For some time now, investors have been asking a simple but important question: What’s next for Nvidia (NVDA) once the AI training phase is over? Currently, Advanced Micro Devices (AMD) stands as a strong contender to benefit from the inference boom, a natural next phase to AI training. Investors knew Nvidia wasn’t going to ignore this market, but Jensen Huang kept everyone wondering what he would do about it. Things are becoming clearer now after the chipmaker’s recent announcement.

Nvidia reportedly plans to unveil a notebook PC this year that would run Microsoft's (MSFT) Windows operating system powered by its own Arm (ARM)-based system-on-a-chip (SoC) platform N1 and N1X, according to rumors circulating in the industry. If true, it would bring some clarity on the management’s intention to diversify away from data center sales, which currently account for over 90% of the company’s revenue. By directly reaching out to the end consumer through its notebook PCs, Nvidia could significantly enhance its Total Addressable Market (TAM), though such adventures come with risks of their own.

About Nvidia Stock

Nvidia designs and manufactures GPUs and networking solutions, critical to powering high-end AI infrastructure. The company is a major driver of the global AI boom, enabling companies to train their large language models through its GPUs that are unmatched in the industry. The company is led by Jensen Huang and headquartered in Santa Clara, California.

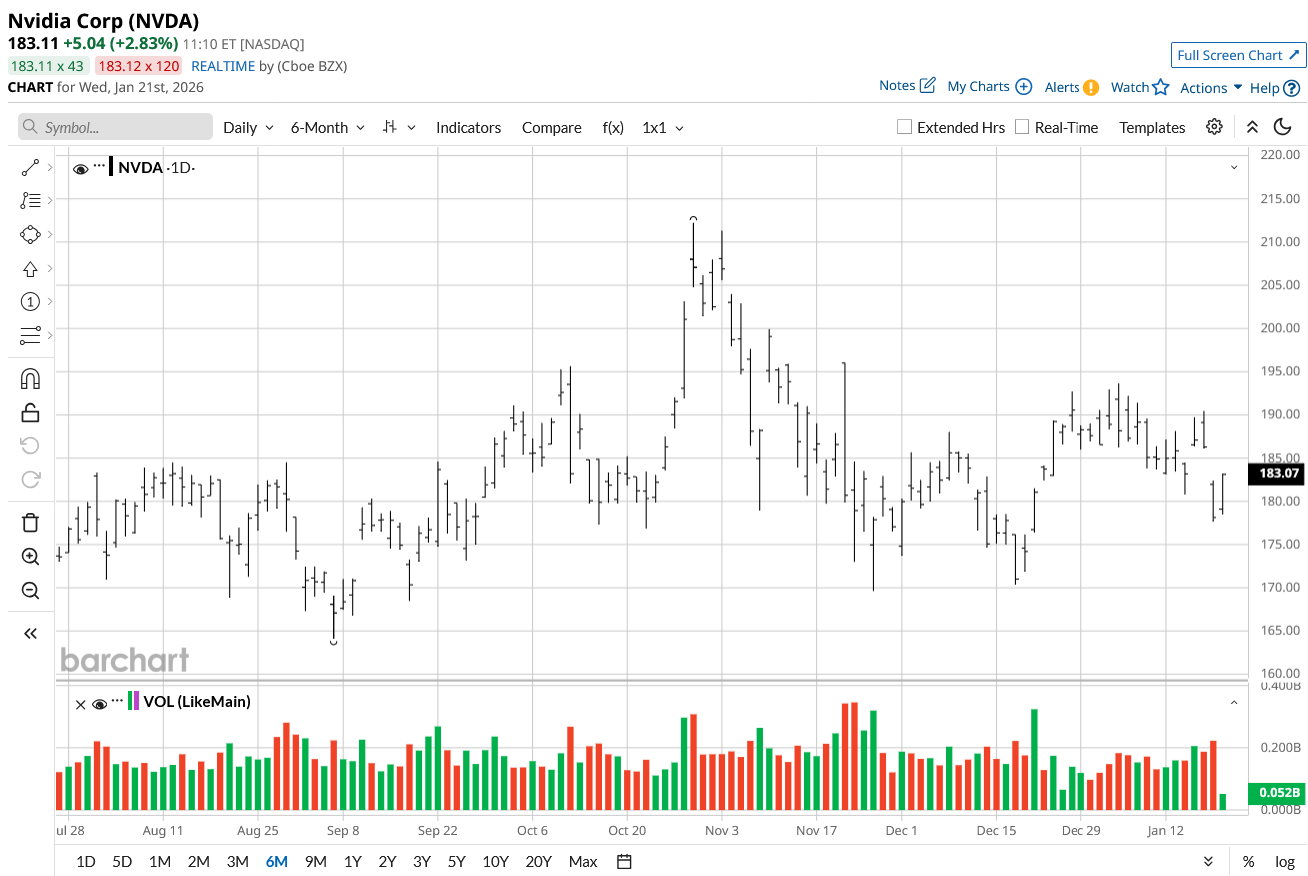

NVDA stock performed 29% in the last year compared to the iShares Semiconductor ETF’s (SOXX) 50%. This is a significant performance gap for a company that is supposedly powering the AI boom. So what gives?

Nvidia’s recent underperformance is largely due to the simple fact that the stock is already up 10x over the past three years. The company has dealt well with amazingly high expectations, and that has eventually caught up with it. However, the news of a new PC is undoubtedly the kind of story the market was waiting for. The question now is whether the current valuation gives a good entry point for an investor to benefit from this shift in strategy. The answer is a resounding yes!

Quite surprisingly, Nvidia only trades at a forward P/E of 40.55x. The reason I say “only” is that its five-year average forward P/E is 56.96x. This is an attractive discount for new investors, especially when one considers the fact that the strong data center business isn’t going anywhere, along with the ecosystem surrounding it.

Nvidia also trades at a forward EV/EBITDA of 32.89x, a 25% discount to its five-year average. On a price-to-cash flow (P/CF) basis, the company also offers a 9% discount. If you like the company’s notebook PC move, there are many strong reasons to support a call to buy the stock at the current price.

Nvidia’s Strong Earnings Trend Continues Unabated

Nvidia is no stranger to high expectations. Despite Wall Street’s lofty expectations, the company has delivered and also managed to increase those expectations at the same time. It reported its Q3 earnings on Nov. 19, once again providing stronger-than-expected guidance for Q4. While analysts had estimated revenue guidance to land around the $61.66 billion mark, Jensen Huang gave a figure of $65 billion, leaving everyone surprised once again.

The earnings call was all about how the Blackwell Ultra had become the best-selling GPU and how the company expects GPU sales to go off the charts. Regarding diversification, Nvidia called the robotics segment an important growth area. Automotive and robotics sales crossed the half billion dollar mark, up 32% YoY. The notebook PC didn’t get any mention, but you can bet it will be a big part of the earnings call at some point next month.

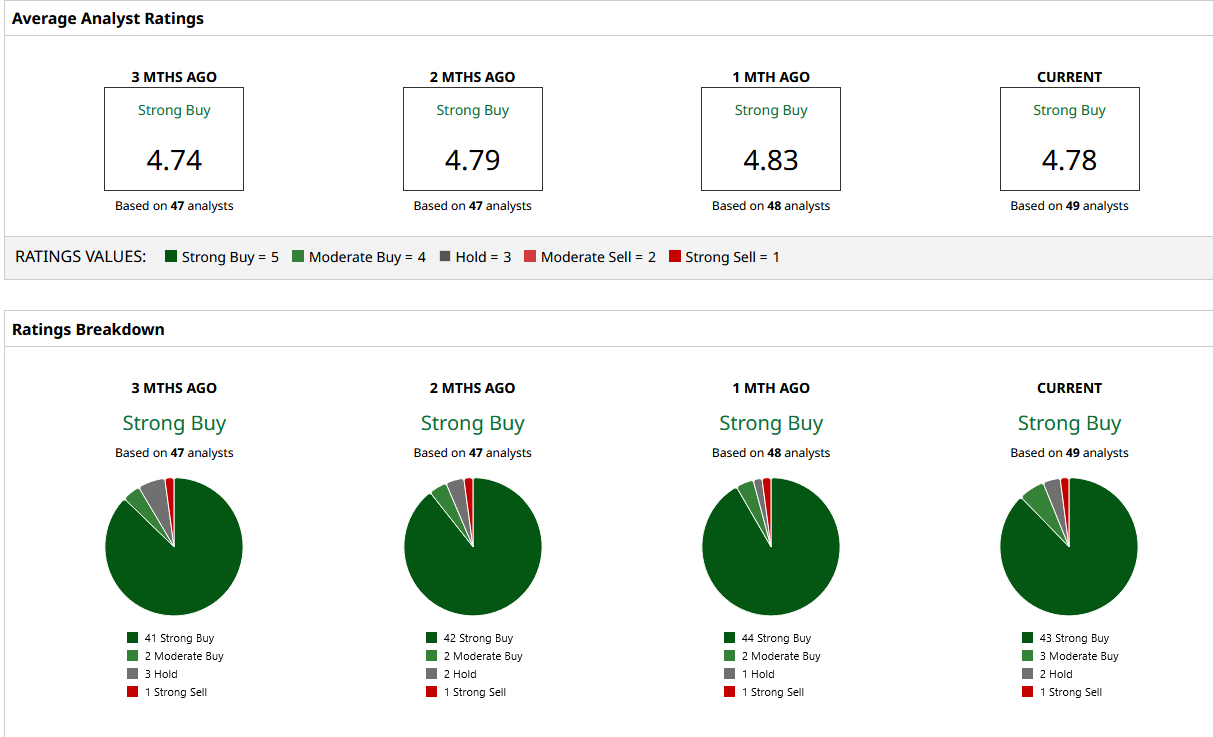

What Are Analysts Saying About NVDA Stock?

It is hard not to be bullish on a stock like NVDA. 43 out of the 49 analysts on Wall Street are extremely bullish on the company’s prospects. Even the mean target price of $255.78 offers 42% upside. Investors could double their money if Evercore ISI’s $352 price target, the highest on Wall Street, materializes.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- BitMine Immersion Just Invested $200 Million in MrBeast. What Does That Mean for BMNR Stock?

- This is the Best Way to Sell Put Options for Income Without Blowing Up Your Account

- Dear IBM Stock Fans, Mark Your Calendars for January 28

- Tesla Just Revived Its Dojo3 Supercomputer. Does That Make TSLA Stock a Buy Here?