Dan Ives, a well-respected tech analyst for investment bank Wedbush, recently predicted that a “formal,” AI-oriented alliance between Apple (AAPL) and Alphabet (GOOG) (GOOGL) would be announced in 2026 and enable AAPL’s market capitalization to reach $5 trillion next year, versus its current level of slightly over $4 trillion.

While such a formal partnership could very well be unveiled in 2026, evidence strongly indicates that the alliance would not come close to boosting Apple’s market capitalization by nearly 25%. Indeed, it’s difficult to envision a scenario in which a formal partnership between AAPL and GOOG would boost AAPL stock much at all. As a result, I would not recommend that investors buy the company’s shares based on Ives’ prediction.

About AAPL Stock

Primarily due to the iPhone’s popularity and its high gross margins, Apple is one of the most profitable companies in the world. In the 12 months that ended in September, it generated income of $112 billion. Consequently, its market capitalization, which stands at about $4.04 trillion, is huge.

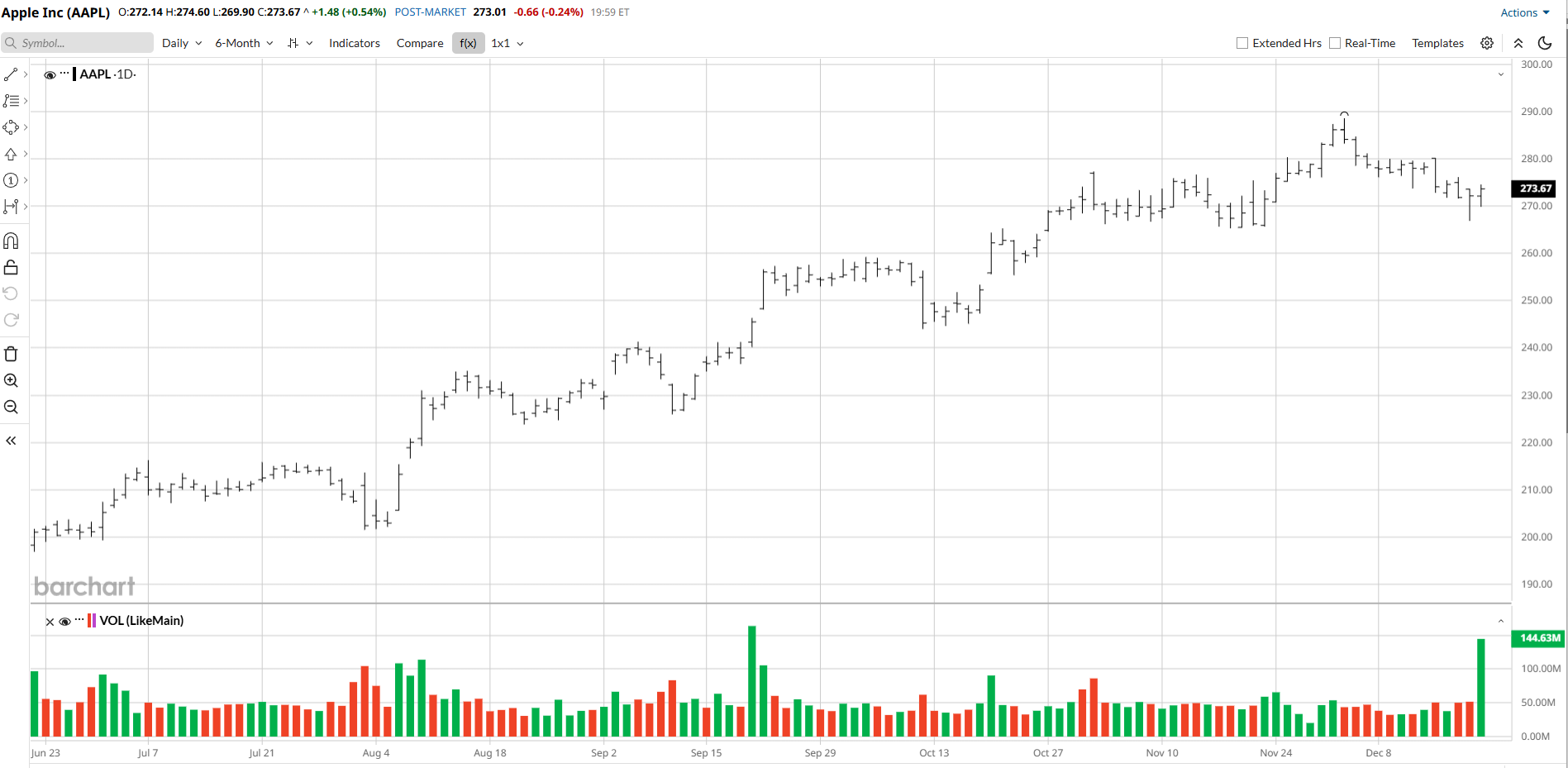

On the other hand, AAPL stock has lagged many of its Big Tech peers in recent years. In the last 12 months, the shares are up only about 7%, while they have gained 42% in the last two years. Conversely, GOOG, for example, has jumped about 60% in the last year and roughly 121% in the last two years.

One issue weighing on AAPL stock is the company’s inability so far to generate a great deal of revenue from the AI revolution.

AAPL’s top line increased 8% last quarter versus the same period a year earlier to $102.5 billion, and it has a trailing price-earnings ratio of 36.3 times.

Why a Potential Partnership With GOOG Probably Won’t Move the Needle Much for AAPL Stock

Ives indicated that AAPL’s market capitalization would be lifted by almost 25% by charging subscription fees for its AI offering. But Microsoft’s (MSFT) experience with its AI assistant, CoPilot, for which it charges some users subscription fees, strongly indicates that Ives’ vision is unrealistic. Specifically, in a post updated last month, Business of Apps reported that “Microsoft Copilot had 33 million active users across Windows, app and website.” Moreover, the website believes that MSFT’s entire AI business generated “about $400 million direct revenue in 2024.”

Every CoPilot user does not pay subscription fees. But even if we assume that Apple was able to quickly obtain as many users as CoPilot has and they all paid a $10 per month fee, the resulting revenue would not move the needle for AAPL stock. Under the latter scenario, AAPL would generate slightly under $4 billion of annual revenue from the offering, versus its total revenue for its last fiscal year of $416.16 billion.

Additionally, as I pointed out in my previous column, “under (Apple CEO Tim) Cook, the results of substantially all the firm’s efforts at innovation, from its efforts to develop a car to Apple TV to AI, have been rather underwhelming.” The latter historical fact also makes me very doubtful about Apple’s ability to turn its AI offering into a huge needle mover of AAPL stock.

Additionally, I noted that "Apple bulls, since at least August 2024, have predicted that the advent of AI would spark “a major upgrade cycle for the iPhone,” but this scenario has not yet materialized. Finally, analysts on average predict that the firm’s revenue will increase by 8.7% during its current fiscal year that ends in September, indicating that most do not expect such a cycle to materialize in 2026.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Super Micro Computer Stock Tumbles, But Investors are Piling into Its Call Options - Time to Buy SMCI?

- Chipotle Just Launched a New Protein-Packed Menu. Should You Buy CMG Stock for 2026?

- Cathie Wood Is Selling DraftKings Stock. Should You?

- Dan Ives Is Betting That Apple and Google Will Partner in 2026. Should You Buy AAPL Stock First?