Kenvue (KVUE) is a global leader in consumer health, offering trusted brands such as Tylenol, Neutrogena, Listerine, Aveeno, and BAND-AID to over 1.2 billion people worldwide. Backed by science and healthcare expertise, its portfolio consists of self-care, skin health, beauty, and essential health products.

Spun off from Johnson & Johnson (JNJ) in 2023, it has operations across North America, Europe, Asia Pacific, Latin America, and the Middle East, with its headquarters in New Jersey, United States.

Today, Kimberly-Clark (KMB) announced that it intends to buy Kenuve for $48.7 billion. The deal is expected to close in 2026. KVUE stock has shot up about 14% today in response.

About KVUE Stock

KVUE stock has exhibited shaky performance in 2025, with a five-day gain of approximately 9% and a one-month increase of 4%. However, almost all of this gain is from the past 24 hours, as the acquisition news broke. Over the past six months, the stock has declined close to 31%, while the 52-week return stands at about 28%, widely underperforming the market index S&P 500’s ($SPX) gain of 20% in the same period.

Kenvue Tops Results

Kenvue Inc. reported its Q2 2025 financial results with revenues of $1.35 billion, slightly beating analyst estimates of $1.31 billion. The company posted an EPS of $0.56, surpassing the consensus expectations of $0.54, driven by strong product demand and stable pricing across its consumer health portfolio.

This solid top- and bottom-line performance highlights Kenvue’s effective market positioning and operational efficiency amid moderate economic uncertainty.

Deeper financial analysis reveals improved gross margins of 45%, reflecting a favorable product mix and cost optimization initiatives. Operating expenses remained controlled, boosting operating income by 6% year-over-year (YoY). The company reported cash and cash equivalents of $620 million, down marginally from the previous quarter but supported by healthy free cash flow. Dividend payouts continued steadily, emphasizing Kenvue’s commitment to shareholder returns.

Looking forward, Kenvue provided guidance projecting Q3 2025 revenue between $1.37 billion and $1.42 billion, with EPS expected in the range of $0.57 to $0.60. Management highlighted ongoing investments in innovation and strategic marketing to sustain growth while cautiously monitoring inflationary pressures and supply chain conditions.

The outlook suggests Kenvue’s confidence in maintaining strong performance within the consumer health segment going forward.

Should You Buy KVUE?

According to estimates from four analysts, Kenvue’s average earnings estimate for Q3, 2025, stands at $0.27, reflecting a 3.57% YoY decrease from last year’s $0.28 per share. The high estimate is at $0.29, while the low stands at $0.25. The company is set to release its third-quarter results on Nov. 6.

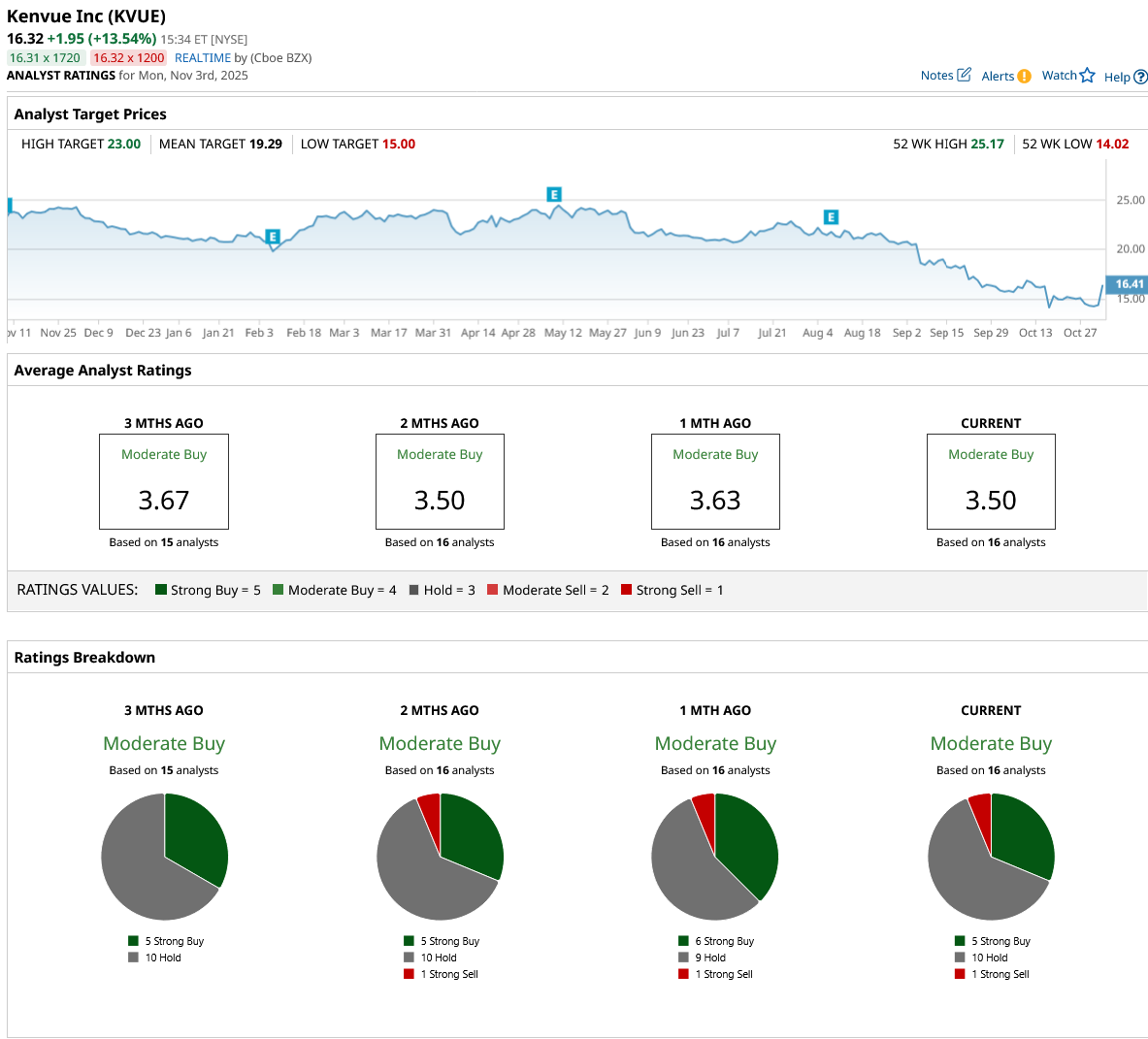

The stock has been rated a consensus “Moderate Buy” by analysts with a mean price target of $19.29, signifying an upside potential of 35% from the market rate. Kenvue has been rated by 16 analysts, receiving five “Strong Buy” ratings, 10 “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart