2025, up 12% year-over-year (YOY). Operating profit rose to DKK 95.9 billion ($14.9 billion), representing a 5% increase. Also, net profit increased modestly, climbing about 4% YOY to DKK 75.5 billion ($11.8 billion). Its EPS for the period was DKK 16.99, marking an increase from the DKK 16.29 reported for the first nine months of 2024.

Sales within the Diabetes and Obesity care segment rose about 12% as demand for obesity care grew strongly, up roughly 37%, while GLP-1 diabetes treatment sales saw more moderate YOY increases. Additionally, rare disease sales contributed with a 10% increase, underlining the diversified growth drivers across the portfolio.

Despite the YOY top line and profit growth, Novo Nordisk narrowed its full-year 2025 guidance, reflecting slightly more cautious expectations amid intensified competition. The company now expects full-year sales growth of approximately 8% to 11% at constant exchange rates and operating profit growth of about 4% to 7%.

Meanwhile, analysts anticipate EPS to improve 9.5% YOY to $3.59 in fiscal 2025, but decline 2% to reach $3.52 in fiscal 2026.

What Do Analysts Expect for Novo Nordisk Stock?

Earlier this month, BMO Capital reiterated its “Market Perform” rating and $46 price target on Novo Nordisk after the company’s CEO comments at a JPMorgan (JPM) conference. Management struck a more optimistic tone for 2026, emphasizing improved commercial execution, a renewed focus on obesity and diabetes, and pipeline strengthening.

On the other hand, CICC Research initiated coverage of Novo Nordisk with an “Outperform” rating, reflecting CICC’s confidence in Novo’s strategic positioning and growth catalysts.

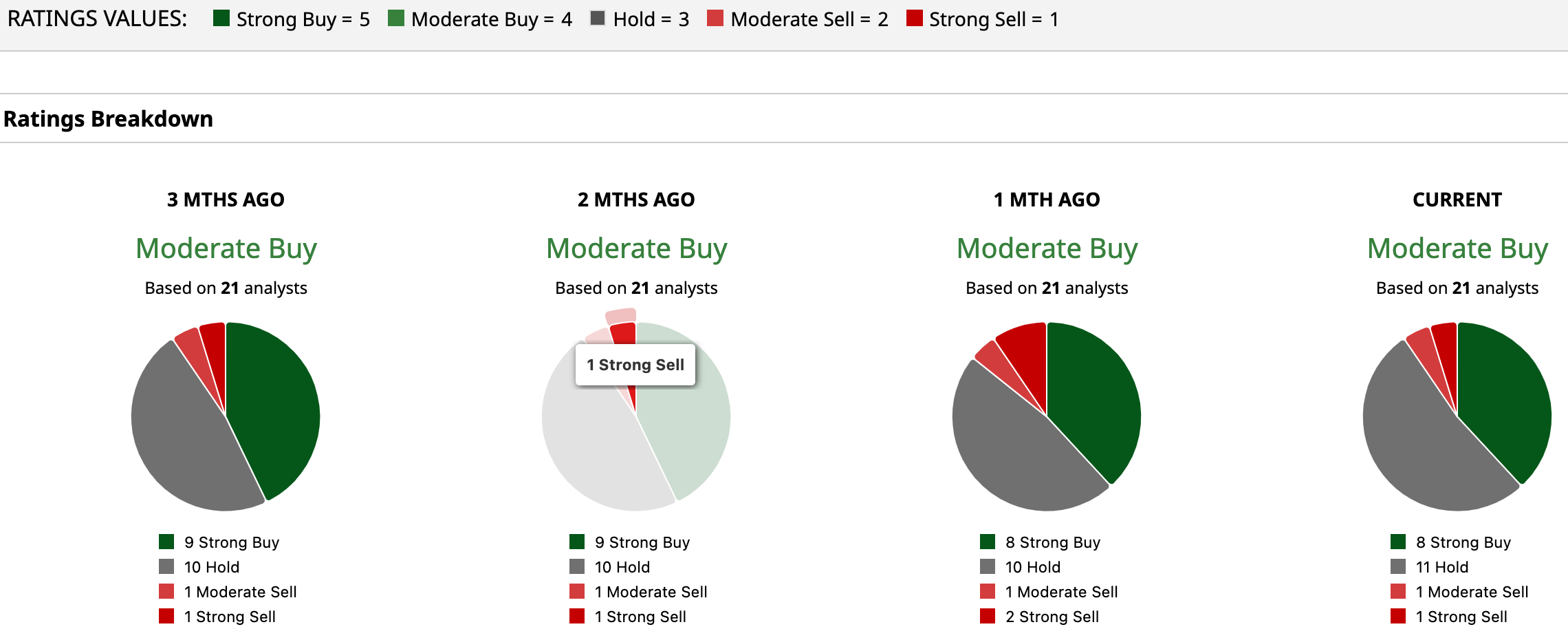

Overall, Wall Street is fairly bullish on NVO with a consensus “Moderate Buy” rating. Of the 21 analysts covering the stock, eight advise a “Strong Buy,” 11 recommend a “Hold,” one suggests a “Moderate Sell,” and one gives a “Strong Sell.”

The stock has surged past the average analyst price target of $54.70, while the Street-high target price of $70 suggests that the stock could rally as much as 15.36%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Could Launch a New PC This Year. Should You Buy NVDA Stock First?

- As Micron Spends $1.8 Billion on a New Chip Fab Site, Should You Buy MU Stock?

- Netflix Just Upped Its Bid for Warner Bros. to All Cash. What Does That Mean for NFLX Stock?

- The New Wegovy Pill Is Already Popular. Does That Make Novo Nordisk Stock a Buy for Q1?