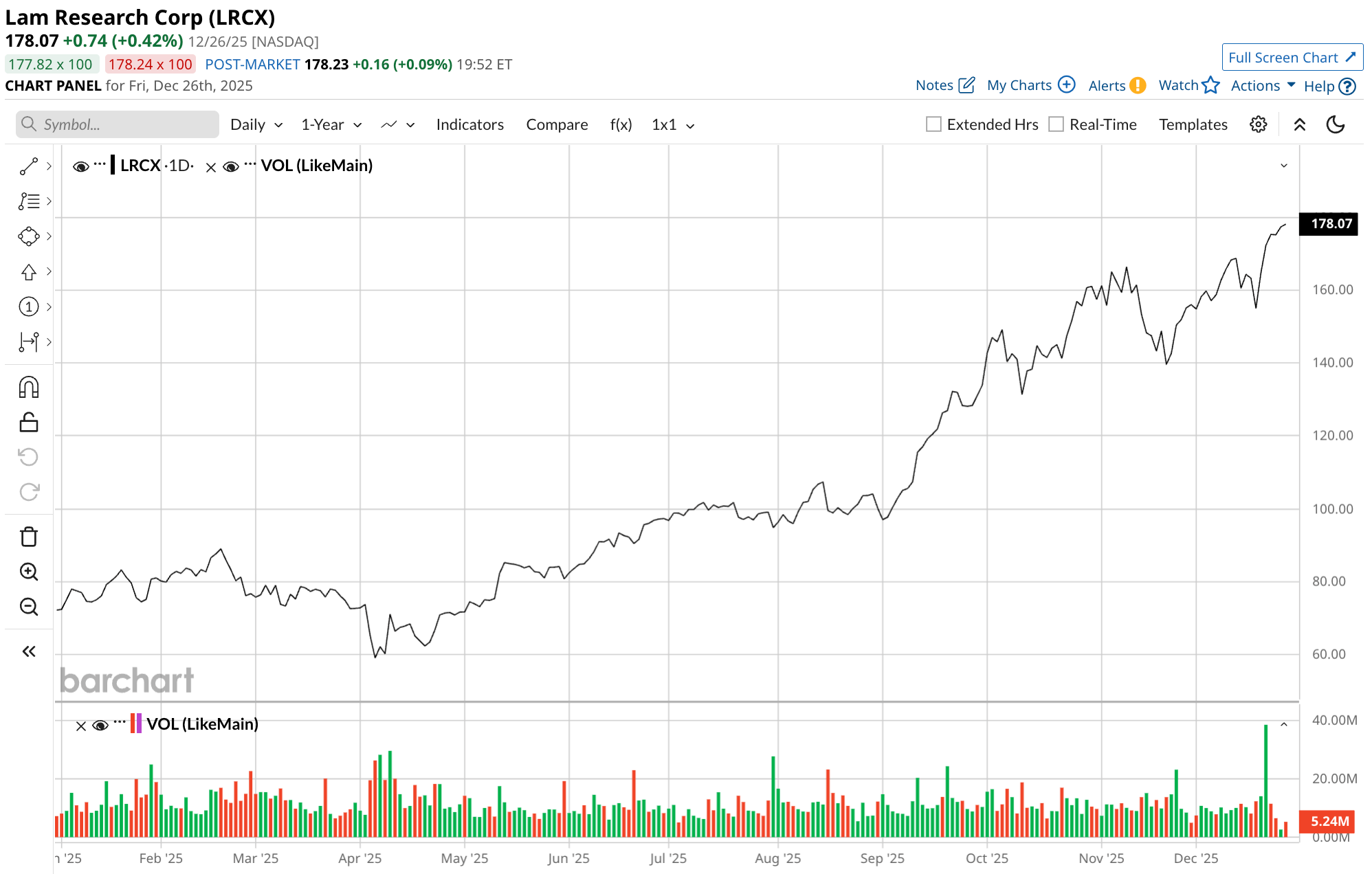

Lam Research (LRCX) has delivered exceptional performance throughout 2025, with shares climbing steadily amid surging demand for advanced semiconductors. As the year nears its end, the stock has surged approximately 141% year-to-date, reflecting robust investor confidence in its role within the expanding AI ecosystem.

