I like diving into more unconventional companies investors may not have heard of. In this piece, I decided to do just that—look at the top-performing AI stock many investors may not have heard of.

I say that because I'm one such investor who didn't recognize this name off the top of my head when I started my research on this piece. Stock screeners can help investors find some unique opportunities, and that's what they're for. But I wasn't expecting to see Kioxia (KXIAY) atop the list of best-performing growth stocks this year.

Let's dive into the key catalysts that have driven this Japanese memory and data storage company to be the best-performing stock in the whole world in 2025.

What's Driving the Move in Kioxia?

I'm going to allow for some credence for myself and anyone reading this piece that may not have heard of Kioxia. This Japanese company (the key reason why investors may not be familiar with Kioxia) has become a central player in the NAND flash memory market, debuting roughly one year ago. Thus, this is a company that's relatively new to the markets, and following many initial public offerings (which are often underpriced to begin with, leading to large pops), that's a key piece of this story I think can't be ignored.

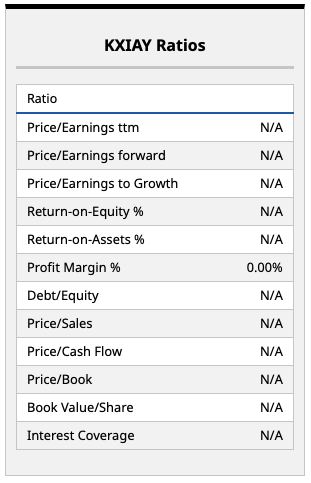

That said, it's also true that Kioxia has some pretty strong fundamentals. While it's difficult to view the company's fundamentals stateside (see above), this is a company that's seen its 540% year-to-date (YTD) increase driven by strong underlying fundamentals. This past quarter, Kioxia reported more than 30% top-line growth on a quarter-over-quarter basis. That's insane growth, and given robust pricing for NAND memory in this market, many believe this is a growth trend that can continue.

Many analysts expect to see memory demand significantly outstrip supply for the year ahead (and potentially for many years). If that's the case, then the company's future profitability should improve. With last quarter's disappointing earnings numbers (and future guidance), the stock did fall 23% after its print. But considering the sheer size of Kioxia's YTD move, that's a drop in the bucket for investors who have remained patient with this name.

What Do Analysts Think of This Memory Player?

I think Kioxia is a difficult company to assess for numerous reasons. Of course, given the fact that we're talking about an international company based out of Japan, there are fewer eyeballs on this name from this side of the Pacific. Accordingly, it shouldn't be a surprise to many that this is a company that doesn't have any Wall Street coverage… yet.

That said, what I was able to find was a projection of earnings expectations over the next quarter, as well as the company's sales forecast for its upcoming Q3 2025 print. What I found interesting is that most analysts covering this name (presumably in Japan) have a bearish take on where revenue growth will come in at over the course of the next quarter. At least on a quarter-over-quarter basis.

That said, over the same period the year prior, the high estimate still comes in higher—and this is a company I'd argue is positioned to beat those high estimates. Often, it's the so-called “whisper number” on the Street that matters more than anything else. I think the market is pricing in much higher revenue and earnings growth than the company indicated may be in play for the coming year.

If that's the case, I do think this stock could still have meaningful upside from here, considering Kioxia's current market capitalization sits at around $40 billion at the time of writing. That's a decently sized company, and one that could see material upside if the supply crunch (and soaring demand) analysts expect to see in 2026 plays out.

I guess we'll all have to watch and see. This is a new entrant to my watchlist for 2026, and I'd invite other investors to follow suit in this regard.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ulta Stock ‘Unleashed’ Gains in 2025. Should You Keep Buying Shares in 2026?

- Nvidia Could Buy AI21 Next. What Does That Mean for NVDA Stock?

- Memory Stocks Could Dominate (Again) in 2026. Should You Buy Micron Stock Now?

- The Next GEICO? Michael Burry Is Pounding the Table on This 1 Warren Buffett-Esque Stock.