Sunnyvale, California-based Synopsys, Inc. (SNPS) provides electronic design automation (EDA) software products used to design and test integrated circuits. With a market cap of $98.8 billion, the company provides design technologies to creators of advanced integrated circuits, electronic systems, and systems on a chip. The global leader in EDA is expected to announce its fiscal first-quarter earnings for 2026 in the near term.

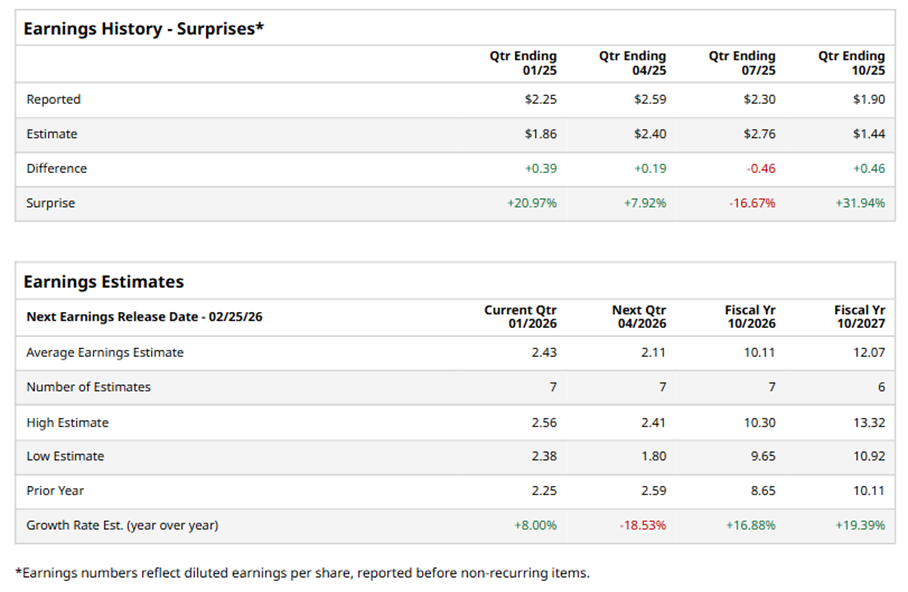

Ahead of the event, analysts expect SNPS to report a profit of $2.43 per share on a diluted basis, up 8% from $2.25 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect SNPS to report EPS of $10.11, up 16.9% from $8.65 in fiscal 2025. Its EPS is expected to rise 19.4% year over year to $12.07 in fiscal 2027.

SNPS stock has underperformed the S&P 500 Index’s ($SPX) 13.3% gains over the past 52 weeks, with shares down 3% during this period. Similarly, it underperformed the Technology Select Sector SPDR Fund’s (XLK) 21.2% gains over the same time frame.

On Dec. 10, 2025, SNPS shares closed up more than 2% after reporting its Q4 results. Its adjusted EPS of $2.90 beat Wall Street expectations of $2.79. The company’s revenue was $2.3 billion, meeting Wall Street forecasts. SNPS expects full-year adjusted EPS in the range of $14.32 to $14.40, and revenue ranging from $9.6 billion to $9.7 billion.

Analysts’ consensus opinion on SNPS stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 21 analysts covering the stock, 15 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” four give a “Hold,” and one recommends a “Strong Sell.” SNPS’ average analyst price target is $559.28, indicating a potential upside of 9.5% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart