With a market cap of $67.2 billion, Arthur J. Gallagher & Co. (AJG) is a global insurance brokerage and risk management firm providing insurance and reinsurance brokerage, consulting, and third-party property and casualty claims services to businesses and individuals worldwide. The company operates through its Brokerage and Risk Management segments, serving a wide range of commercial, public, nonprofit, and underwriting entities.

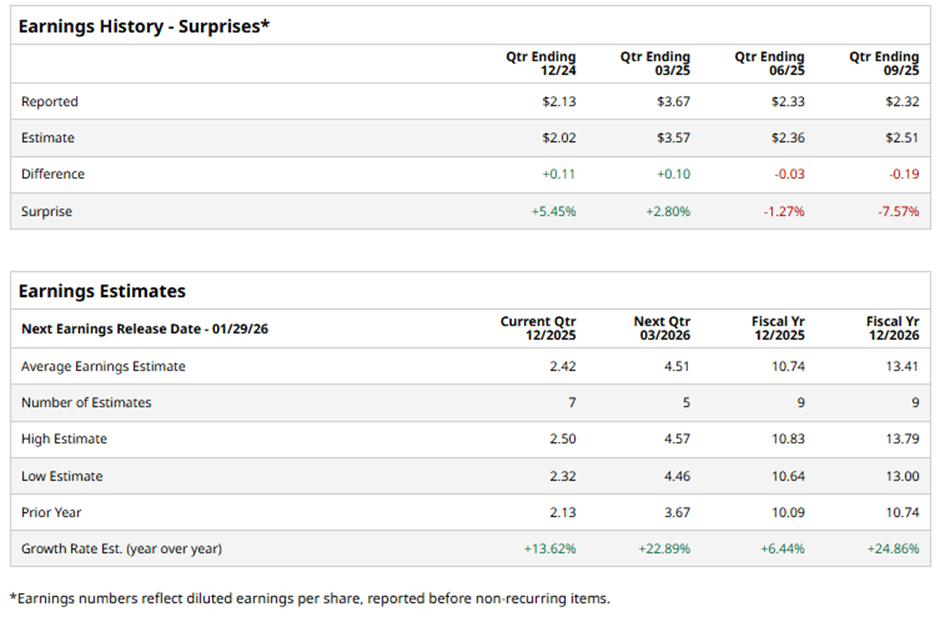

The Rolling Meadows, Illinois-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts predict AJG to report an adjusted EPS of $2.42, up 13.6% from $2.13 in the prior year's quarter. It has surpassed Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast the insurance and risk-management company to post adjusted EPS of $10.74, a 6.4% rise from $10.09 in fiscal 2024. Looking ahead, adjusted EPS is projected to grow 24.9% year-over-year to $13.41 in fiscal 2026.

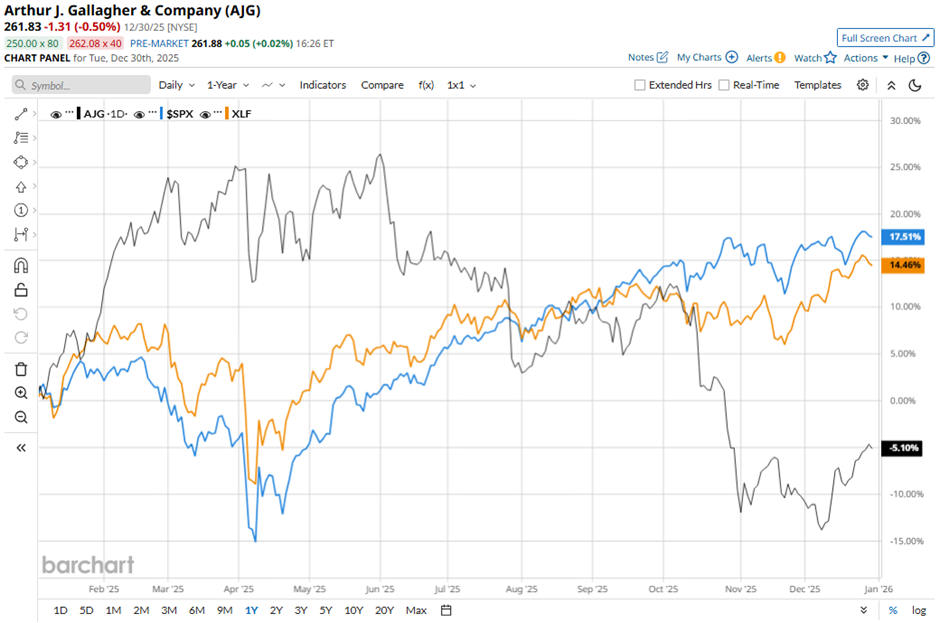

Shares of Arthur J. Gallagher have declined nearly 8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.8% gain and the State Street Financial Select Sector SPDR ETF's (XLF) 14.3% return over the period.

Shares of Arthur J. Gallagher fell 4.8% following its Q3 2025 results on Oct. 30. The company reported adjusted EPS of $2.32, which missed Wall Street expectations despite rising from $2.26 a year earlier. Adjusted revenue of $3.33 billion also came in below Street forecasts, even though it represented strong year-over-year growth from $2.76 billion.

Analysts' consensus view on AJG stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 14 recommend "Strong Buy," nine suggest "Hold," and one indicates “Strong Sell.” This configuration is more bullish than three months ago, with 12 analysts suggesting a "Strong Buy."

The average analyst price target for Arthur J. Gallagher is $303.68, indicating a potential upside of nearly 16% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Will Greg Abel Reverse Warren Buffett’s ‘Mistake’ as Berkshire Hathaway’s New CEO?

- Investors Need to Get Ready for a Stock Market Correction in 2026. Here’s Why.

- Buy These 6 Down-and-Out Stocks for a ‘Dogs of the Dow' Rebound in 2026

- 3 Stocks to Short in Early 2026, and 3 ETFs That Make Betting Against Them Even Easier