Intuit Inc. (INTU) is a leading financial software and technology company that develops products and services to help individuals, small businesses, and accounting professionals manage finances, taxes, and marketing. Its well-known offerings include QuickBooks for small business accounting, TurboTax for tax preparation, Credit Karma for personal finance and credit monitoring, and Mailchimp for email marketing. The company is headquartered in Mountain View, California, and has a market cap of $147.3 billion, reflecting its position as one of the most valuable software firms.

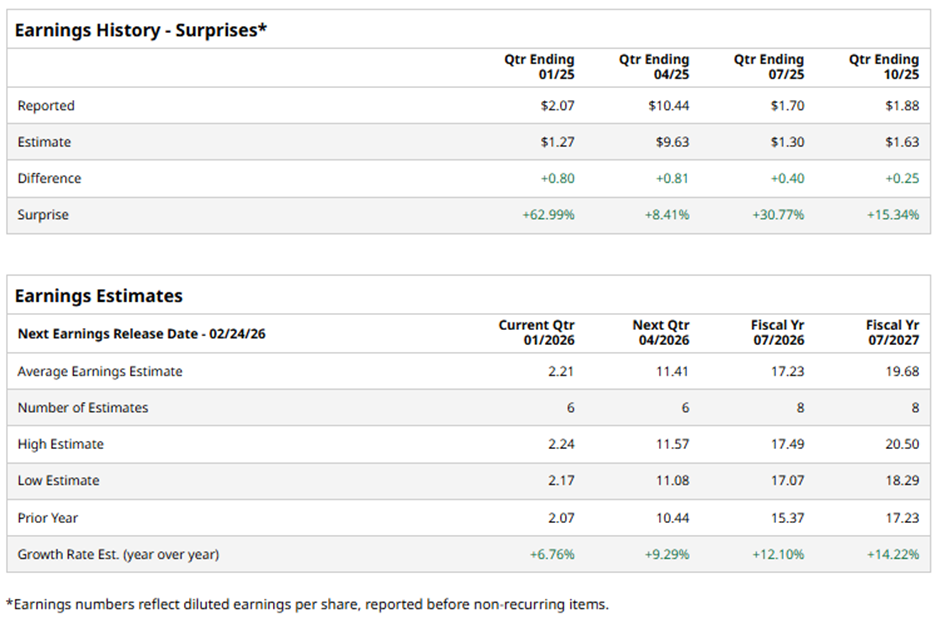

It is expected to announce its fiscal Q2 2026 earnings soon. Ahead of this event, analysts expect this company to report a profit of $2.21 per share, up 6.8% from $2.07 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For fiscal 2026, analysts expect INTU to report a profit of $17.23 per share, representing a 12.1% increase from $15.37 per share in fiscal 2025. Moreover, its EPS is expected to grow 14.2% year-over-year to $19.68 in fiscal 2027.

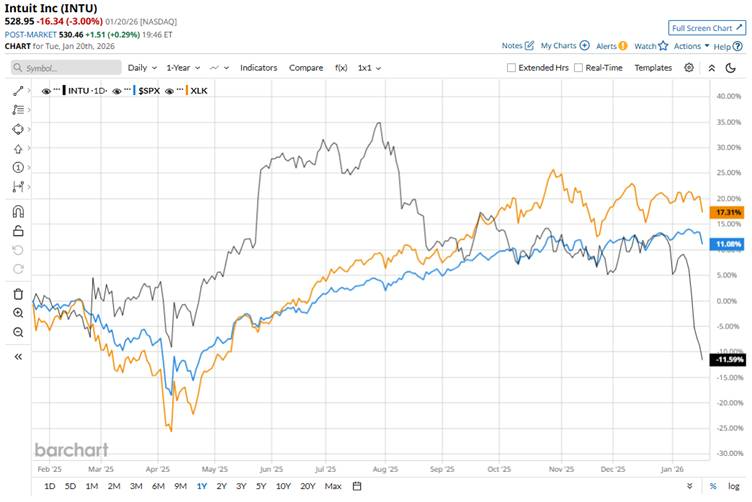

Shares of Intuit have declined 12.4% over the past 52 weeks, underperforming both the S&P 500 Index’s ($SPX) 13.3% return and the Technology Select Sector SPDR Fund’s (XLK) 21.2% uptick over the same time frame.

Intuit’s stock is witnessing a significant slump this month, driven by investor concerns about slowing near-term growth and tougher year-over-year comparisons after a strong 2025 season, and analyst downgrades that lowered price targets and tempered expectations for 2026 growth. Additionally, fears about AI-related disruption in the software sector and caution over the pace of Intuit’s AI integration have weighed on sentiment.

Wall Street analysts are cautiously optimistic about INTU, with an overall “Moderate Buy” rating. Among the 30 analysts covering the stock, 19 recommend “Strong Buy,” three indicate “Moderate Buy,” seven suggest “Hold,” and one advises a “Strong Sell” rating. The mean price target for INTU is $814.31, implying a 53.9% potential upside from the current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump’s Greenland Threats Scaring You Off? Buy This Dividend Stock as a Hedge

- Should You Buy the Dip in 3M Stock Today?

- Is Ryanair Stock a Buy, Sell, or Hold as Elon Musk Proposes Buying the Discount Airline?

- This Little-Known Fertility Stock Is Up 215% in the Past 5 Days. Should You Chase the Mysterious Penny Stock Rally Here?