Klarna (KLAR) stock lost nearly 10% on Nov. 18 after the buy-now-pay-later (BNPL) firm posted $95 million in net loss for its fiscal Q3, down sharply from $12 million in net income last year.

The selloff saw KLAR’s 9-day relative strength index (RSI) slip into the oversold territory below 30, indicating bears will likely remain in control in the near-term. The 14-day RSI is now hovering just above 30 as well.

Following the post-earnings decline, Klarna shares are down over 25% versus their IPO price.

Should You Invest in Klarna Stock Today?

Long-term investors may consider loading up on KLAR stock on the post-earnings dip primarily because management attributed the quarterly loss to an accounting timing issue.

The underlying operational efficiency, it confirmed, actually improved in Q3.

Additionally, the Klarna Card has notched up 4 million sign-ups in under four months, which CEO Sebastian Siemiatkowski told CNBC “must be the most successful new card launch by a bank in US history.”

The microenvironment hasn’t so far resulted in “material differences” in payback or spending habit either – he added – further bolstering the case for owning Klarna stock heading into 2026.

KLAR Shares Are Trading at an Attractive Valuation

Speaking with CNBC, Klarna’s chief executive also said the company’s unique ability to adjust its underwriting and refresh its balance sheet “within a month or two” remains underappreciated.

The BNPL firm’s artificial intelligence (AI)-enabled merchant analytics and customer service tools were among other key differentiators he named during the interview.

What’s also worth mentioning is that KLAR shares are currently going for a price-sales (P/S) multiple of 4.15x only, which makes it notably more inexpensive to own than its fintech peers like Block (XYZ) and Affirm (AFRM).

Options data also currently indicate a potential recovery in the fintech stock to about $41 by March 30.

What’s the Consensus Rating on Klarna Group?

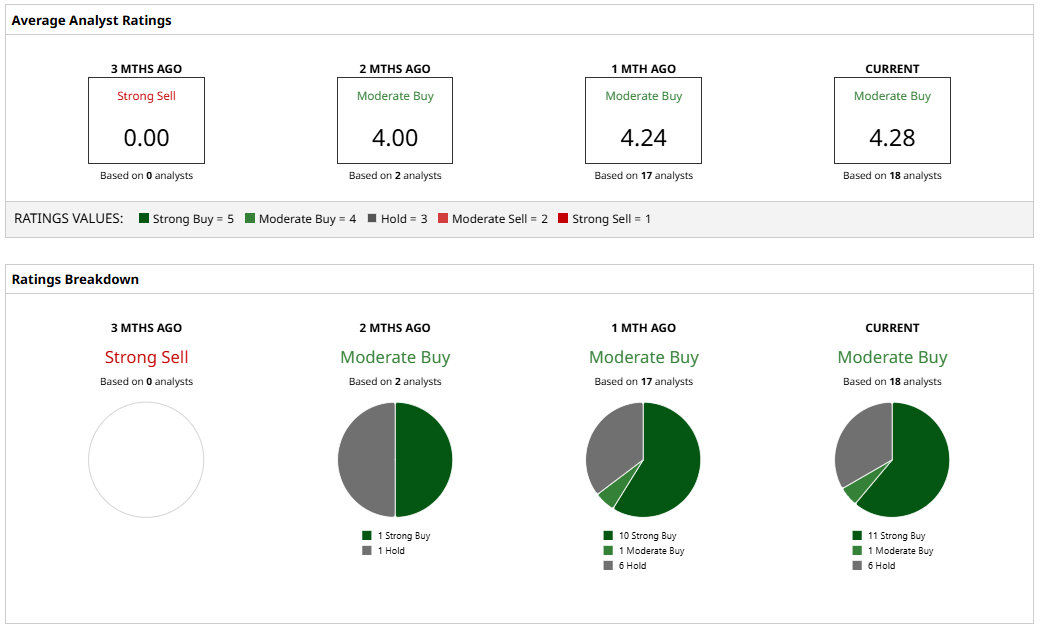

Investors may also take heart in the fact that Wall Street remains bullish as ever on KLAR shares heading into 2026.

According to Barchart, the consensus rating on Klarna stock currently sits at “Moderate Buy” with the mean target of about $49 indicating potential upside of more than 50% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart