One product that has emerged in the exchange-traded fund landscape focuses on taking a popular stock index or single stock, writing zero-days-to-expiration (0DTE) call options against that underlying core position, and 0DTE put options too. Does that sound confusing?

The secret is, it should, even to a fairly tenured investor.

0DTE ETFs can be very useful products, but they have the same “baggage” as many other covered-call ETFs. But don’t try to convince those who have poured into them. I’ll say this to leave no doubt: I like the concept here. However, based on the time and focus it took for me, no stranger to option investing and investing in general, to understand the full range of possible outcomes from using ETFs like this, I shudder to think what billions in AUM currently invested in these vehicles is capable of doing.

I’m not talking about a relatively calm market. And I’m not talking about self-directed investors, since they are their own boss when it comes to investment decisions.

I am thinking about these as a longtime investment advisor. In that world, it’s all fun and games until someone loses a million. Or two or three. Then, the questions start.

And they often end up with the end client realizing too late that they did not truly comprehend how much they could lose. That’s not just possible in the future, it is likely. I just do not know when. But as with every stock market bubble and subsequent bursting of the same, there’s a long list of things that went on during the frenzy and thrill of it all that no one cares about.

That is, until a digit or two comes off the old investing statement. If an advisor is involved, there’s a good chance that no matter what disclosure and discussion might have taken place when investing in exotic, new ETFs, the client will call foul.

I’m retired from the personal investment advice business, and I do not mean to be ghoulish or condescending here.

So to put it out there in plain language, here are three questions I came up with for investors to consider when trafficking in ETFs that combine an index or stock, and options that expire within a day or two. Thus grabbing a little bit of premium income daily, to pad the old wallet.

1. Are 0DTE Options Stress-Tested?

It seems so, although we can only account for what has actually occurred. Where I live in South Florida, hurricane season brings high winds, and we think our windows are good up to perhaps 180-200 mph forces. But that hasn’t happened, so we won’t know for sure until it does.

Still, 0DTE strategies are wildly popular, accounting for roughly half of all option trading according to several sources. When you think about it, every option contract is a 0DTE on its expiration date.

