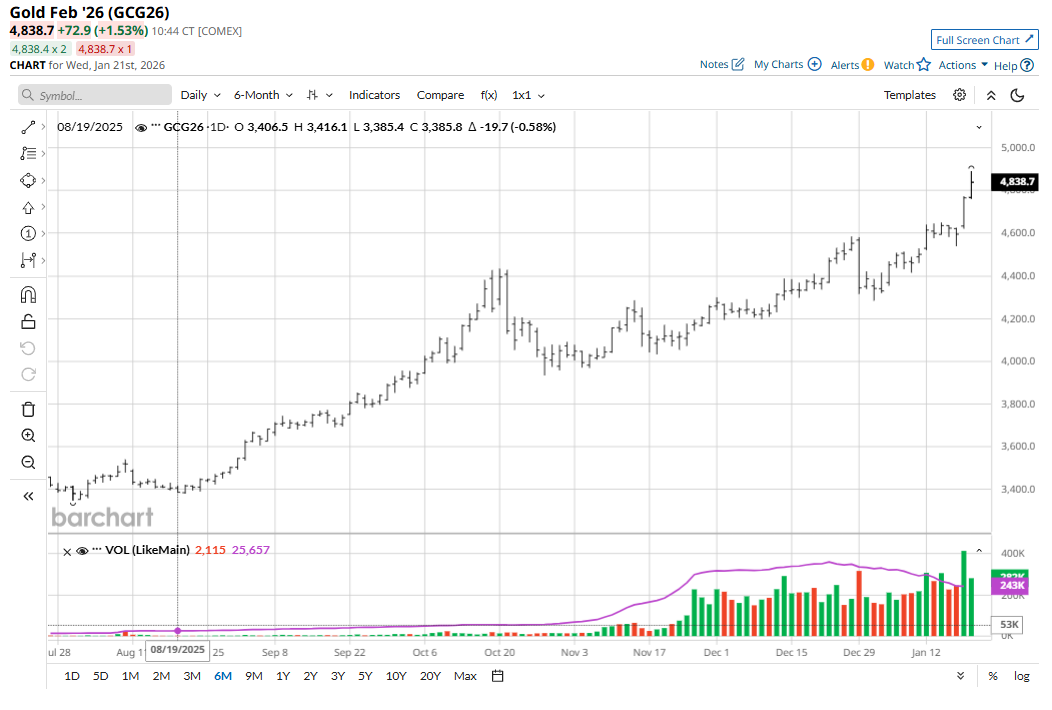

Gold (GCG26) prices at mid-week were solidly higher but down from an overnight high that set another record of $4,891.10, basis February Comex futures.

Gold backed down a bit after President Donald Trump said at a speech to the World Economic Forum in Davos, Switzerland, that he won’t use force to acquire Greenland. That took some of the risk aversion out of the marketplace after Trump had said a couple weeks ago that he would not rule out using military force to take Greenland.

