It's rare for penny stocks to find their way into mainstream attention — that is, unless a familiar name enters the equation. That happened when Mixed Martial Arts Group Limited (MMA) announced that it has completed a private placement worth $3 million, led by American Ventures, with contributions from Donald Trump Jr. The development saw MMA stock go on an upward trend as trading volumes soared at the onset.

Of course, any speculative investor would be attracted by the headline alone. But celebrity-financed investments do not necessarily equate to good shareholder gains. The question is what makes it worthwhile to buy MMA stocks based on the fundamentals, price, and capital structure at this time? Is MMA a solid pick, or this just a flash in the pan? Let's take a closer look.

About Mixed Martial Arts Group Stock

Mixed Martial Arts Group Limited (MMA) carries out its business as MMA.INC, a technology-enabled ecosystem that targets the global combat sports sector. MMA.INC’s ecosystem incorporates gym management software, engagement platforms for athletes and enthusiasts, as well as digital media properties like BJJLink and MixedMartialArts.com. Additionally, the company has a partnership agreement with UFC GYM to incorporate its technology offerings across gyms, athletes, and fans globally. MMA.INC has operations in 16 nations with some 800 gyms under its umbrella.

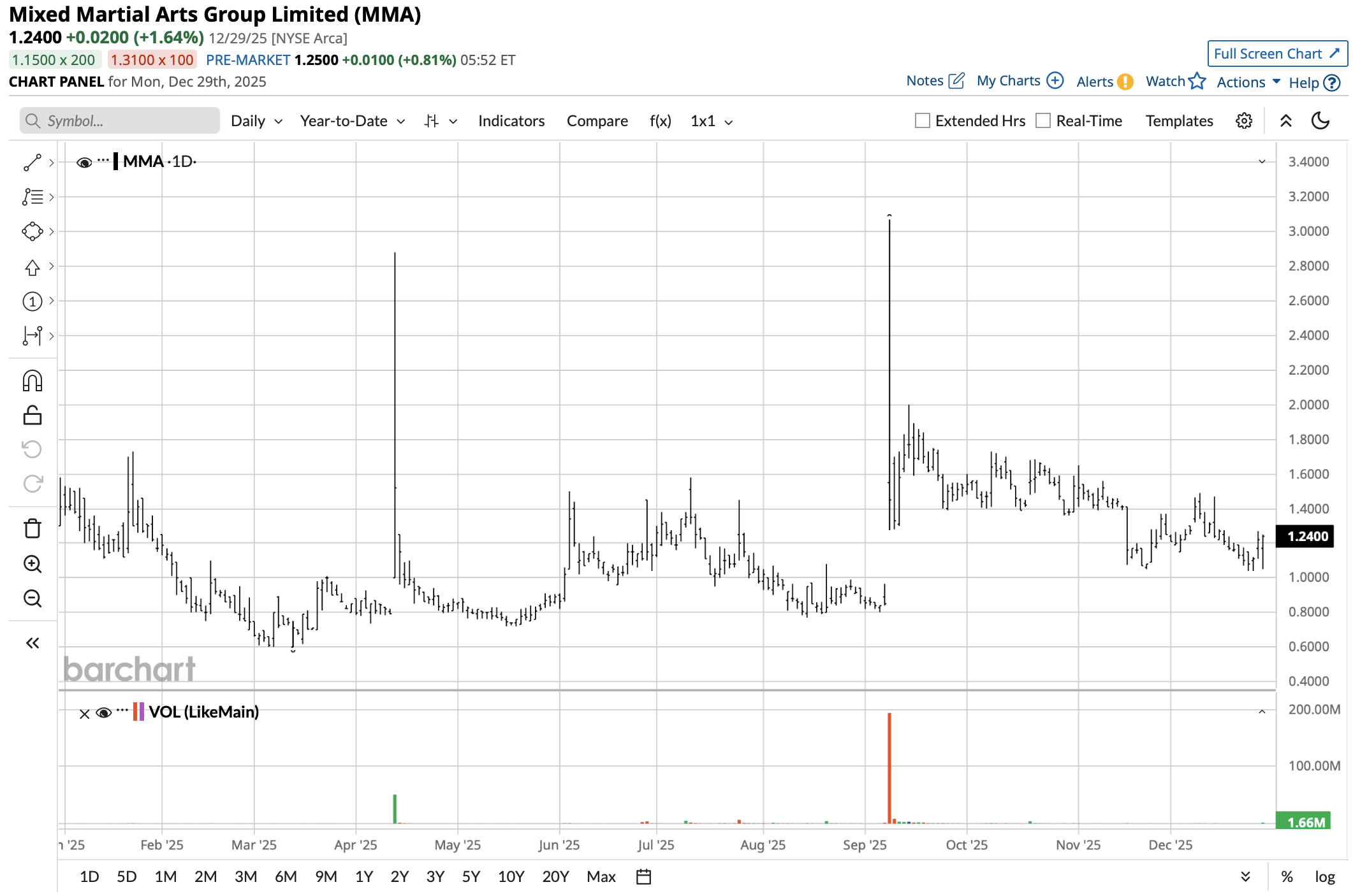

MMA stock is quite volatile. Shares currently trade for around $1.14, which is in the middle of its 52-week range of $0.60 and $3.07. It is evident that MMA stock's performance over the last year is well below that of market leaders such as the S&P 500 Index (SPY). Although trading has recently improved with news relating to the private placement, this is not consistent.

From a valuation perspective, there are risks associated with MMA stock. The company has been unprofitable with severely negative margins. There are also no earnings or cash flow-related multiples that can be used for the purposes of the aforementioned calculations. The company currently trades for 17 times sales, which is a high multiple for a micro-cap company with a market capitalization of roughly $15 million.

MMA Raises $3 Million in Private Placement

MMA issued a press release on Dec. 29, announcing that it had entered into definitive agreements to dispose of 4.29 million shares of Series A preferred stocks at a price of $0.70 per share in a deal that is estimated to generate gross proceeds of around $3 million. However, the preferred stocks are convertible at $0.70 per share with placement agent warrants issued to purchase additional 342,857 ordinary shares.

The funds will be used to finance the growth of the platform, speeding up the MMA.INC Web3 ecosystem roadmap, as well as the advancement of the firm's collaboration with UFC GYM. Management also noted the growth MMA has experienced in BJJLink, its gym software solution, as well as the platform's adoption by fighters, gyms, and fans.

Notably, MMA also signed an equity purchase agreement enabling American Ventures to purchase a maximum of $20 million in ordinary shares over a period of time, on pre-defined conditions. Although there is the potential of liquidity, there is the associated risk of dilution as well. The private placement of $0.70 per share will definitely become the benchmark, which is well below the market level, and will serve as a resistance factor in case of future stock offerings.

What Should Investors Watch Next?

Analyst coverage of MMA stock is not yet available and, as a consequence, investors are unable to rely on consensus price targets and rating recommendations to shape earnings expectations. MMA stock's share price, with a few exceptions, has been reactive to news flow and capital markets activity rather than earnings-related drivers. Going forward, shares are likely to benefit if the company's management team can capitalize on its substantial user base and manage dilution well.

For now, MMA remains a high-risk, developmental stock. The infusion of capital by a notable investor brings more attention to the company, but that has not impacted fundamentals. It's important for stockholders interested in MMA to be aware of the risks involved since the current rise in price may not necessarily be an indication of an upward trend.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ulta Stock ‘Unleashed’ Gains in 2025. Should You Keep Buying Shares in 2026?

- Nvidia Could Buy AI21 Next. What Does That Mean for NVDA Stock?

- Memory Stocks Could Dominate (Again) in 2026. Should You Buy Micron Stock Now?

- The Next GEICO? Michael Burry Is Pounding the Table on This 1 Warren Buffett-Esque Stock.