Nvidia (NVDA) is a global technology leader specializing in graphics processing units (GPUs), data center hardware, and artificial intelligence solutions. The company’s GPUs power everything from gaming and creative workstations to cloud computing, self-driving cars, and AI-driven data centers. Nvidia’s breakthroughs in GPU-accelerated computing and its CUDA software platform have been instrumental in advancing high-performance computing and AI across industries.

Founded in 1993 and led by Jensen Huang, Nvidia is headquartered in Santa Clara, California. The company operates in 38 countries with an estimated 92% market share of the discrete GPU market.

About Nvidia Stock

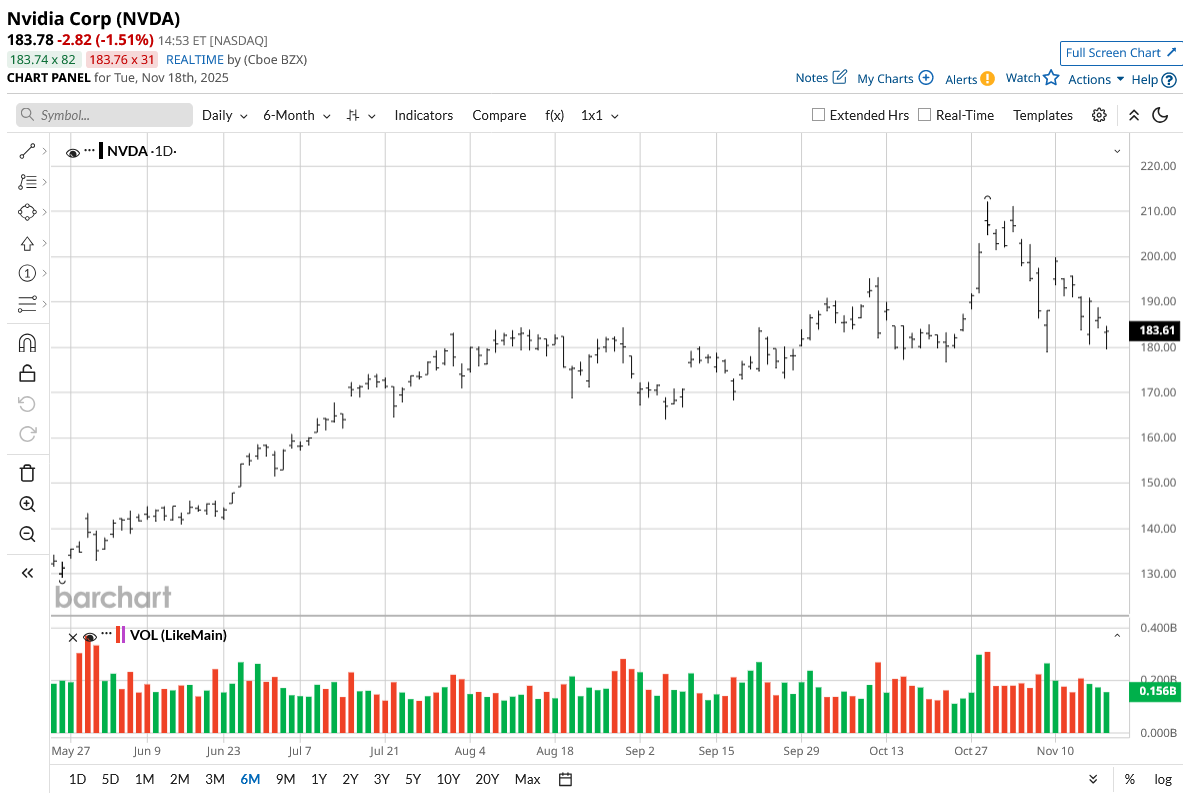

Nvidia's stock has shown strong performance through 2025 despite recent volatility. Over the past five days, NVDA stock has slid 4.6% but has shown resilience in the one-month period, where it is up nearly 1%. Over the six-month timeframe, Nvidia has gained 36%, driven by robust demand. Its 52-week performance is close to 31%, while the stock is 13% off its 52-week high of $212.19 set on Oct. 29.

The AI company has outperformed the illustrious S&P 500 ($SPX), which has 13% at the same time and only 12% in the last six months.

Nvidia’s Robust Q2 Results

Nvidia posted its previous second-quarter results on Aug. 27, where the company produced adjusted earnings of $1.05 per share, surpassing analyst estimates of $1.01 per share. Revenue for the quarter came to $46.7 billion, up 56% year-over-year (YoY), while edging past estimates. However, despite the strong numbers, the stock slid on result day as investors worried about geopolitical issues relating to China.

Nvidia reported a 56% growth in its data center sales, driven by AI demand, while gaming revenue was up 49% to $4.3 billion. Gross margin for Q2 came to 72.7%, trailing behind the previous year’s number, while operating income totaled $30.2 billion, with net income coming to $25.8 billion, showcasing strong data center and workload demand. Free cash flow for the quarter remained robust, supporting the company’s $60 billion share repurchase plans.

For the upcoming third-quarter results scheduled to be released on Nov. 19 after market, Nvidia has estimated revenue of $54 billion as AI infrastructure continues growing, with management optimistic surrounding AI’s long-term market opportunity.

Ives Makes AI Spending Claim

Wedbush analyst Dan Ives has labeled the recent tech selloff a buying opportunity for tech investors. Ives said that the selloff created a “white-knuckle moment” with concerns surrounding AI stocks such as Nvidia, Tesla (TSLA), Microsoft (MSFT), and Palantir (PLTR). Despite Palantir’s robust earnings report, its stock slid, furthering fears of an “AI Bubble” among investors who now worry about Nvidia’s potential revenue miss, citing China tariffs.

Wedbush also sees this period as a short-lived panic moment while expecting another major tech rally as investors continue to capitalize on the AI revolution.

The analyst also noted a couple of key highlights from Q3 tech earnings, such as strong cloud growth from Amazon (AMZN), Alphabet (GOOG) (GOOGL), and Microsoft, and increased capital expenditure expected from Meta (META) and other big tech firms in 2026, projected at $550-$600 billion, up from $380 billion this year.

Ives has also focused on Nvidia’s upcoming Q4 results as a critical validation point for the AI revolution and also as a catalyst for the rally. The analyst characterized the current scenario as an “AI Arms Race” fueled by the big techs.

Should You Buy NVDA Stock?

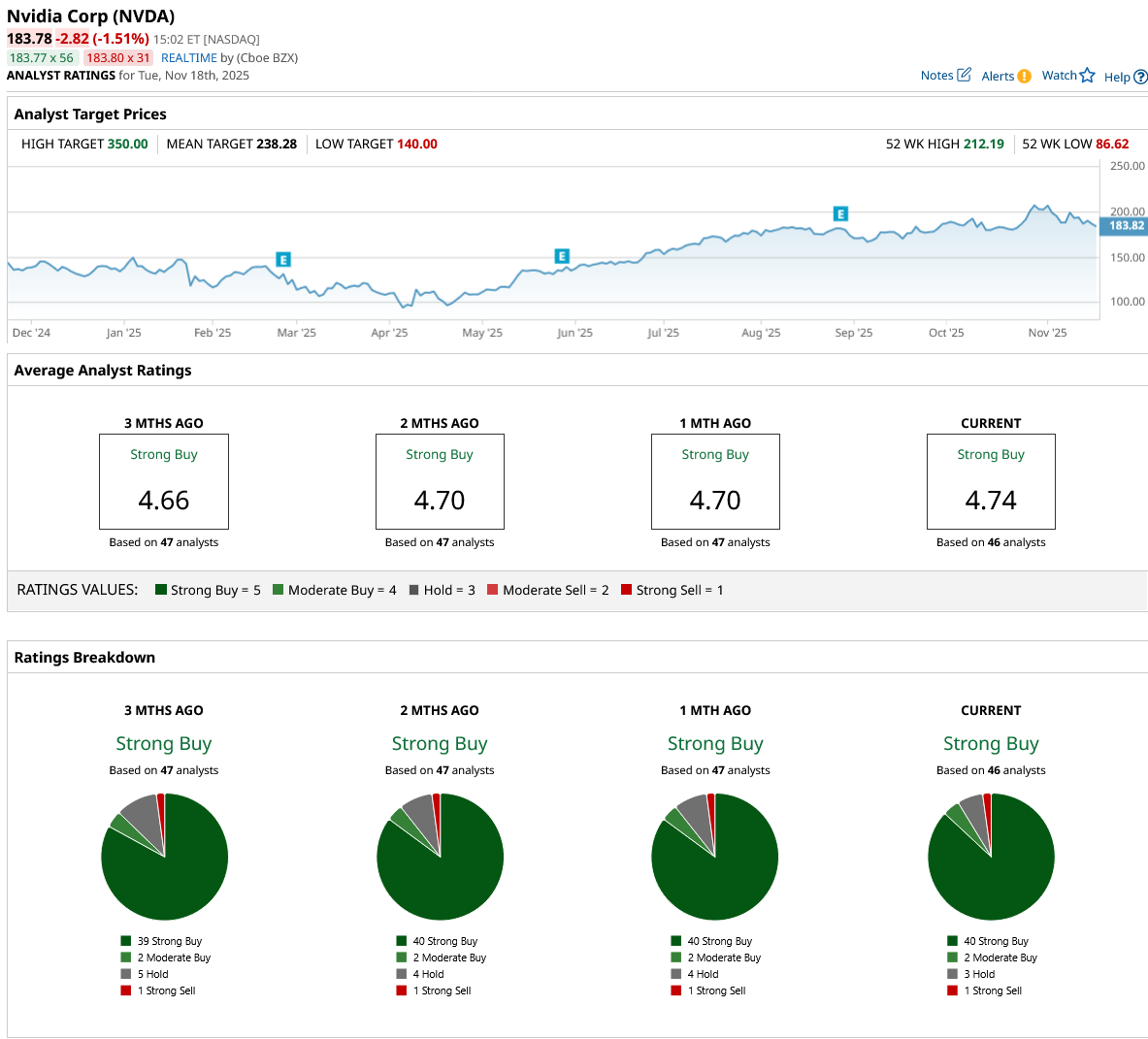

Investors and market experts are optimistic about Nvidia, with a consensus “Strong Buy” rating and a mean price target of $238.28, reflecting an upside potential of 30% from the market rate.

NVDA stock has been reviewed by 46 analysts, receiving 40 “Strong Buy” ratings, two “Moderate Buy” ratings, three “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Dip in Cloudflare Stock or Stay Far Away After Widespread Internet Outages?

- AI Spending Is ‘NOT’ Slowing Down, According to Wedbush. That Makes Nvidia Stock a Buy Before November 19.

- This Consumer Stock is Already in a Bear Market. Smart Money Sees 20% More Downside Ahead.

- Apple Is Apparently Getting Ready to Replace CEO Tim Cook. Is That Good News for AAPL Stock?