A large tranche of deep out-of-the-money Alphabet, Inc. (GOOGL) call options that expire in over a year and a half highlights the underlying value of Alphabet stock. This is seen in today's Barchart Unusual Stock Options Activity Report.

GOOGL stock is up over 5% today at $300.94 per share. This occurred several days after it was revealed that Berkshire Hathaway (BRK.A) had purchased a substantial amount of Alphabet shares.

Since Friday, Nov. 14, after it was revealed that Berkshire had bought $4.3 billion worth of Alphabet stock as of Sept. 30, GOOGL stock has risen almost 10% from $274.91.

I had discussed how valuable GOOGL stock was last week in my Nov. 11 Barchart article, “Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued.”

I discussed in the article how the stock could be worth $408.27 per share. This is based on its very strong free cash flow (FCF) and FCF margins.

That price target is still worth +16% more than today's price. And if Alphabet can continue showing high FCF margins, the price target could likely rise.

This could be one reason why some institutional investors are taking a long view and buying long-dated out-of-the-money (OTM) call options.

Heavy Buying of Long-Dated Calls

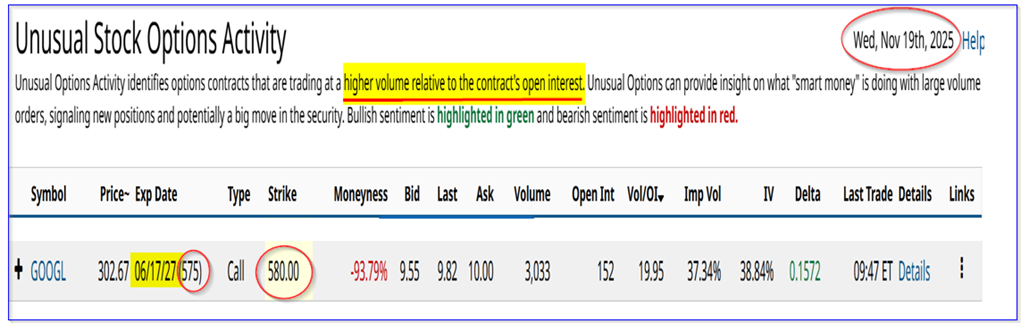

This is seen in Barchart's Unusual Stock Options Activity Report today. It shows that over 3,000 call option contracts have traded at the $580.00 strike price for expiry on June 17, 2027.

That is over one and a half years from now (575 days), and the strike price is $279.06 or +92.7% higher than today's price (i.e., $580/$300.94 -1).

Moreover, the premium is $9.82, so the breakeven point is $580+$9.82 = $589.82, or $288.87 higher, i.e., +96% over today's price.

This means that for all intents and purposes, the buyers of these calls expect that GOOGL stock will more than double in the next year and a half.

Why Buy Long-Dated GOOGL Calls?

This is also a way to buy GOOGL shares with less dollar outlay and yet obtain a leveraged upside in the stock. For example, to buy 100 shares of GOOGL stock means:

100 x $300 = $30,000

But this same $30,000 can purchase about 30 call option contracts (i.e., $30,000 / ($9.82 x $100) = 30.6). That gives the investor exposure to 3,000 GOOGL shares (i.e., 30 calls x 100 shares per call) rather than 100 shares of GOOGL stock.

So, over time, if GOOGL stock moves up by $108 to $408, it's possible that GOOGL calls expiring June 17, 2027, could rise by 15.72% (based on the delta ratio):

$108 x 0.1572 = $16.98

So, the calls would be worth $9.82 + $16.98, or $26.80. That would provide a great potential expected return (ER):

$26.80 / $9.82 = 2.73

In other words, the investment profit would be +173%, compared to a just a 16% gain to $408 per share by just holding GOOGL shares.

That means the investor's account would be worth $80,400 ($26.80 x 100 x 30), buying these long-dated calls. That compares to just $40,800 owning just 100 shares. That implies a 2x greater return with just a 16% gain in GOOGL stock.

So, this is a great way to gain exposure to a large number of GOOGL shares. Moreover, there is good downside protection here, since the call options have a long expiration period.

The bottom line is that, assuming GOOGL stock performs as expected, based on its strong free cash flow, this is a good way to make a good expected return in GOOGL stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Here’s How You Can Have Your Cake with AMD Stock and Eat It Too – With Just 6.6% Downside Risk

- Large, Unusual Call Options Trading in GOOGL Stock Highlights Its Value

- High-Probability AMZN Iron Condor with 13% Return Potential

- This Consumer Stock is Already in a Bear Market. Smart Money Sees 20% More Downside Ahead.