Juno Beach, Florida-based NextEra Energy, Inc. (NEE) is one of the largest electric power companies in the U.S. and a global leader in renewable energy. Valued at $172.1 billion by market cap, it delivers electricity to millions in Florida through FPL and develops wind, solar, storage, and clean-fuel projects across North America via its NextEra Energy Resources unit.

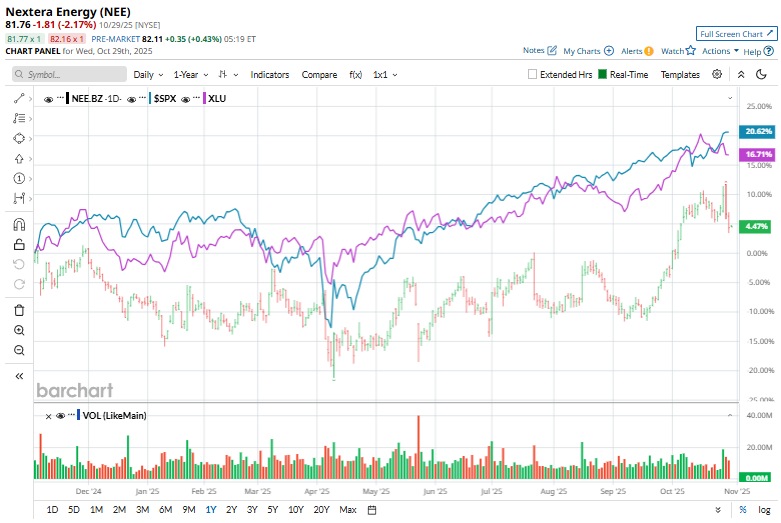

The utilities giant has notably underperformed the broader market over the past year. NextEra’s stock prices have surged 2.8% over the past 52 weeks and 14.1% on a YTD basis, lagging behind the S&P 500 Index’s ($SPX) 18.1% gains over the past year and 17.2% returns in 2025.

Even within its own sector, NextEra has lagged as the Utilities Select Sector SPDR Fund (XLU) has surged 3.7% over the past 52 weeks and returned 19% in 2025.

On Oct. 28, NextEra shares fell 2.9% after the company released its third-quarter earnings. Thanks to the robust demand for clean energy, its adjusted EPS climbed to $1.13, comfortably above expectations. While its utility arm, Florida Power & Light, continued to shine with double-digit profit growth, revenue of $8 billion fell short of the Street's expectations.

For fiscal 2025, ending in December, analysts expect NextEra to deliver an adjusted EPS of $3.68, up 7.3% year-over-year. The company has built a strong track record, beating earnings expectations in each of the last four quarters.

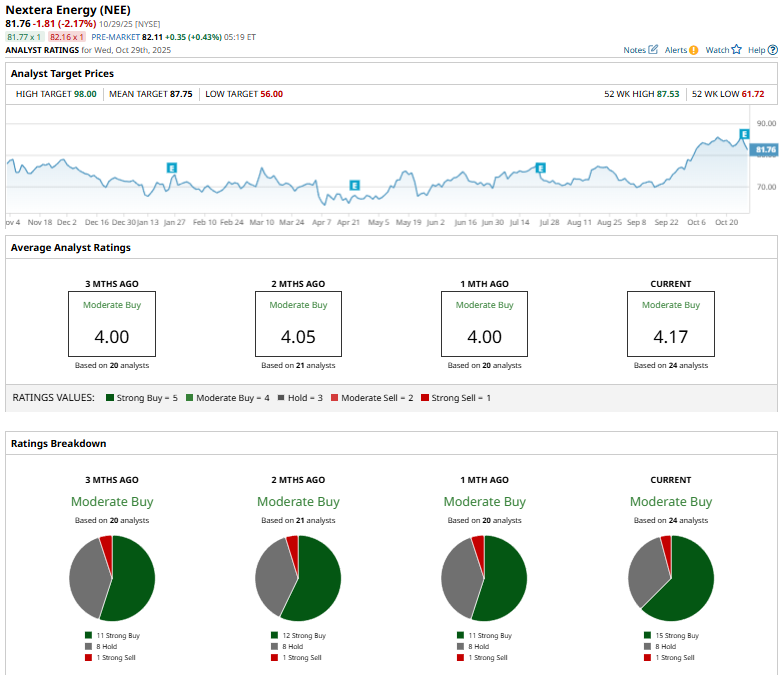

Analyst sentiment leans reasonably positive as well, with the stock carrying a consensus “Moderate Buy” rating overall. Of the 20 analysts covering the stock, opinions include 15 “Strong Buys,” eight “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, when 11 analysts gave “Strong Buy” recommendations.

JPMorgan Chase & Co. (JPM) Jeremy Tonet reaffirmed a “Buy” rating on NextEra Energy on Oct. 15, setting a $94 price target.

NEE’s mean price target of $87.75 suggests a 7.3% upside potential. Meanwhile, the Street-high target of $98 represents a substantial 19.9% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Muted Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit

- Dear Apple Stock Fans, Mark Your Calendars for October 30