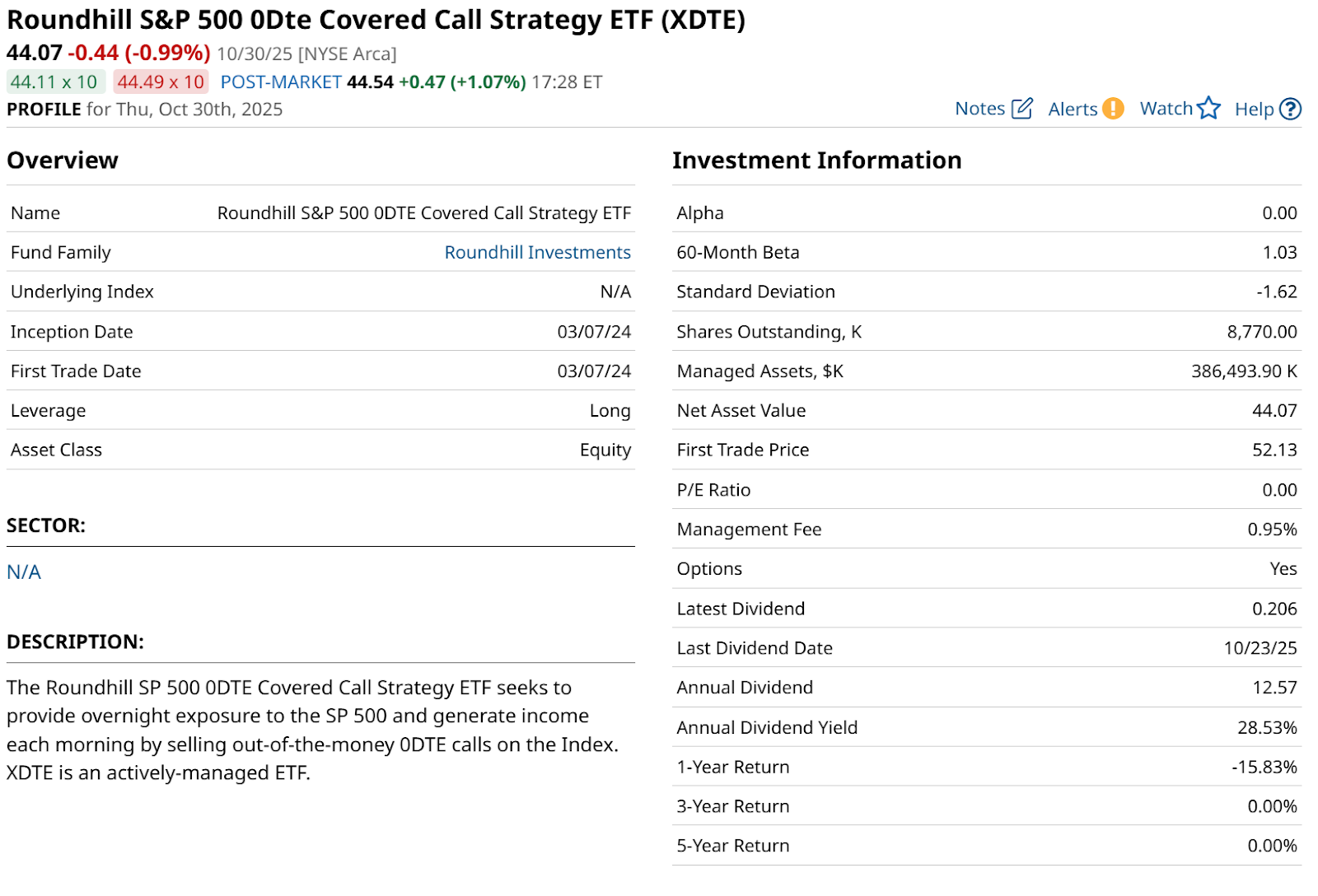

Still, ETFs like the Roundhill S&P 500 0DTE Covered Call Strategy ETF (XDTE) are now at least somewhat tenured, with substantive asset bases and more than 18 months under their belt. And we did have that shakeout in April of this year. However, that’s not the big risk here.

2. How Do 0DTE ETFs Perform?

Just fine… unless the underlying security falls hard. Then, all bets are off. Because the amount of covered call premium cash flow earned on any single day is not going to make up for big declines in the underlying index or stock.