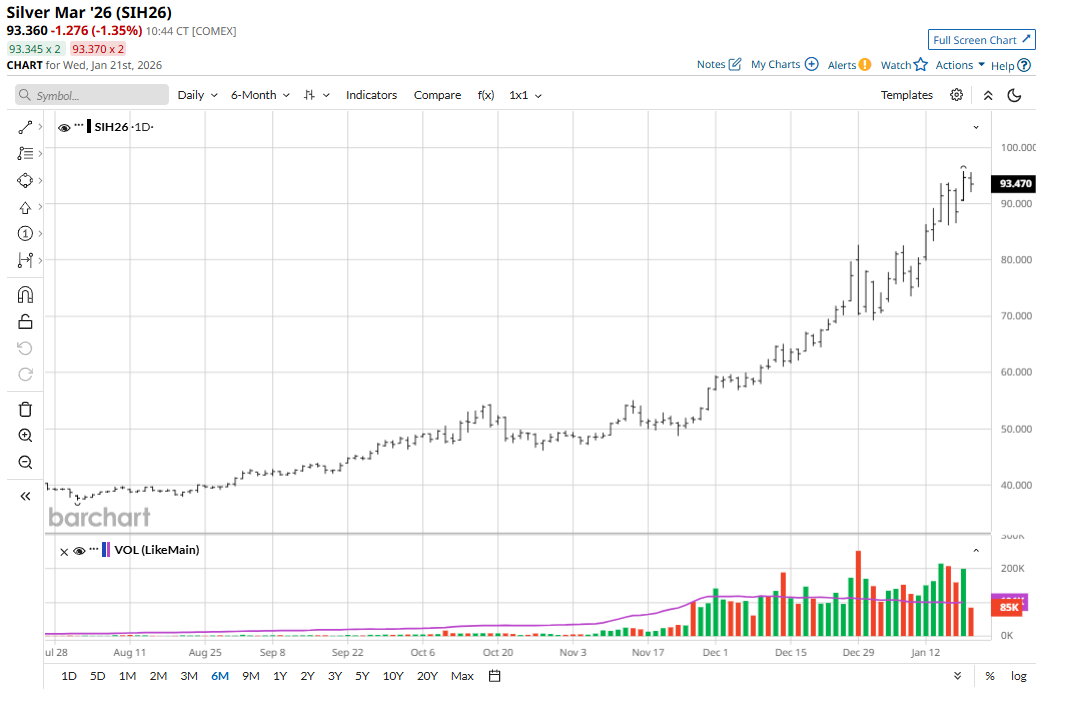

Gold and silver prices this week have extended their record rallies as the crisis over Greenland and a meltdown in Japanese government debt support safe-haven demand. March silver (SIH26) futures on Tuesday hit a new peak of $95.78 an ounce.

Bullish Elements for the Gold and Silver Markets

A very active and uncertain geopolitical environment at present is driving unprecedented safe-have demand for gold and silver. This situation is not likely to change anytime soon. I see three other main elements that will continue to drive better demand for gold and silver.

One is the growing competition between the U.S. and China for world dominance — both economically and militarily. The U.S. wants to acquire Greenland, which seems to open the door wider for China to more actively force its control of Taiwan. The U.S. has more aggressively enforced its foreign policy, as seen by the U.S. military’s capture of the Venezuelan president and the bombing of Iran’s main nuclear installation. My bias is that China thinks it will have to match the U.S. in its own more aggressive foreign policy. If this scenario plays out, it could mean a future military confrontation between the U.S. and China.

Another element that will continue to drive demand for gold and silver is the push by major global economies to stockpile so-called rare-earth minerals that has spilled over into increased demand for gold and silver. A report on Bloomberg today said extreme retail consumer investor demand for silver is creating supply shortages around the globe.

The last bullish element for gold and silver is the move by Brazil, Russia, India, China, and South Africa (BRICS) to move away from doing commerce via the U.S. dollar ($DXY). This “de-dollarization” means major central banks are buying more gold for their sovereign reserves.

My Bias

It now seems to be a foregone conclusion that gold will hit $5,000.00 an ounce — and sooner rather than later. Just last summer, gold traded around $3,400.00. I’ve said before that from a time perspective the bull runs in gold and silver are very mature and likely in their latter stages. But the latter stages of a bull market run can produce the biggest price moves, which we are seeing now.

The gold and silver markets will move from their current boom cycles to new bust cycles at some point. Price history proves this. However, the price floors of the busts, when they do occur, will be much higher. My estimate for the new price floor on a silver bust is $50 to $60. For gold, my estimate for a new price floor on a gold bust is $3,000.00 to $3,500.00.

Tell me what you think. I enjoy getting feedback from you, my valued Barchart reader.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Gold and Silver Hit New Record Highs on Greenland Crisis. 3 Factors That Will Keep Driving Demand.

- Why You Should Play Record Gold Prices with the GLD ETF

- Silver Prices Keep Confounding Experts. I Won’t Be Surprised If They Hit $100 Soon.

- This Gold Stock Is Winning on the Back of a So-Called ‘Sell America’ Trade