Markets are once again grappling with uncertainty. We saw the S&P 500, Dow Jones, and Nasdaq fall yesterday due to concerns over Greenland, while investors also weighed policy uncertainty as Fed Chair Jerome Powell approaches the end of his term. Meanwhile, others are concerned about the stretched valuations of certain AI tech stocks, which had been the main drivers of the 2025 bull run.

At this point, many of us are reading the room and switching to more bearish stances. If you fit in this category, then it’s likely that you’ve already considered selling calls or call credit spreads to take advantage of the renewed fear and volatility.

But the question is, how do you identify the ideal trade? Well, there are a few Barchart features that can help with that.

What Are Naked Calls And Bear Call Spreads?

But first, let’s cover the basics. A short or naked call is an options strategy where you sell a call option, while a bear call contains the naked call, but caps losses by having another option (same underlying and expiration) at a higher strike. As the seller, you receive a credit whenever you initiate these trades.

As the name suggests, a naked call is more exposed because it carries theoretically unlimited downside risk if the stock makes a sharp move higher. The risk of a naked call comes from assignment - when the buyer of the call exercises their right to buy the asset at your strike price, regardless of the current market price. So, imagine buying 100 shares of XYZ stock worth $100 and then having to sell them for $75 each.

For bear calls, the risks are limited. Since you have the long call at a lower strike, it caps potential losses by offsetting gains on the short call if the underlying moves sharply higher.

Either way, both option strategies rely on the underlying asset remaining below the short call strike at expiration to realize full profit. That makes the short strike a critical decision point, one that can either make or break the trade.

Selecting The Short Strike

Now, Barchart has a few features that can help you make that decision.

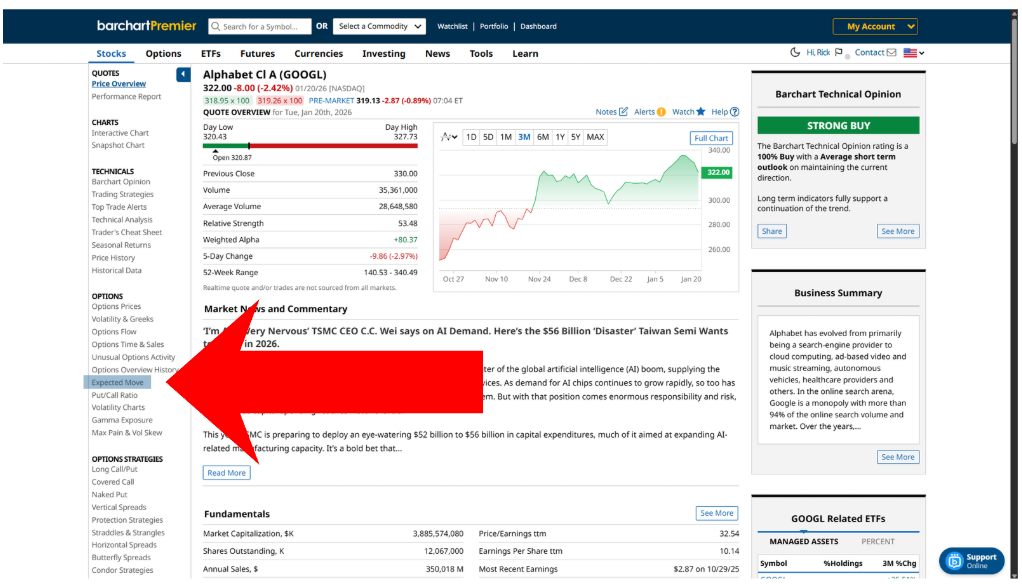

Expected Move

First and foremost is the expected move feature. This calculates the potential range that the underlying asset is expected to trade within by a certain expiration date. These values are calculated by taking 85% of at-the-money long straddle premiums. The feature can be found right here from any Stock Profile Page.