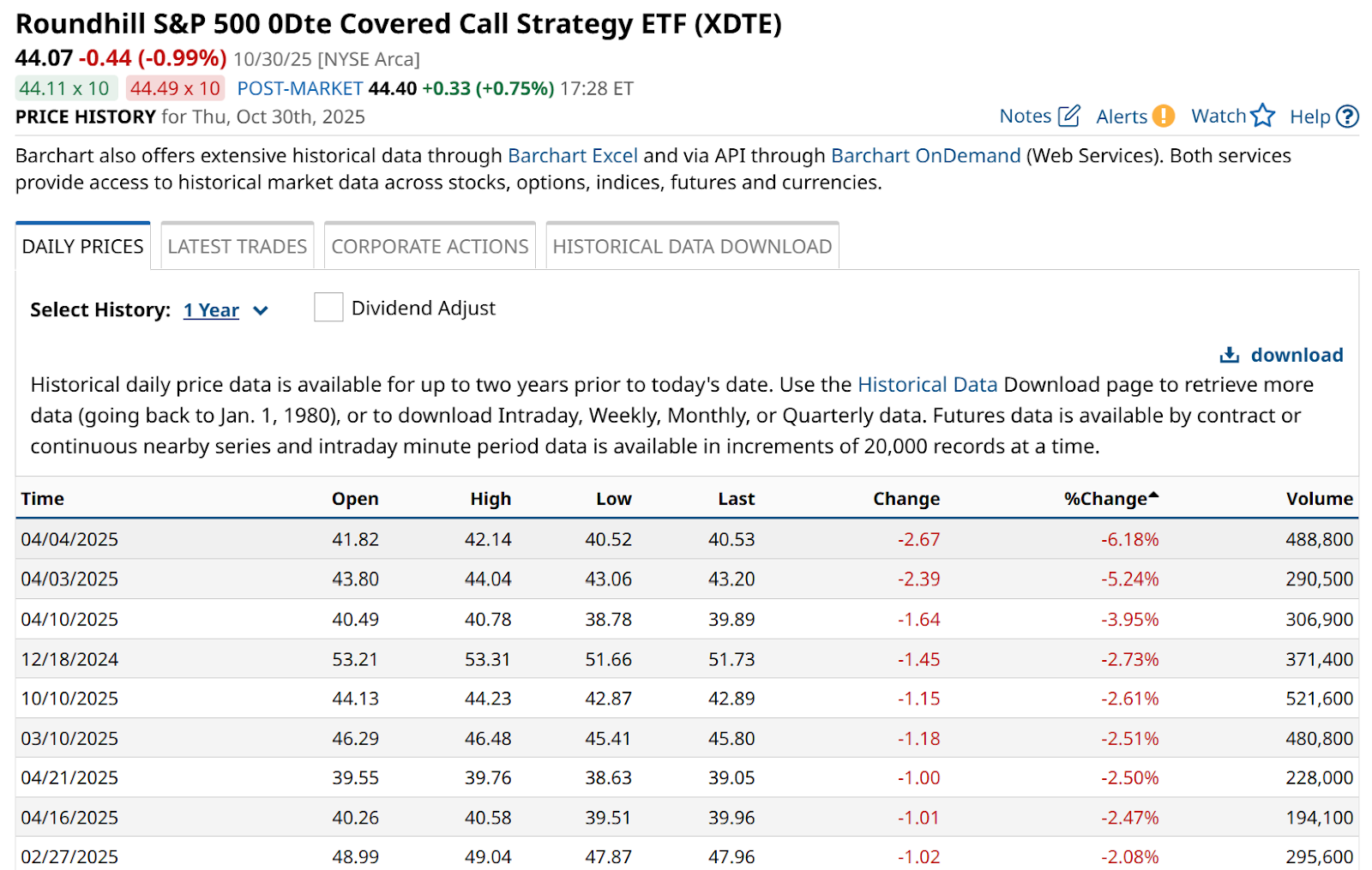

Case in point: XDTE lost at least 2% on nine separate occasions this year. The market quickly recovered, so no harm, no foul. But there will come a time when investors don’t immediately buy the dip.

That’s going to shock a lot of people who saw the headlines like “25% yield” and did not realize that has nothing to do with the resulting TOTAL return. Because so far, XDTE and its ilk have delivered returns better described as highly correlated to the target index.

In other words, you get a slightly lower return, slightly less risk, but the return you do get is predominantly option income, not capital gains. The main advantage here is psychological. You are getting a nice yield.

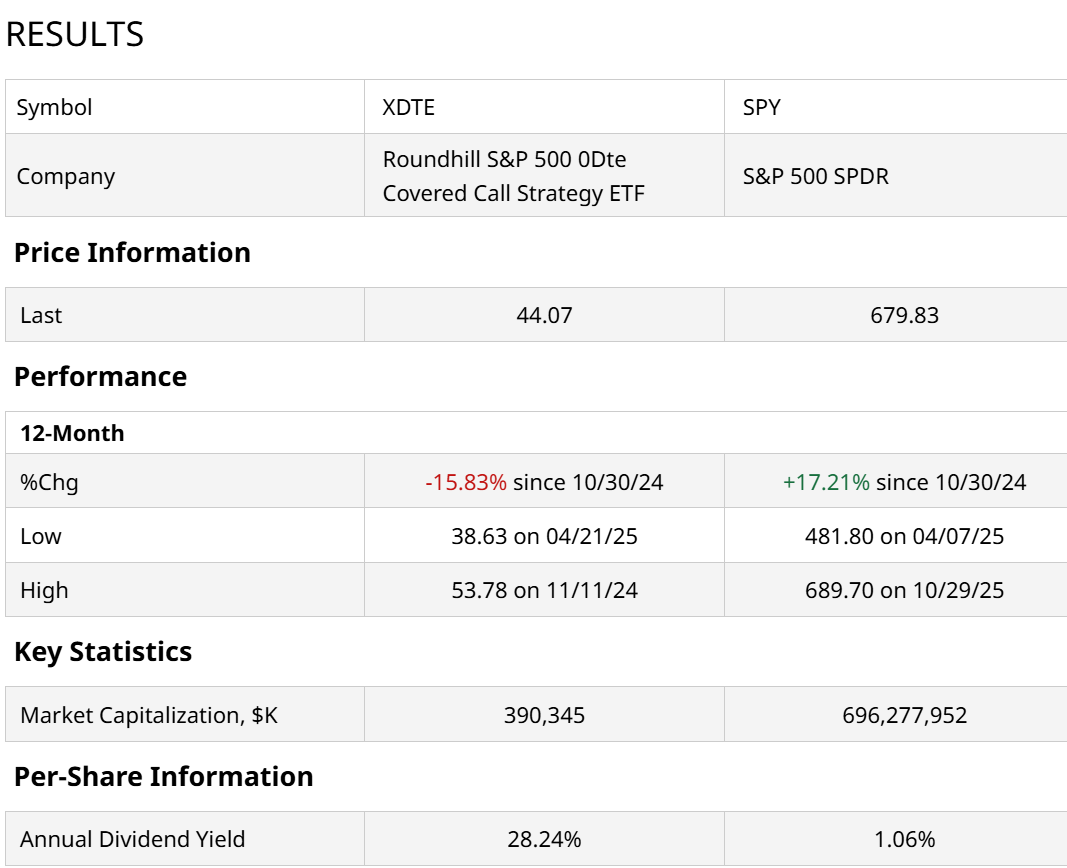

Comparing XDTE to an S&P 500 Index ($SPX) ETF (SPY) below, we see how this plays out.

Through Wednesday, Oct. 29’s close, XDTE’s total return (not shown in table) was about 10% year to date. That compares to about 17% for the S&P 500. Since XDTE’s inception on March 7, 2024, it is up 28% versus 35% for the S&P 500. Competitive, a high yield, but where’s the “alpha” for the risk taken? This is something investors need to think about.

3. Will a Covered Call Strategy Such as XDTE Protect my Capital When the Market Falls Suddenly?

No. So if that happens, you’d better hope the market pops right back up. XDTE has had two stress tests so far. The best indicator of its ability (or lack thereof) to protect capital in a market drubbing was earlier this year. The S&P 500 fell by 19% from Feb. 18 through April 8. XDTE? It fell by 18%.

The market soon recovered, up a whopping 39% since that April 8 low. XDTE is up 31% since that time. That sounds impressive in raw performance terms. But the key question remains, is that what so many investors want, that they are flocking to this strategy?

As is the case with many of these option-driven strategies, the best part is the income, and the offsetting weakness is the price sensitivity. As noted here before, I think the best way for investors to counter that, if they wish to, is to supplement their use of 0DTE ETFs with some sort of proactive price hedge. For instance, S&P 500 put options, or an inverse ETF.

The bottom line here: Every investor has to make their own priorities. But that is best done by understanding what you own. “It sounds good,” or “it’s popular” are not examples of that.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart