ALBANY, OR / ACCESS Newswire / June 13, 2025 / In today's economic climate, poor credit scores tend to make getting a loan extremely difficult. Emergency funds, consolidation of debts, and unexpected expenses may be covered by a bad credit installment loan.

>>>Visit Official Site To Get Instant Loans>>>

Fortunately, many lenders focus on issuing installment loans specific to individuals who have bad credit. In this in-depth resource, we discuss some of the top installment loan providers for individuals with poor credit, including name-brand providers Blue River Loan, Now Personal Loan, GetCash 4 Me, Credit Lend, and Wizzay.

Guaranteed Installment Loans For Bad Credit (Top Picks)

Now Personal Loans - choose for guaranteed installment loans for bad credit direct lenders only

Wizzay - the best choice for emergency loans online guaranteed approval

Blue River Loan - bad credit personal loans guaranteed approval $5,000

Get Cash 4 Me - bad credit personal loans guaranteed approval direct lenders

Credit Lend -no credit check installment loans guaranteed approval direct lender

What is an Installment Loan?

You can borrow a certain amount of money and pay it back over time in equal, fixed monthly installments with an installment loan. It's easy on the budget because you pay the same amount every month. Since interest rates are often fixed for these loans, you will always be aware of your monthly payment amount.

Key Features of Installment Loans:

Fixed monthly payments: For sure, this will be exact, so I can manage this well.

Variable repayment terms: You can choose from which loan term you will settle in a few months or you will settle in more years.

Can Be Used for Any Purpose: Installment loans can be used for a variety of purposes, even for payments on medical bills, repairing homes, and even for weddings.

Can Be Found Even with Bad Credit Scores: If you do not have excellent credit, you will still qualify for an installment loan.

What You Should Consider Before Choosing an Installment Loan

Before you select an installment loan, several things you ought to consider first, including the interest rates. A low credit score may result in loans with a higher interest rate. However, it is wise to shop around and compare the interest rates of different lenders to get the best rates.

Loan Terms: The repayment terms of the loan may also be different. Typically, a long repayment period equals less repayment but leads to a large sum of interest payable at a later stage.

Fees: In some cases, lenders may add extra fees. These may include origination fees, which are used to process the loan, fees for late payment, or a penalty if you would like to prepay the loan early. Ask for these fees before agreeing to any loan.

Eligibility Criteria: The lender has their separate criteria for who can borrow the money. Some will demand a minimum credit score, while others will want a specific level of income and other conditions.

Customer Reviews: It is always good to check what other borrowers say about a lender. Reviews can tell you if the lender is reliable if they offer good customer service, and if there are any hidden fees or issues.

