eBay Inc. (EBAY) is a leading e-commerce company that operates one of the world’s most established online marketplaces, connecting millions of buyers and sellers. Headquartered in San Jose, California, the platform facilitates commerce through auction-style listings, fixed-price sales, and mobile apps, catering to individuals and small businesses with a wide range of products from collectibles and electronics to fashion and home goods. The company has a market cap of around $41.5 billion.

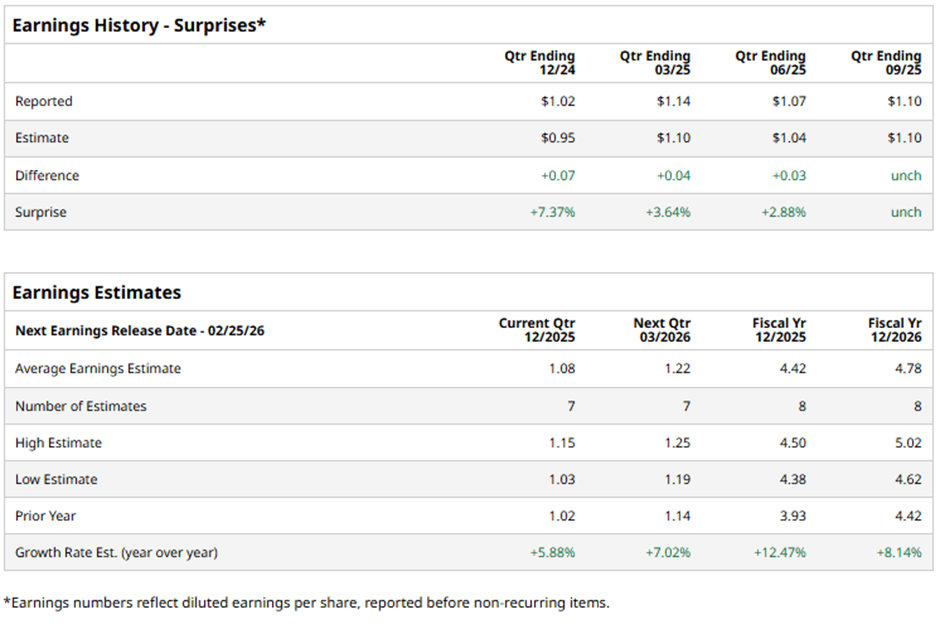

The e-commerce company is expected to release its Q4 2025 earnings in the near term. Ahead of this event, analysts expect eBay to post earnings of $1.08 per share, marking a 5.9% increase from $1.02 per share reported in the same quarter last year. Additionally, the company has surpassed or met Wall Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, analysts forecast EBAY to report an EPS of $4.42, an increase of 12.5% from $3.93 reported in fiscal 2024. Moreover, in fiscal 2026, its earnings are expected to surge 8.1% year-over-year to $4.78 per share.

EBAY has surged 37% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 13.3% gain and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 3.9% rise during the same period.

eBay’s stock rose largely because the company delivered better-than-expected earnings and revenue growth, with consistent GMV increases that boosted investor confidence. Strong performance, along with strategic initiatives such as enhanced AI-powered tools, improved seller experiences, and partnerships, helped drive the rally.

In the third quarter ended Sept. 30, eBay reported revenue of $2.8 billion, marking about a 9% year-over-year (YOY) increase, while GMV came in at $20.1 billion, up around 10% YOY. Non-GAAP EPS stood at $1.36, a 14% rise compared with the prior year.

Analysts’ consensus view on EBAY is moderately optimistic, with a “Moderate Buy” rating overall. Out of 34 analysts covering the stock, nine recommend a “Strong Buy,” two suggest “Moderate Buy,” 21 advise a “Hold,” one gives a “Moderate Sell,” and one “Strong Sell.” EBAY’s mean price target of $96 indicates an upside potential of 5.8%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart