Artificial Intelligence (AI) stocks have been at the center of Wall Street’s attention lately, but behind the headlines and hype, investors are really searching for companies that can turn AI ambition into real-world products and lasting profits. Not every tech giant has managed that balance, which is why each major AI move still matters to the market.

That’s precisely what puts Meta Platforms (META) back in focus. The company’s recent acquisition of AI agent startup Manus isn’t just another headline-grabbing deal; it’s a clear signal that Meta wants AI to play a deeper, more practical role across its apps and business tools. Manus’ technology is built to handle everyday tasks like research, coding, and data analysis, areas where AI can quickly become indispensable.

For long-term investors, this move raises an important question. Does buying Manus make META stock more compelling right now?

Meta Stock Performance

Meta Platforms is the parent of Facebook, Instagram, WhatsApp, and other social apps used by some 3.5+ billion people daily. It dominates digital ads and is aggressively pivoting toward AI and the metaverse. Unlike pure-play AI startups, Meta combines technology platforms with a massive social network ecosystem. The company currently boasts a market cap of $1.7 trillion, making it one of the members of the “Magnificent 7” elite group.

Meta shares have rebounded strongly in 2025. The stock has climbed over 13% year-to-date (YTD) amid strong ad sales and AI optimism. On charts, the stock is trading above its 50-day moving average, signaling continued momentum, and well above its mid-April lows.

Following the rally, META's valuation appears stretched, with metrics like price-to-book at 9, vastly higher than the sector median of 2, indicating an expensive stock. Additionally, the price-to-sales ratio is 9, significantly above the sector median of 1, further emphasizing its overvaluation. However, investors should note that high-growth stocks will often trade at premium multiples, reflecting expectations of stronger future sales and earnings.

Acquisition News: Manus Deal

On Dec. 30, Reuters reported that Meta agreed to buy Manus, a startup claiming to build the world’s first general AI agent. Manus’s technology can autonomously perform tasks with minimal prompts (beyond typical chatbots), and the company relocated to Singapore from China earlier in 2025. “Meta will operate and sell the Manus service and integrate it into its consumer and business products, including in Meta AI,” Reuters noted. Rosenblatt analyst Barton Crockett praised the fit with Meta’s vision, calling it “a natural fit into Meta’s fast-growing WhatsApp SMB footprint, with extensions into Mark Zuckerberg’s agentic-rich vision of personal AI.”

In practice, the Manus acquisition should help Meta deliver more advanced assistant-like features to users and advertisers. Investors will watch how quickly Manus’s tech is brought into products (e.g., Meta’s consumer AI and business tools). However, the Chinese roots of Manus may attract U.S. scrutiny amid geopolitical tensions.

Overall, this move signals Meta doubling down on AI, which could accelerate future revenue via better ad tech and new AI services if regulators don’t intervene.

Meta Platforms Beats Q3 Revenue Beat

Meta Platforms reported third-quarter revenue of $51.24 billion, up about 26% year-over-year (YoY), beating consensus. While operating income held near historical levels, with an operating margin of about 40%, even as costs rose versus a year earlier. Total costs and expenses increased roughly 30%, reflecting higher AI-related spending.

Net income was $2.71 billion, and diluted EPS was $1.05 for the quarter after Meta booked a one-time, noncash income-tax provision of about $15.93 billion tied to recent tax legislation; excluding that charge, adjusted net income would have been roughly $18.64 billion, about $7.25 a share.

Management signalled bigger near-term outlays for AI. For full-year 2025, Meta now expects total expenses in the range of about $116 billion to $118 billion and capital expenditures of roughly $70 billion to $72 billion, and it guided fourth-quarter revenue to about $56 billion to $59 billion.

The tax charge and higher spending expectations weighed on sentiment. Analysts note the underlying business, ad demand, and user metrics remain broadly healthy, but investors will want to watch the execution of the AI build-out and the pace of monetization.

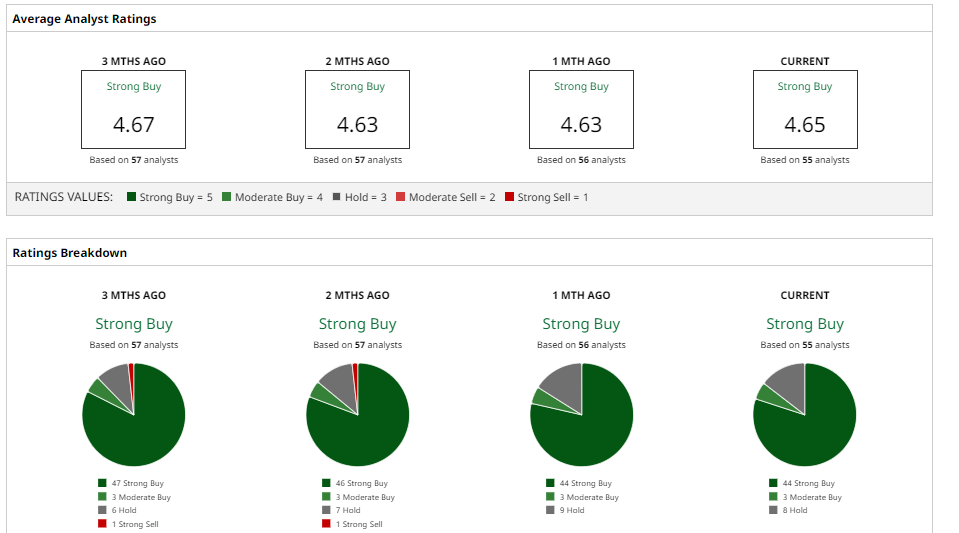

What Do Analysts Say About META Stock?

Wall Street is generally optimistic about Meta. Big banks have seen significant appreciation, supported by robust advertising and Meta's long-term AI vision.

In mid-December, Morgan Stanley restated its “Overweight” rating, and the company has a one-year price target of approximately $853, representing 30% upside from current prices. The company is optimistic that Meta's expanded ad capabilities will boost income despite increased spending.

Goldman Sachs maintained its “Buy” rating, though analyst Eric Sheridan raised his price target to $870.

RBC Capital Markets reduced its target by approximately $810, bringing it below $840. The firm said most investors view Meta's AI activities as untested, which, if successful, could support long-term revenue growth.

Barclays and Raymond James, in contrast, reduced their targets to $770 from $825 due to the fears that high expenses and massive capital investments might narrow down the returns in the near term.

Overall, analysts see continued upside if AI-driven advertising momentum holds, with a consensus “Strong Buy” rating and an average 12-month price target of $840, which suggests an expected upside of around 26% from here.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ulta Stock ‘Unleashed’ Gains in 2025. Should You Keep Buying Shares in 2026?

- Nvidia Could Buy AI21 Next. What Does That Mean for NVDA Stock?

- Memory Stocks Could Dominate (Again) in 2026. Should You Buy Micron Stock Now?

- The Next GEICO? Michael Burry Is Pounding the Table on This 1 Warren Buffett-Esque Stock.