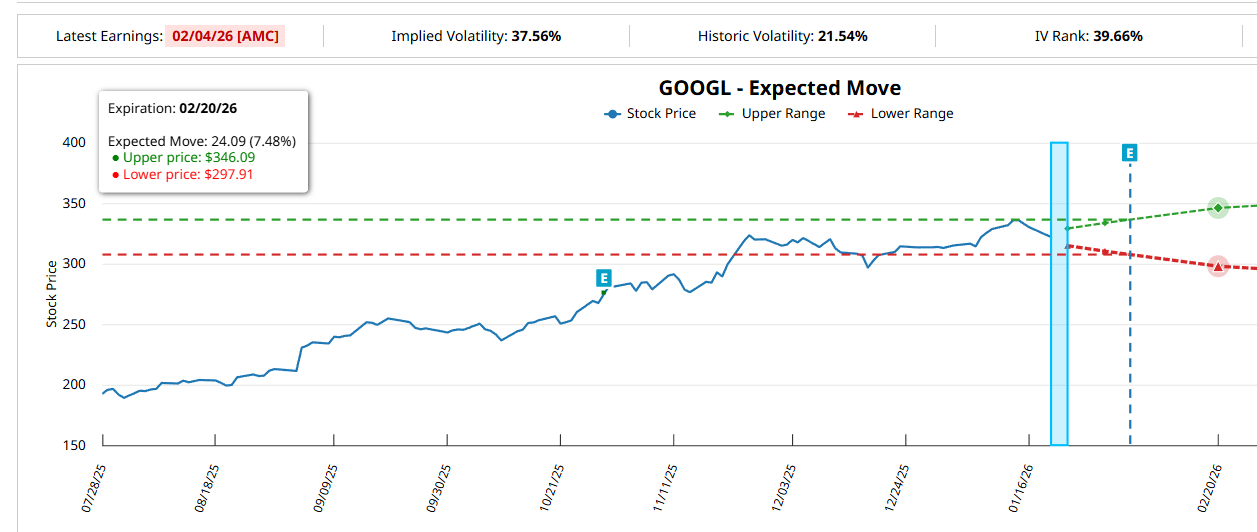

So, using Alphabet (NASDAQ: GOOGL) as an example, we can see here that the stock is expected to trade between $298 and $346 by February 20, 2026, which is roughly 30 days from today.

Since you’re planning to sell calls, consider a strike at the upper end of the range.

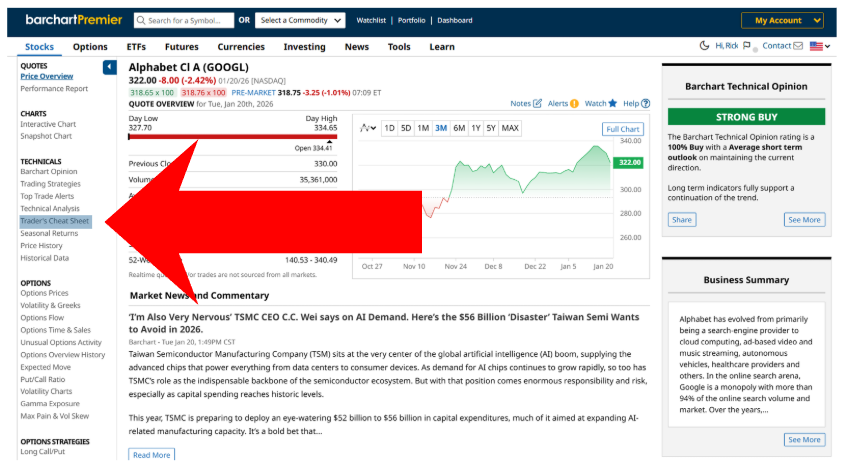

Trader’s Cheat Sheet

Now, for more technically-inclined traders, Barchart’s Cheet Sheet should prove useful. The feature consolidates key technical indicators and trend signals into a single, easy-to-read snapshot that shows potential support, resistance, and notable price levels for trading. It can be found right here on the Profile Page.

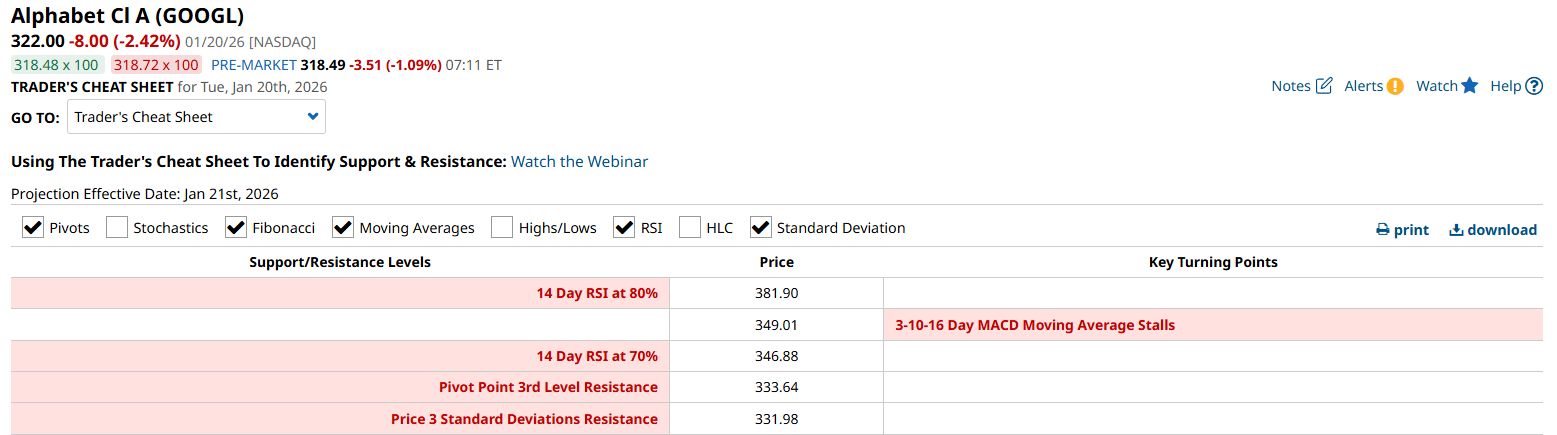

According to the Cheat Sheet, $346 is the price around which GOOGL is expected to reach the 14-day (70%) RSI level.

For those unfamiliar, the RSI, or relative strength indicator, is a momentum indicator that measures the speed and magnitude of price movements to help identify overbought or oversold conditions. 70% is the overbought level and may indicate that the stock price is stretched and is due for a consolidation or a pullback.

In other words, it can also serve as a good strike price for selling calls.

Naked Call Breakdown

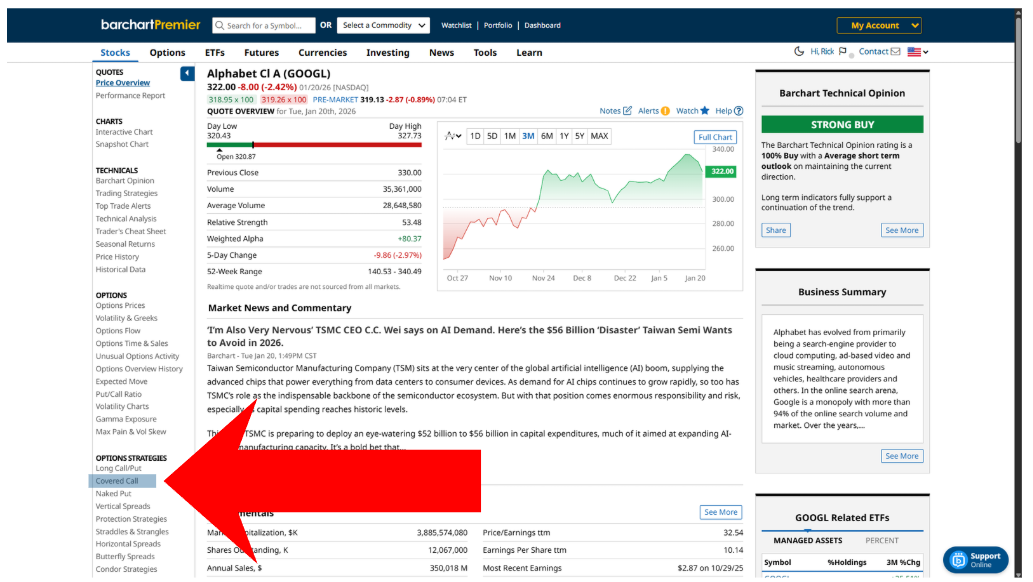

So now that you have a target strike price, you can jump to selling calls. You can access the potential short call trades through Covered Call under Option Strategies right here.

Now, the covered call screener is focused more on, well, covered calls, but it also works for naked calls. You can change the expiration date in the dropdown right here.

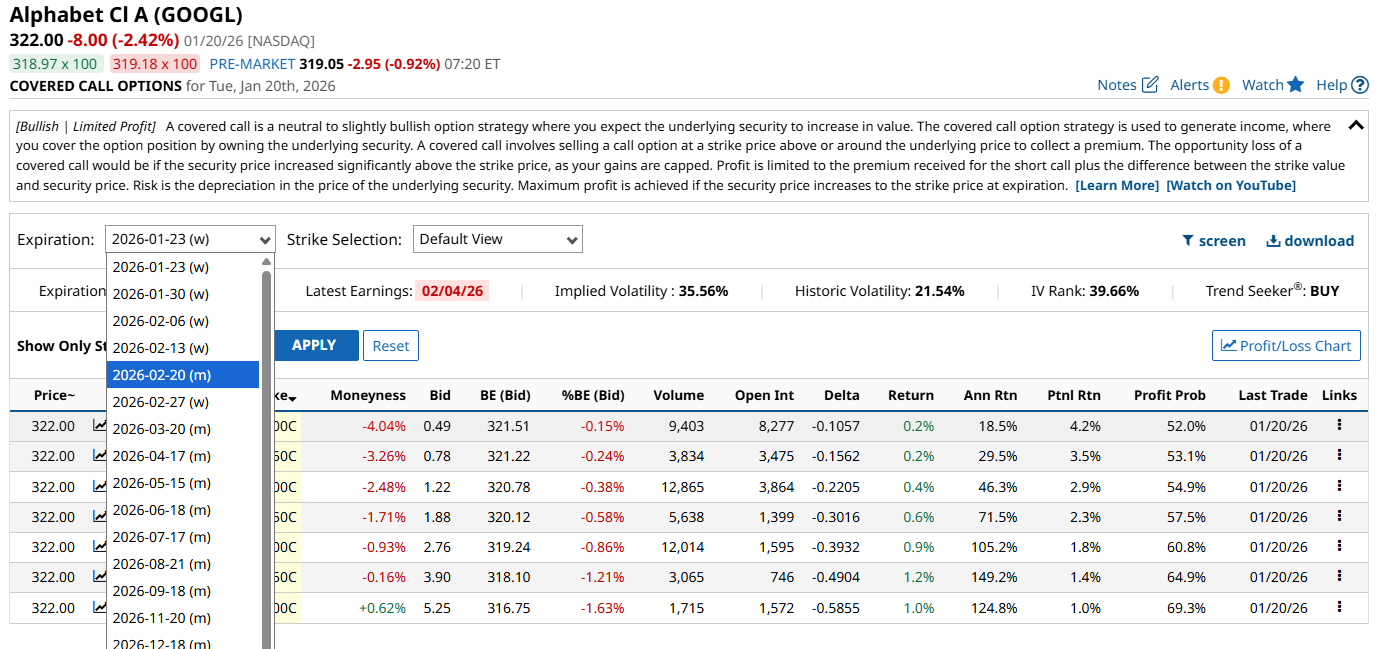

And from the available trades, you can look at the closest strike prices to $346. And since these strikes are spaced $2.50, you can select $345.

According to the screener, you can sell a 345-strike call on GOOGL and receive $5.75 per share, for a total of $575 per contract. This is your maximum profit for the trade.

As long as GOOGL stays below $345 by February 20, you get to keep the entire premium without further obligation. If GOOGL exceeds $345 by expiration, you will get assigned, and you will have to buy 100 shares of the stock for whatever it’s trading for at the moment and sell them for $345 each.

Bear Call Breakdown

Now, the problem with naked calls is that the risk is virtually unlimited. We can place a cap on the risk by buying a call with the same underlying and expriation, only with a higher strike. The combination forms whats called a Bear Call Spread. So, let’s jump over to the bear call screener to see how the trade looks against a naked call.

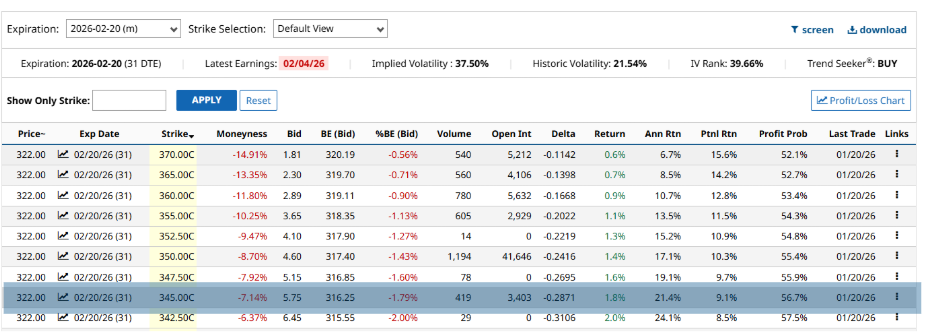

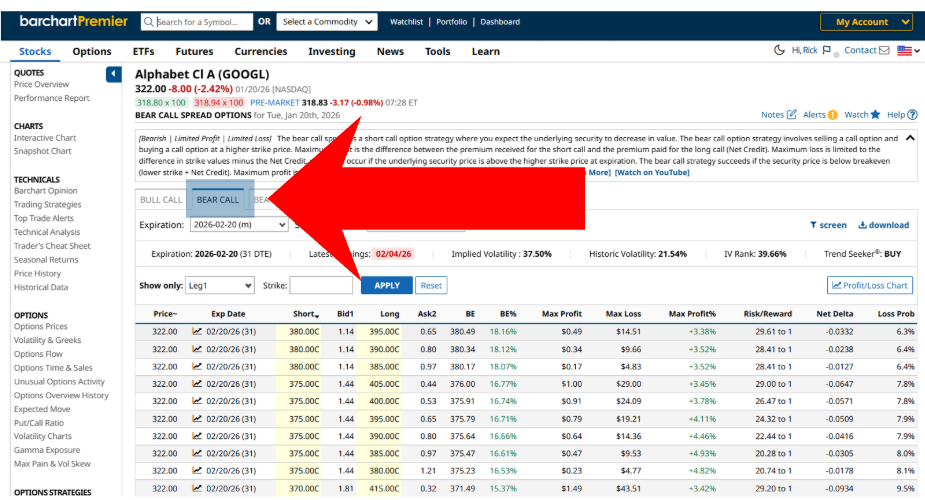

To access the bear call screener, go to Vertical Spreads, then the Bear Call section.

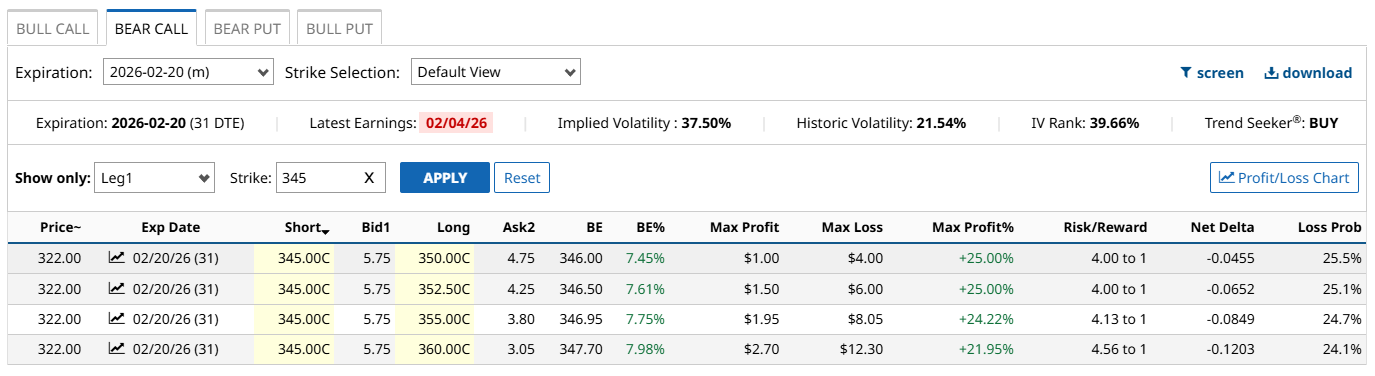

Once there, you can type in 345 in the Strike field, and you’ll be given several choices:

So, let’s take the 345-360 spread here as an example, as it has the lowest loss probability.

According to the screener, you can sell a 345-strike short call on GOOGL and get $5.75 per share. Then, you can buy a 360-strike call and pay $3.05 per share, resulting in a net credit of $2.70. That is also your maximum profit for the trade.

If GOOGL trades below $345 by expiration, you keep the net credit and are free from any further obligation.

Now, remember that the long call strike still matters here, as it caps off your loss. The maximum potential loss for the trade is calculated by taking the distance between the short and long call strike, known as the width of the spread, and then subtracting your net credit.

In this case, it works out to $12.30 per share - but only if GOOGL trades above $360 at expiration.

But what if you GOOGL trades between $345 and $360 at expiration? Well, you’ll get either partial profit if the stock stays below $347.70 - your breakeven price - or partial loss if above.

Final Thoughts And Reminders

Naked and bear call spreads can be effective tools for capitalizing on short-term market weakness and fear. However, naked calls carry significant risk, especially if the underlying asset experiences a parabolic move during your contract period. Now, bear calls are certainly safer, but at the expense of lower net credit.

At the end of the day, your risk appetite and trading preferences will be the deciding factor in which strategy you’d choose to employ. Just remember to manage the risks, utilize your tools effectively, and keep a close eye on your trades.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart