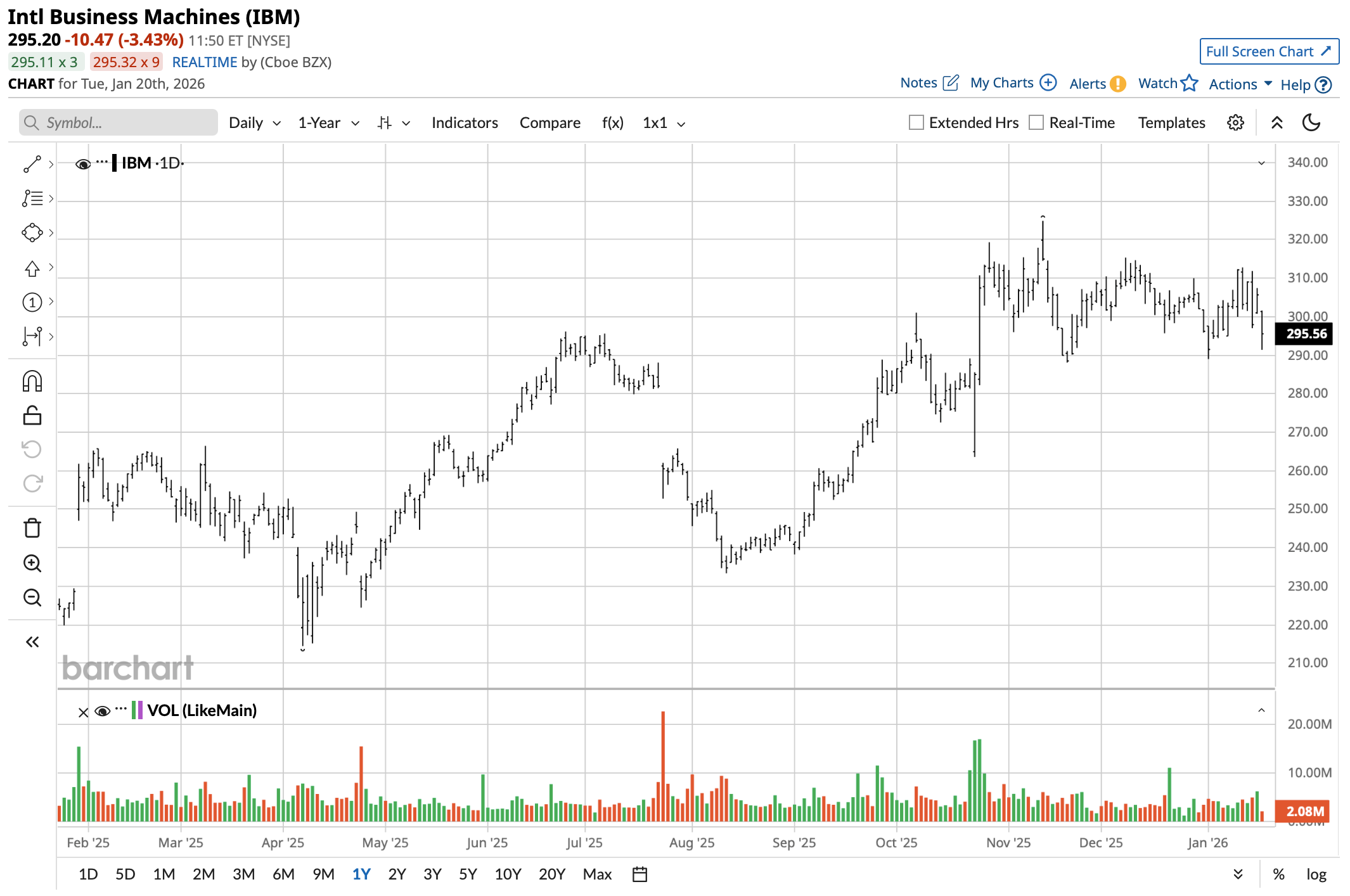

International Business Machines (IBM) has been stumbling into the latter part of January, falling by about 3% in the last week as market participants have turned cautious before the announcement of Q4 2025 results on Jan. 28. The developments are interesting. IBM stock has been one of the more stable large-cap tech stocks in the last year.

However, now that the stock is trading around $295, having touched a peak above $320 earlier in the quarter, it seems that the market is re-evaluating just how much good news is already priced in. The upcoming earnings report is looking increasingly like a sentiment reset, rather than simply a scorecard review.

More generally, IBM’s report comes at a time when investors are becoming increasingly picky during earnings season. With mega-cap tech stocks trading at rich valuations and growth stocks under increasing focus for sustainability, guidance quality is as important as beating expectations. IBM is a company where the focus is squarely on the sustainability of software growth, free cash flow guidance, and how long the Z17 cycle can sustain performance into 2026.

About IBM Stock

IBM is a global company that provides hybrid cloud, software, and services, as well as mission-critical solutions like mainframes. The company has shifted focus in recent years from commoditized services in information technology to more valuable software and artificial intelligence (AI)-based enterprise workloads. IBM has a market capitalization of approximately $272 billion.

Looking at the past 52 weeks, IBM’s stock has moved in a broad range, from a low of approximately $214 to a high of just under $325. Despite the current correction, IBM’s stock is still significantly higher than a year ago, although it has trailed the S&P 500 Index ($SPX) over the past month.

From a valuation perspective, IBM is currently trading at a multiple of approximately 27x trailing and 25x forward earnings (P/E), in addition to a price-to-sale (P/S) multiple of approximately 4.2x. Notably, these multiples represent a premium compared to IBM’s own history, driven by enthusiasm related to its incorporation of AI, as well as its mainframes. The question going into this earnings release is whether such multiples continue to be supported by fundamentals.

IBM to Post Q4 Earnings

IBM is expected to report earnings of around $4.33 per share for the quarter ending 2025, an increase from $3.92 per share during the same period of the previous year. However, analysts’ estimates regarding the company’s revenues are more varied, with general expectations of good infrastructure performance due to the ongoing Z17 mainframe cycle.

Industry commentary surrounding the software and consulting businesses is going to be very important. The software business is the core of the IBM margin story, and it is going to be very closely watched for any indication of softening, even if it is modest. This is because the rerating of IBM has been largely due to its improving quality of revenues.

The guidance is likely to be what really gets things moving. The markets will be eager for any information regarding full-year 2026 guidance, especially regarding margin and free cash flow expansion. IBM has always pointed out its prudent management of costs and its predictable cash flows, and any reiteration or revision of such guidance could make significant moves in this stock.

IBM has confirmed its earnings date of Jan. 28 for Q4. With the shares under pressure recently, even a good but unremarkable quarter may be all it takes to stabilize them, while positive guidance could kickstart upside.

What Do Analysts Expect for IBM Stock?

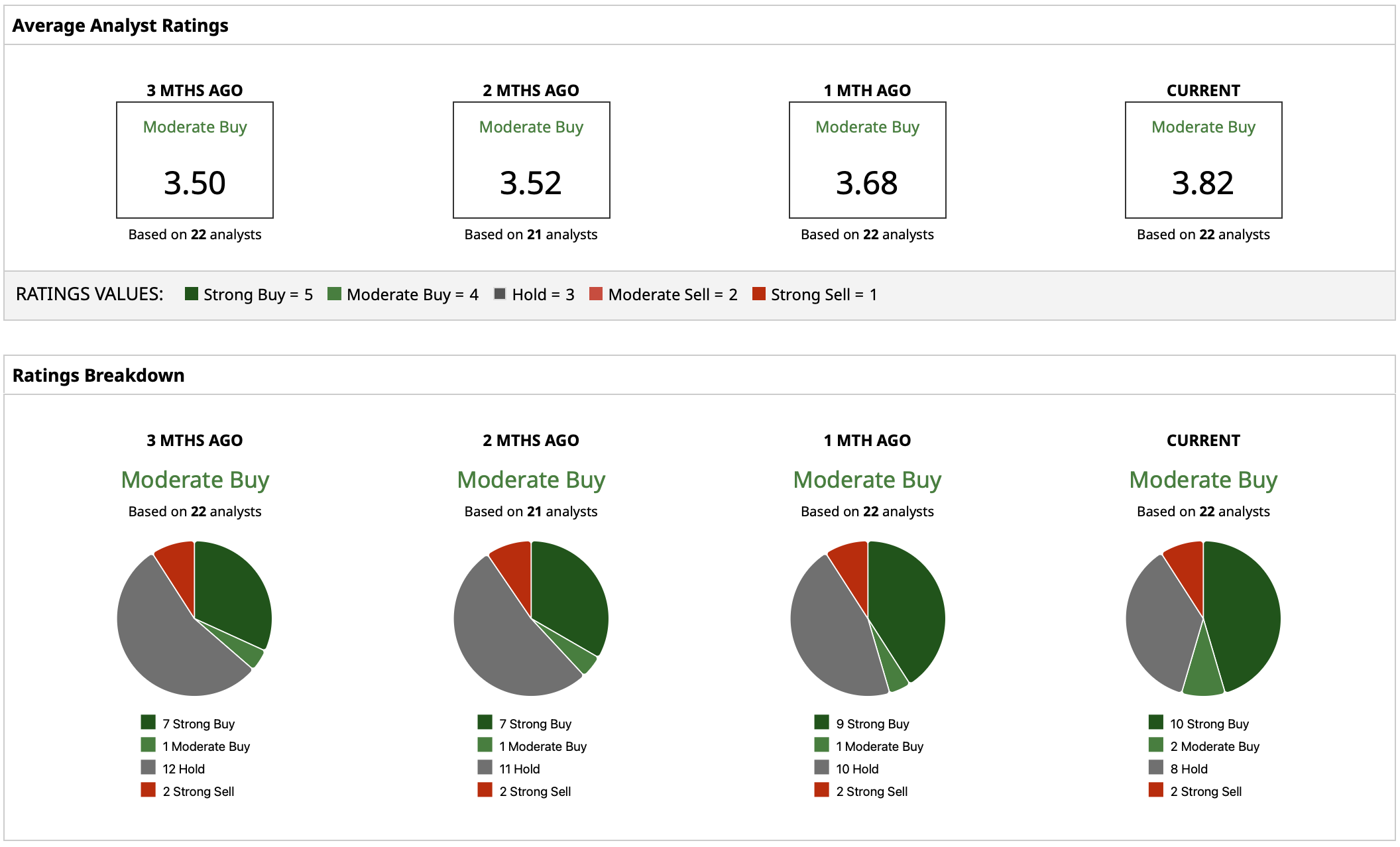

Analyst sentiment on IBM is mixed, but overall, the stock has a “Moderate Buy" consensus rating, with an average analyst price forecast of $300. The stock is expected to offer a significant gain if it beats estimates, as indicated by the highest price forecast of $360. However, potential downside is also a possibility if growth trends slow down, as indicated by the lowest price forecast of $198.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Netflix Is Below 1-Year Lows With Heavy Call and Put Option Activity - Bullish Signals for NFLX

- Nebius Just Scored a Major Supercomputer Win. Should You Buy NBIS Stock Here?

- This Space Stock Just Won a Key Role in Building Trump’s Golden Dome. Should You Buy Shares Now?

- CEO Sanjay Mehrotra Says Demand for Memory Will Keep Lifting Micron Stock for Years to Come