Eversource Energy (ES) is a leading utility company that engages in the generation, transmission, and distribution of electricity and natural gas, as well as regulated water services. The company, headquartered in Springfield, Massachusetts, operates through multiple segments, including Electric Distribution, Electric Transmission, Natural Gas Distribution, and Water Distribution. Eversource Energy has a market cap of around $25.4 billion.

Companies worth more than $10 billion are generally described as “large-cap” stocks, and Eversource Energy fits right into that category. The company distinguishes itself as a leader and serves more than 4.4 million customers.

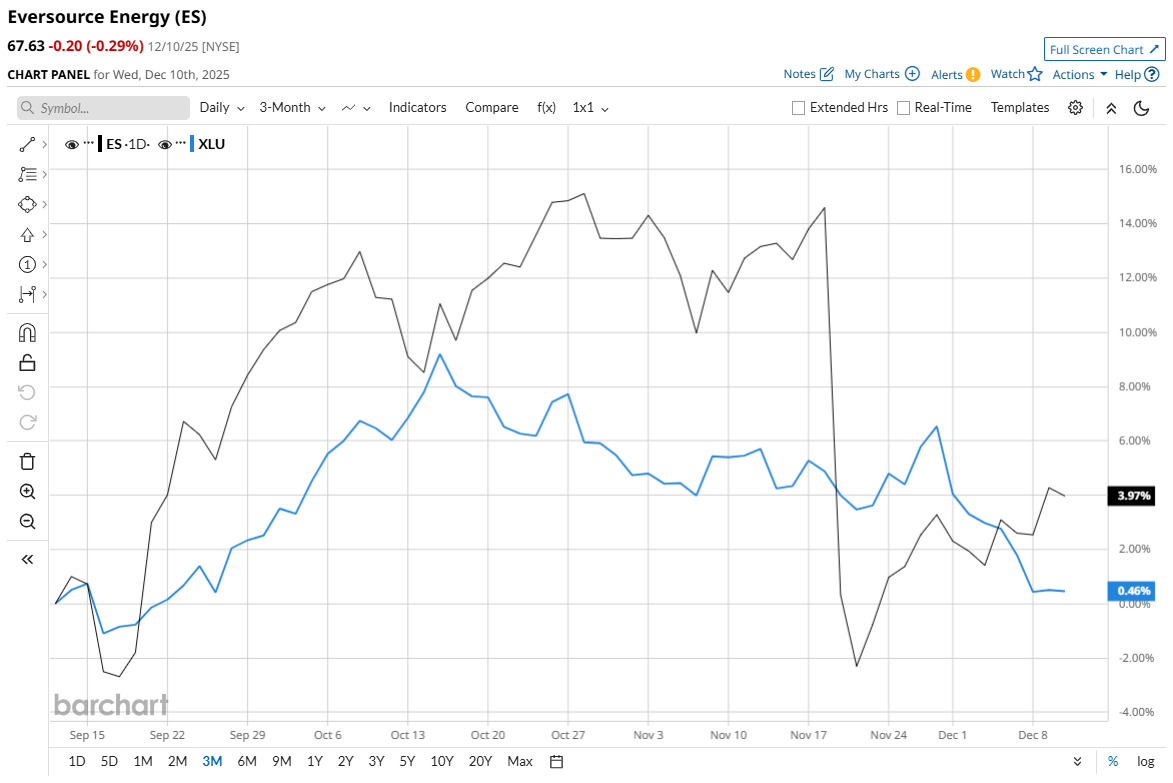

ES is down 10.1% from its 52-week high of $75.25, reached on Oct. 28. Shares have gained 5.7% over the past three months, surpassing the State Street Utilities Select Sector SPDR ETF’s (XLU) marginal returns over the same time frame.

In the longer term, ES is up 17.8% on a YTD basis and 11.7% over the past 52 weeks, again outperforming XLU’s gains of 12.9% YTD and 9.4% over the past year.

The stock has been trading mostly above the 200-day moving average since mid-May, except for some fluctuations lately. However, the stock is trading below the 50-day moving average since mid-November.

The stock generally trended upward as the company returned to profitability after a prior net loss, with stronger earnings driven by its core regulated electric and gas businesses and infrastructure investments. Eversource reported a meaningful net income turnaround in Q3 2025 compared to 2024, which helped improve investor sentiment. The company reported earnings of $367.5 million, or $0.99 per share, for the third quarter of 2025, compared with a loss of $118.1 million, or $0.33 per share, in the prior-year quarter.

However, the stock witnessed a significant plunge in mid-November after Connecticut regulators rejected the company’s proposed sale of its Aquarion water utility unit, a deal valued at over $2 billion, and investors reacted to the setback.

Nevertheless, ES has outperformed its rival, Edison International (EIX), which declined 28% YTD and 30.6% over the past year.

However, the stock has a consensus rating of “Hold” from 17 analysts in coverage, and the mean price target of $72.78 suggests a 7.6% premium to its current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart