The artificial intelligence (AI) revolution is entering a critical phase, and two software companies are positioned to capitalize on what analysts are calling a once-in-a-generation opportunity.

Wedbush analyst Dan Ives believes the upcoming tech earnings season will validate the massive AI buildout. Ives expects Q4 results will be led by Big Tech and backed by field checks, indicating robust enterprise AI demand.

Ives projects that AI spending will reach $3 trillion over the next three years, with more than $550 billion in capital expenditures already in motion. He argues that investors remain nervous about the scale of investment required, yet they fail to appreciate the tidal wave of growth on the horizon from enterprise and government spending on AI technology.

The opportunity is shifting beyond infrastructure. For every dollar spent on Nvidia (NVDA) chips, Ives estimates an $8 to $10 multiplier across the rest of the tech ecosystem. As AI deployments mature, platforms that monetize usage and workloads stand to benefit disproportionately.

Snowflake (SNOW) and MongoDB (MDB) emerge as key beneficiaries. Both companies are levered to the enterprise consumption phase ahead, positioning them to profit as AI adoption accelerates across industries in 2026 and beyond.

Is Snowflake Stock a Good Buy?

In fiscal Q3 of 2026 (ended in October), Snowflake grew revenue by 29% year-over-year (YoY) and raised its full-year guidance. This signals continued strength in the data cloud market despite fluctuations in customer migration activity.

CEO Sridhar Ramaswamy said the SaaS platform remains focused on operating near the 30% growth mark, which is remarkable for a company at Snowflake's scale. The pure consumption-based business model creates some quarterly lumpiness, as customers time their data migrations around internal transformation schedules rather than Snowflake's reporting calendar.

CFO Brian Robins noted that migration activity improved over the past 90 days leading up to the recent earnings report. It faced minimal headwinds during the quarter, with only a $1 million to $2 million impact from a hyperscaler outage. Robins emphasized that the full-year guidance provides a clearer picture of business performance than individual quarterly snapshots.

Snowflake is positioning itself as the essential platform for enterprises preparing their data infrastructure for artificial intelligence applications. Ramaswamy described the current moment as the beginning of the industrialization of thought, where AI models can plan and execute tasks that previously required human intervention.

Companies are realizing that high-quality, accessible data stored in platforms like Snowflake becomes the foundation for transforming business processes through automation.

Snowflake introduced a new generation warehouse that delivers notable performance improvements while remaining roughly price neutral. This allows customer queries to run faster without Snowflake taking a revenue hit, creating a win-win scenario, as Ramaswamy calls it. Faster query speeds often lead customers to run more analyses, which can drive incremental consumption.

Snowflake is also developing AI-powered tools to accelerate its own operations. The company has a product in private preview called Cortex Code that acts as a data agent to handle complicated configuration tasks. Ramaswamy identified AI-driven migrations as a potential game changer, as the current migration process remains constrained by the capacity of Snowflake and partner teams to handle these high-stakes projects safely.

Snowflake continues to expand partnerships with major software vendors, including Salesforce (CRM), ServiceNow (NOW), SAP (SAP), and Workday (WDAY), positioning these relationships as mutually beneficial rather than zero-sum competition.

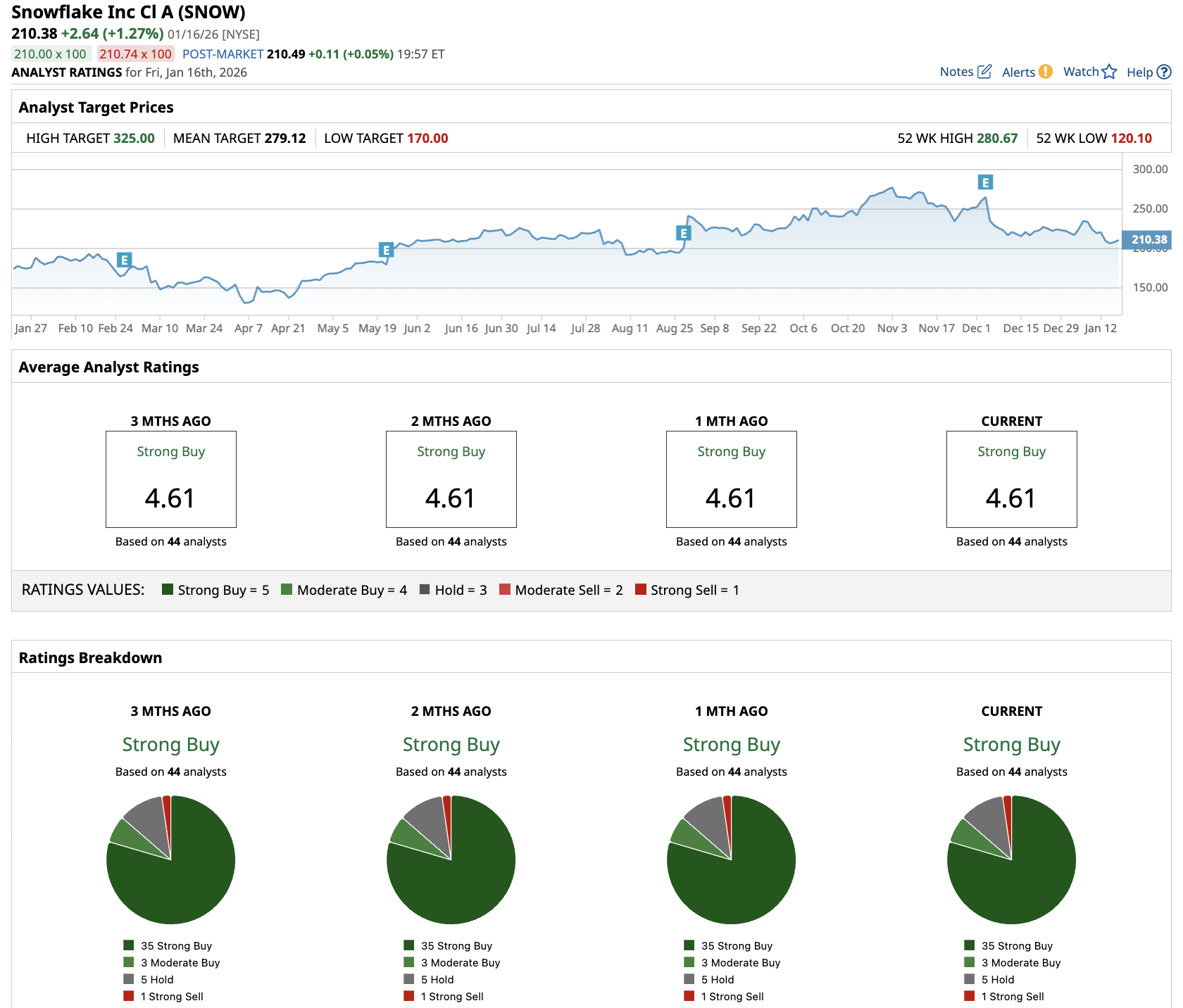

Out of the 44 analysts covering SNOW stock, 35 recommend “Strong Buy,” three recommend “Moderate Buy,” five recommend “Hold,” and one recommends “Strong Sell.” The average SNOW stock price target is $279, above the current price of $210.

The Bull Case for MongoDB Stock

MongoDB delivered strong third-quarter results under new CEO Chirantan Desai, who joined the company roughly 30 days before the recent earnings report. The database company raised its fourth-quarter Atlas guidance substantially, with CFO Mike Berry attributing about one-third of the increase to Atlas consumption growth and two-thirds to stronger enterprise agreement business.

Desai brings in-depth enterprise relationships from his tenure at Oracle (ORCL), ServiceNow, and Cloudflare (NET). He sees MongoDB positioned to evolve from a document database into a comprehensive modern data platform. Desia also expects AI adoption to unfold over 10 to 20 years, with the industry currently only in year two.

The company added 8,000 new customers year-to-date (YTD), representing 67% growth. In the most recent quarter, MongoDB added 2,500 customers, a 40% increase from the prior year period.

MongoDB is seeing success with AI-native companies, though this revenue remains immaterial to overall results. Desai highlighted one AI company that grew from paying a few thousand dollars annually to $130,000 two years ago and now generates $9 million in annual revenue. The company cited another example where usage jumped from minimal levels to become a major customer through organic growth on the platform.

Management maintains that enterprise AI applications remain largely in the pilot phase rather than in production deployment. Desai estimates meaningful production rollouts are still a few quarters away, as companies work through requirements around scale, durability, availability, and real-time learning needed to truly transform business operations.

The company announced plans to relaunch its developer outreach in San Francisco on Jan. 15, acknowledging it lost mindshare in key technology hubs over the past decade while growing rapidly in other markets. Atlas now represents 75% of revenue, up from just 2% when the company went public in 2017. MongoDB targets Atlas growth of at least 20% annually while improving operating margins by 100 to 200 basis points on average.

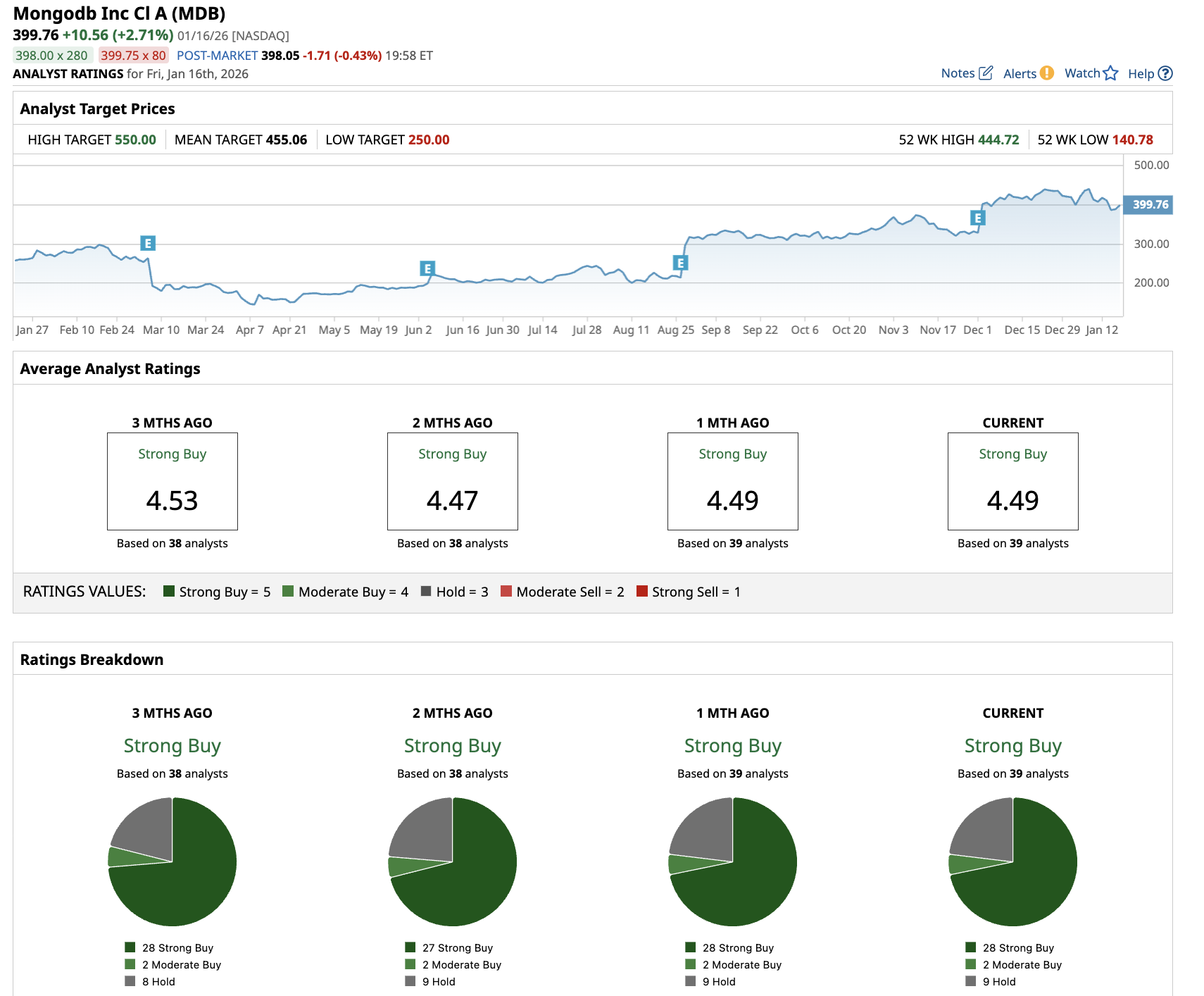

Out of the 39 analysts covering MDB stock, 28 recommend “Strong Buy,” two recommend “Moderate Buy,” and nine recommend “Hold.” The average MDB stock price target is $455, above the current price of $400.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart