Tesla (TSLA) is again caught in the spotlight after CEO Elon Musk told shareholders that Tesla’s wildly ambitious AI agenda may soon include making its own chips. At the company’s annual meeting, Musk said Tesla is designing a fifth-generation “AI5” processor and likely needs to build “a gigantic chip fab” to meet demand.

He even floated discussing with chipmaker Intel (INTC) about partnering on the project. Musk bragged the Tesla-designed chips would be extremely power-efficient and cheap, about a third of Nvidia’s (NVDA) power draw at roughly 10% of the cost, and quipped that he’s got “chips on the brain” these days.

The news shows Musk is doubling down on Tesla’s shift from just selling cars to becoming an AI-and-robotics powerhouse. Investors are now asking: Does this justify TSLA’s lofty valuation, or is the stock too rich for its own good?

About TSLA Stock

Tesla is a global leader in electric vehicles, battery energy storage, and renewable energy products. It builds popular EVs (the Models S, 3, X, and Y, as well as the new Cybertruck) and solar/battery systems while pushing hard into self-driving software and humanoid robots. Under CEO Elon Musk, Tesla has grown into the world’s biggest automaker by market cap, about $1.5 trillion as of now.

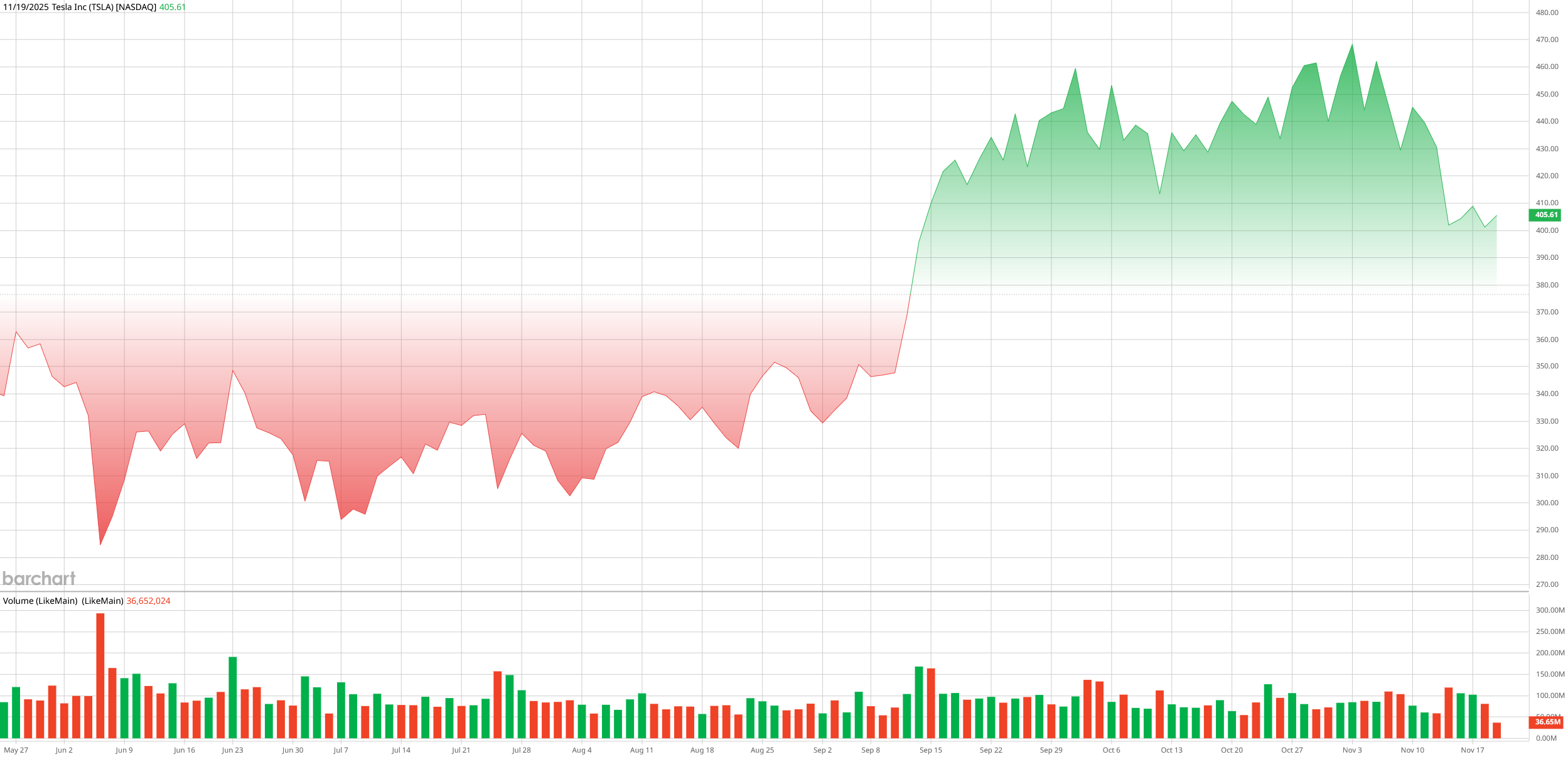

Tesla shares remain flat in 2025, giving up October gains due to rising EV competition, slowing China sales, investor concerns over Musk’s pay, and cautious sentiment around AI and FSD promises.

The biggest frustration for Tesla investors continues to be its valuation. Near the $400 level, the stock still looks expensive. Tesla trades at a forward P/E that hovers between roughly 270x and 370x, along with about 15x forward sales. That stands far above traditional automakers such as Toyota, which sits closer to 0.9×. Even when stacked against major tech names, Tesla’s multiples remain among the highest in the market.

Musk’s AI Chip Plan: Effects & Expectations