Key drivers behind this impressive rally include explosive growth in AI data center investments, heightened spending on high-bandwidth memory (HBM) and 3D NAND storage technologies, as well as Lam’s critical positioning in the wafer fabrication equipment (WFE) market, which has benefited from multi-year capex cycles at major chipmakers.

Geopolitical shifts and export dynamics have added volatility, but ultimately, Lam has persevered, as demand from regions like Taiwan and South Korea offset challenges elsewhere. Record revenues and strong cash flows have also driven stock buybacks and dividends, rewarding shareholders with income and capital appreciation.

Despite these substantial gains pushing the stock to new all-time highs, LRCX remains one of the best picks-and-shovels plays for the AI boom. It offers indirect yet reliable exposure to the ongoing supercycle without the same volatility chip designers face.

About Lam Research Stock

Lam Research is a leading provider of innovative WFE and related services essential to the global semiconductor industry. Headquartered in Fremont, California, the company excels in delivering sophisticated process systems that allow chip manufacturers to create ever-smaller, more intricate, and higher-efficiency integrated circuits.

Its comprehensive lineup includes specialized tools for deposition (building thin film layers), etching (precisely removing material to form patterns), cleaning (ensuring contaminant-free surfaces), and metrology (advanced measurement and inspection). These solutions support the full spectrum of front-end and back-end manufacturing processes in modern chip production.

Lam derives income from selling high-value capital equipment, performing refurbishments, and providing long-term maintenance and support contracts to fabs worldwide. With operations and technologies deeply embedded in semiconductor advancements in key regions, including the U.S., Asia, and Europe, Lam plays a foundational role in enabling next-generation devices that power AI, computing, and connectivity.

Why LRCX Is a Top Picks-and-Shovels Stock

In the AI revolution, where chip designers like Nvidia (NVDA) grab headlines, Lam Research operates as a classic “picks-and-shovels” beneficiary – supplying the indispensable machinery that makes advanced AI chips possible. Unlike the chipmakers, Lam thrives in a concentrated oligopoly within the WFE industry, where patented, high-precision tools are critical for production scaling and can’t be swapped out for a rival’s machines.

Lam’s strength lies particularly in memory technologies vital for AI workloads, such as stacking hundreds of silicon layers in HBM for ultra-fast access and dense 3D NAND for massive storage. Breakthrough innovations like cryogenic etching processes enable ultra-deep, distortion-free channels through over 400 layers – overcoming physical limits that would otherwise render chips unusable – while complementary dielectric systems build complex high-aspect-ratio structures.

This expertise positions Lam to capture significant value from the projected $105 billion WFE market in 2025. The market is expected to expand rapidly in the years ahead as every $100 billion in AI infrastructure spending funnels billions into equipment. Hyperscalers Amazon (AMZN), Google (GOOGL), Meta Platforms (META), and Microsoft (MSFT) alone have collectively committed to spending $600 billion in capex in 2026.

Despite occasional headwinds like U.S. export curbs impacting certain markets, demand from leading foundries in permitted regions has driven near-record results. Trading at reasonable multiples relative to its growth trajectory, Lam offers lower-risk exposure to the AI megatrend, making it a standout for investors seeking long-term participation in semiconductor advancement without betting on individual chip winners.

What Do Analysts Expect for Lam Research Stock

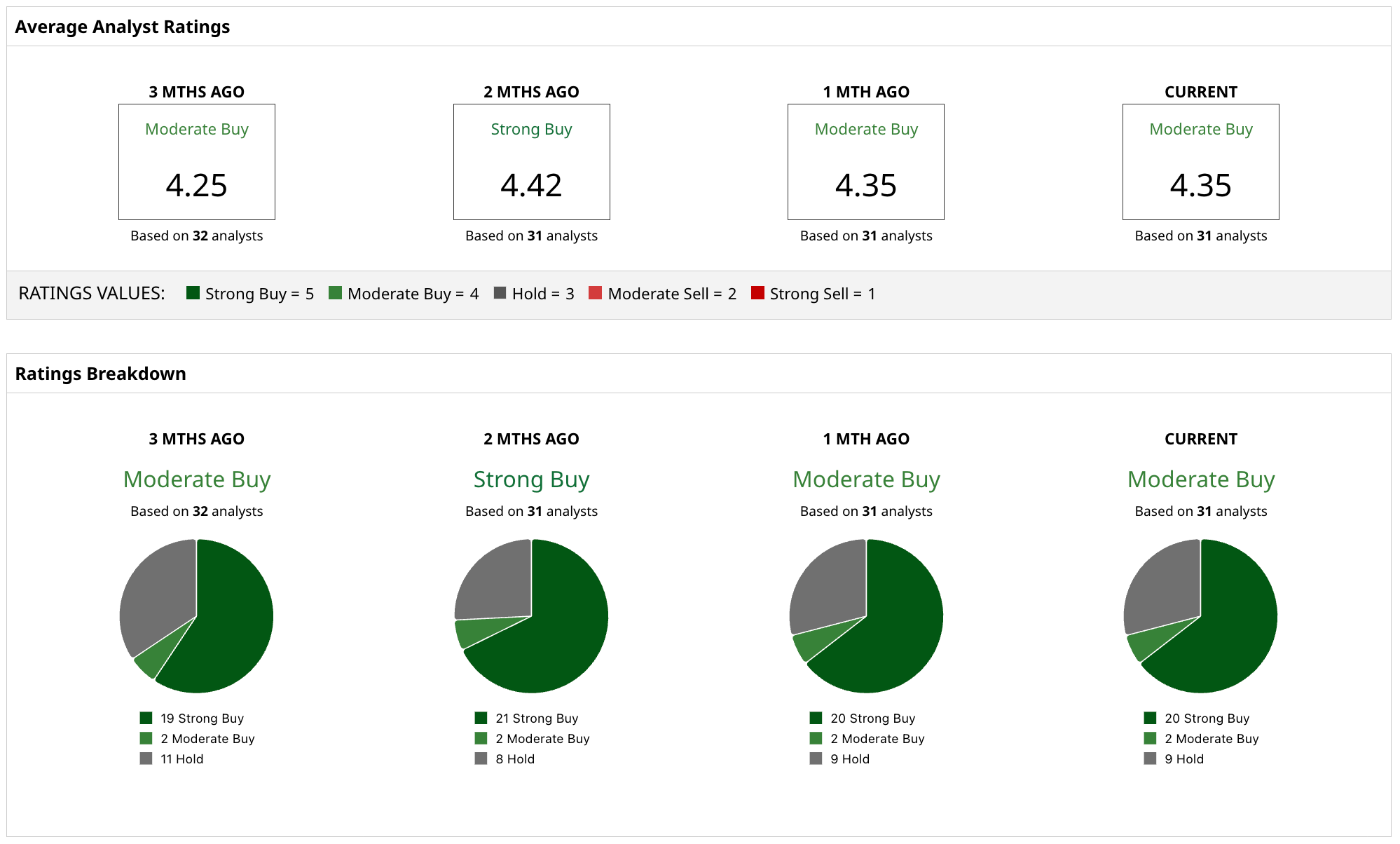

Wall Street maintains a generally positive stance on LRCX, with a consensus rating of “Moderate Buy” based on input from 31 analysts. The breakdown shows strong enthusiasm, including approximately 20 “Strong Buy” recommendations, two “Moderate Buys,” and nine “Holds” – there are no “Sell” ratings in the mix. This outlook has grown slightly more bullish in recent months, with upgrades reflecting confidence in sustained AI-driven WFE spending.

Its mean target of $170.97 represents potential downside of about 4% from its current $178 price. While acknowledging near-term risks from geopolitical factors and market saturation in certain segments, analysts highlight Lam’s technological edge and recurring revenue streams as supportive of continued growth into 2026 and beyond.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart