Nvidia (NVDA) shares ended in the red on Tuesday following reports that the company’s suppliers have paused production of key components used in its advanced H200 chips.

These reports arrive only days after Beijing told its custom officials to “prevent” H200 chips from entering the country as part of its broader push to rely more on locally produced chips.

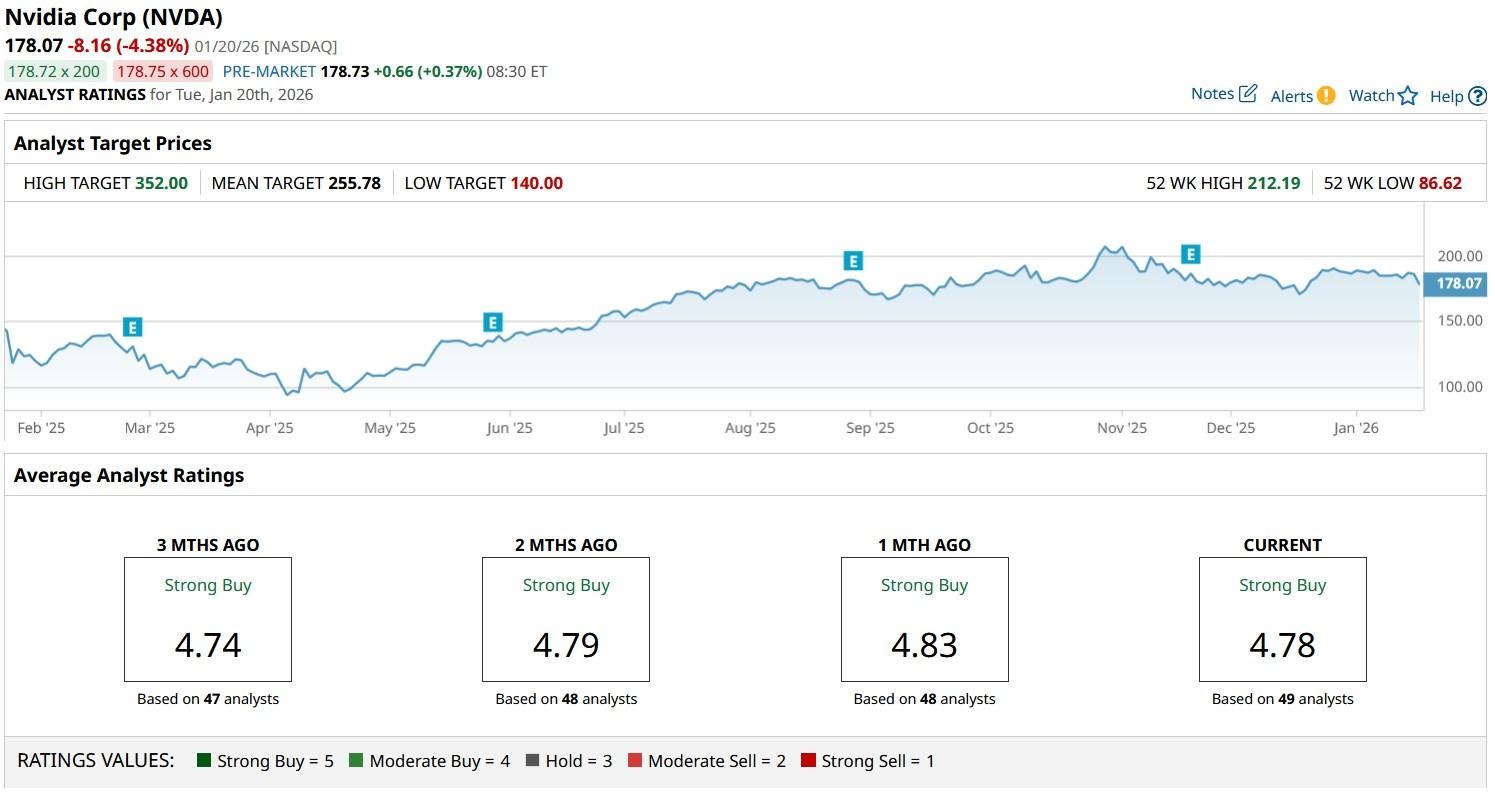

Despite the decline on Jan. 20, Nvidia stock remains up 110% versus its 52-week low.

Why This Production Halt Is Super Negative for Nvidia Stock

NVDA stock inched down primarily because the semiconductor giant had expected over 1 million orders from China with deliveries scheduled for March.

But Beijing’s ban on H200 imports and the subsequent halt of component production have cast uncertainty over those plans. This could materially impact revenue growth.

Additionally, since suppliers had already scaled up for March deliveries, the pause raises inventory and supply chain risks as well.

In short, these recent reports underscore Nvidia’s vulnerability to geopolitical and regulatory risks.

Oppenheimer Remains Bullish on NVDA Shares

Oppenheimer analysts recommend owning Nvidia shares despite the China setback in 2026 mostly because the multinational is an “AI castle on the hill.”

According to them, the company’s chips offer best “performance per watt” not just for training, but for inference as well.

The investment firm sees NVDA hitting $265 this year, noting it “sets the pace with annual cadence of leading artificial intelligence accelerators.”

Nvidia is expected to earn $1.45 a share in its current financial quarter, up nearly 71% on a year-over-year basis, which could prove a near-term catalyst that drives the AI stock higher.

Note that NVDA remains decisively above its 200-day moving average (MA), signaling its broader uptrend remains intact.

How Wall Street Recommends Playing Nvidia

Other Wall Street analysts seem to agree with Oppenheimer’s bullish call on Nvidia stock as well.

According to Barchart, the consensus rating on NVDA shares sits at “Strong Buy” currently with the mean target of about $256 indicating potential upside of nearly 43% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Netflix Is Below 1-Year Lows With Heavy Call and Put Option Activity - Bullish Signals for NFLX

- Nebius Just Scored a Major Supercomputer Win. Should You Buy NBIS Stock Here?

- This Space Stock Just Won a Key Role in Building Trump’s Golden Dome. Should You Buy Shares Now?

- CEO Sanjay Mehrotra Says Demand for Memory Will Keep Lifting Micron Stock for Years to Come