Musk laid out the vision that Tesla is designing its own AI chip (the so-called AI5 processor) to power future self-driving and robotics needs. He warned that even top contract fabs like TSMC (TSM) or Samsung (SMSN.L.EB) can’t deliver enough volume and said Tesla “probably will have to build a gigantic chip fab,” which he called a “terafab” to get 100,000 wafer starts per month. He even floated teaming up with Intel’s foundry business: “Maybe we’ll do something with Intel… probably worth having discussions” to accelerate the plan. The goal is to make an ultra-efficient, inexpensive chip.

I think the effects of this plan could be huge or costly. If Tesla builds its own fab, it could lock in dedicated capacity and tailor the process exactly for Tesla’s software stacks. But building a new semiconductor fab is expensive and risky. It could cost $10 billion to $20 billion and years of work. In the near term, Tesla still relies on existing suppliers: it currently partners with TSMC and Samsung for earlier-gen chips. Musk says a small run of AI5 chips may come in 2026, with mass production in 2027.

Tesla Delivers Record Revenue Growth

Tesla reported record revenue growth in its Q3 earnings but squeezed profits. Total Q3 revenue was $28.09 billion, representing a 12% increase year-over-year (YoY).

Earnings, however, were hit by rising costs. GAAP net income was about $1.37, down 37% YoY, and diluted GAAP EPS was just $0.37 below street forecasts. Operating income fell to about $1.62B with only a 5.8% margin, dragged down by higher R&D (AI/robotics projects), stock compensation, and new tariffs.

Free cash flow was a bright spot: Tesla generated roughly $3.99 billion in FCF in Q3, a record for the company. Cash and equivalents ended the quarter at about $41.6 billion, giving Tesla plenty of dry powder.

“Even as vehicle deliveries grow, we have to invest in autonomy, AI and future lines,” noted Musk in the conference call. Musk is known to quip, “I’m super hardcore on chips… I have chips on the brain” when talking about these projects. Tesla did not give detailed numeric guidance for Q4 or full-year 2025. CFO Vaibhav Taneja said the push into new tech is weighing on costs this year.

Wall Street analysts currently expect full-year 2025 revenue to be around $97B and EPS to be near $1.15, versus $2.04 in 2024, reflecting margin pressure. Moreover, management did hint that expansions like Cybercab, Semi, and Megapack 3 are on track for 2026, but short-term momentum will depend on consumer demand without EV tax credits.

Analysts’ Take & Price Targets

Wall Street seems divided on Tesla's prospects. Morgan Stanley reiterated an “Overweight” rating with a $410 price target. The team highlights Tesla’s third-quarter delivery beat and sees long-term upside if AI and robotics initiatives succeed, though they acknowledge the stock currently trades at a P/E of 272x above their fair-value model.

Goldman Sachs recently nudged its target to $395 with a “Neutral” rating. Goldman’s Tesla analyst cautions that the stock depends heavily on Musk executing on humanoid robots and autonomy. He noted that if Tesla captures an outsized share of those markets, there’s meaningful upside potential, but if competition or execution slips, there could be downside risk.

On the bullish side, Wedbush’s Dan Ives remains optimistic with a “Buy” rating and a $600 target, arguing that Tesla’s long-term value creation in robotaxis and AI is still underappreciated. Deutsche Bank also reiterated a “Buy” with a $440 target, pointing to confidence in Musk’s broader vision.

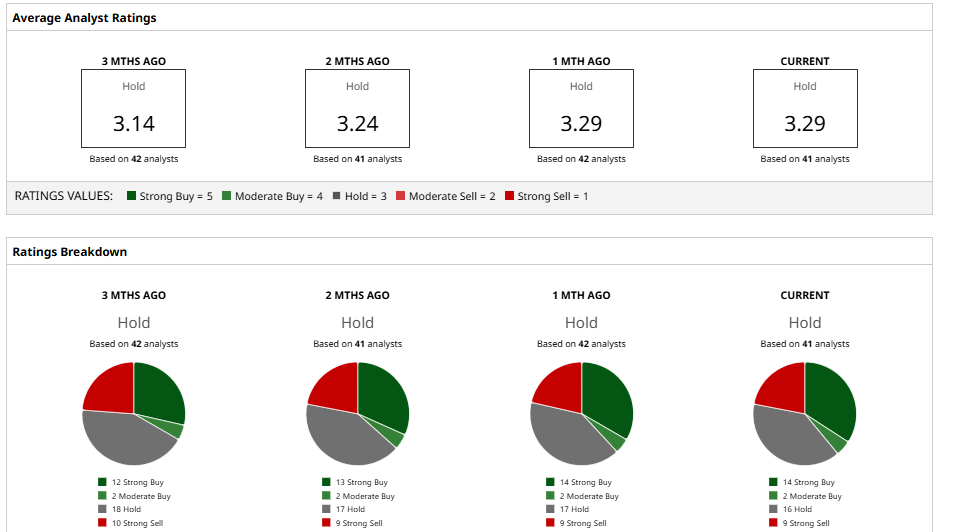

The consensus among roughly 40 analysts lands near a “Hold,” with an average price target in the $300s, which suggests the stock could pull back 4% from its current levels. In short, some expect further gains if Tesla’s AI and robotics bets pay off, while others warn that with valuations already stretched, any stumble could hit the stock hard.

The Bottom Line on TSLA Stock

Tesla is playing a very long game. The chip-fab hint and AI focus keep the door open for a major future payoff, but investors must judge whether today’s stock price already bakes in too much hope. In the short run, Tesla is still mainly a car and battery company, and its profit margins have been under pressure. If you’re excited by robotaxis and Elon’s grand vision, you might stick around for the ride, but if you want solid near-term numbers and a cheap valuation, TSLA might feel too high-risk right now.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Musk Hints That Tesla Could Make Its Own AI Chips, Should You Buy TSLA Stock?

- Think AI Stocks Are Overvalued? Invest in These Data Center Power Trades for the Next Growth Phase.

- Don’t Miss the Cup and Handle Pattern Our Top Chart Strategist is Tracking Now

- Will Natural Gas Rally During the 2025/2026 Withdrawal Season?