Best Installment Loan Providers for Bad Credit

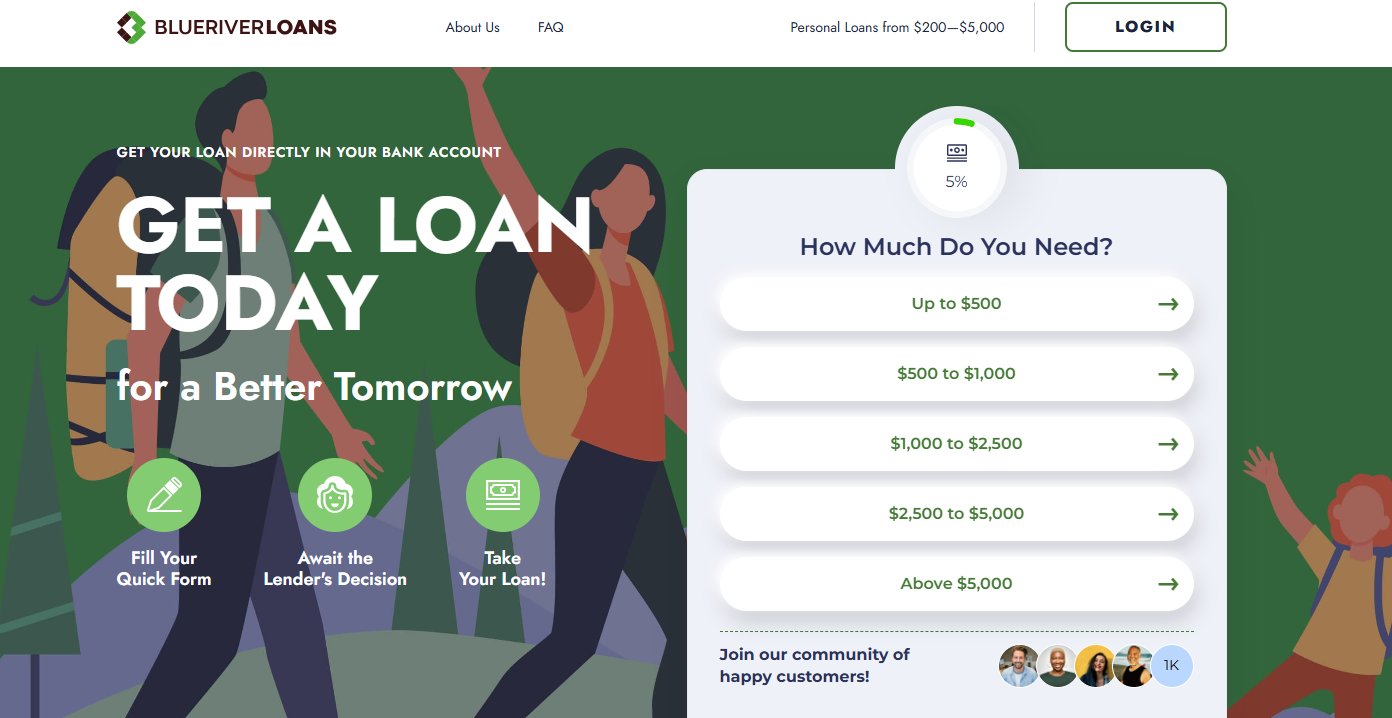

#1. Blue River Loan - Top Choice for Payday Installment Loans

Blue River Loan is one of the most in-demand lending services, especially to those with bad credit. Fast approval and easy application make Blue River Loan a lender that gives access to installment loans to those who need them most. Their flexible repayment options and competitive interest rates make it an option for people in financial stress. Blue River Loan is best for people who want to access cash fast but don't qualify for regular loans due to bad credit.

Key Features:

Loan Amounts: $500 to $5,000

Repayment Terms: 6 to 24 months

Approval Time: Fast approval process with quick funding

Collateral: No collateral is required

Repayment Flexibility: Borrowers can choose a repayment plan that suits their budget.

Pros:

Fast Funding: If you need cash quickly, Blue River Loan's fast processing time is one of its most attractive features.

No Hidden Fees: Unlike some lenders, Blue River Loan is transparent about fees so that you won't face any surprise charges.

Flexible Repayment Options: Adjust your payment schedule to your financial situation.

Cons:

Higher Interest Rates for Low Credit Scores: If you have poor credit, you may face higher rates, which could increase the cost of borrowing.

Strict Income Verification Requirements: The application process may require detailed proof of income to ensure your ability to repay the loan.

2. Now Personal Loan - Guaranteed Installment Loans for Bad Credit

Now Personal Loan also offer borrowers the opportunity to access installment loans, even for bad credit holders. Their goal isn't only to provide you with money but also to help you fix your credit scores. The application process offered is user-friendly, and the loans will be reported to the credit bureaus. As such, over time, this slowly improves the profiles of responsible borrowers.

Key Features:

Loan Amounts: $1,000 to $10,000

Repayment Terms: 12 to 60 months

Prepayment Penalties: No prepayment penalties

Credit Reporting: Reports to credit bureaus to help improve your credit score

Pros:

Long Repayment Periods: The extended repayment terms provide flexibility, allowing borrowers to make lower monthly payments.

Credit-Building Opportunities: By reporting your payments to credit bureaus, Now Personal Loan offers a chance to rebuild your credit score.

No Prepayment Penalties: You can pay off your loan early without incurring additional fees.

Cons:

High APR for Low Credit Scores: Borrowers with poor credit may be charged a higher APR, making the loan more expensive.

Longer Processing Time: Compared to other lenders, personal loans can now take longer to process and approve.

3. GetCash 4 Me - Emergency Loans for Bad Credit

GetCash 4 Me is an easy online lender with installment loans targeted at providing cash to people with a poor credit rating. Their lightweight application process allows for quick access to funds, often with same-day approval and funding. Being a direct lender, GetCash 4 Me requires minimal documentation, so the hassle of finding money quickly without going through a long process of application is alleviated.

Key Features:

Loan Amounts: $500 to $7,500

Repayment Terms: 6 to 36 months

Approval Time: Same-day approval and funding available

Credit Check: No hard credit inquiry for the initial application

Pros:

Fast Application Process: You can get approved quickly, sometimes even the same day you apply.

No Impact on Credit Score for Initial Inquiry: GetCash 4 Me doesn't perform a hard credit check during the inquiry process, which means it won't affect your credit score.

Flexible Eligibility Criteria: Even individuals with poor or limited credit history may be eligible for loans.

Cons:

Higher Fees and Interest Rates: Because of the minimal documentation and flexibility, GetCash 4 Me may charge higher interest rates and fees compared to traditional lenders.

Shorter Repayment Terms: The shorter repayment period may lead to higher monthly payments, which can be a strain for some borrowers.

4. Credit Lend - Best Choice for No Credit Check Loans

Credit Lend is an online lending site that offers installment loans with good competitive interest rates for people with poor credit. The application process is very easy and fast, and the loans are interest rate fixed, therefore enabling applicants to know ahead of time precisely what they will be obligated to pay in terms of interest payments on their borrowings. Credit Lend has made borrowing accessible and easy so that even those who have previously suffered bad credit can get borrowed.

Key Features:

Loan Amounts: $1,000 to $15,000

Repayment Terms: 12 to 48 months

Interest Rates: Competitive fixed interest rates

Collateral: No collateral is required

Pros:

Transparent Terms and Conditions: Credit Lend is clear about the costs and repayment terms, so there are no hidden surprises.

Easy Application Process: The online application is simple and quick, making it easy to get started.

Moderate Interest Rates for Qualified Borrowers: If you have a decent credit score, you might qualify for reasonable interest rates.

Cons:

Higher Rejection Rate for Very Low Credit Scores: Applicants with extremely poor credit may find it harder to qualify for a loan.

Processing Time May Vary: The loan approval and funding time can differ, so that you may experience delays compared to other lenders.

5. Wizzay - Instant Approval Payday Loans Offers

You can borrow a certain amount of money and pay it back over time in equal, fixed monthly installments with an installment loan. It's easy on the budget because you pay the same amount every month. Since interest rates are often fixed for these loans, you will always be aware of your monthly payment amount. The online application process is fast, and the company prides itself on offering personalized loan amounts that cater to individual needs.

Key Features:

Loan Amounts: $1,500 to $20,000

Repayment Terms: 24 to 60 months

Application Process: Online application with instant decision

Early Repayment: No penalties for early repayment

Pros:

Large Loan Amounts Available: Wizzay allows for larger loan amounts, which is beneficial for individuals who need substantial financial assistance.

Longer Repayment Terms: The longer repayment options offer more flexibility for borrowers, making monthly payments more affordable.

Competitive APR for Bad Credit Borrowers: Wizzay offers reasonable interest rates even for those with bad credit, making it an attractive option.

Cons:

Stricter Income Requirements: Wizzay may have higher income thresholds for loan approval, so it's important to meet those standards.

Interest Rates May Be Higher Than Expected: While Wizzay's rates are competitive, they could still be higher than traditional financial institutions, especially for borrowers with lower credit scores.

Tips to Improve Your Chances of Getting Approved for a Loan

If you have bad credit, then there are some things that can be done in order to get a better shot at installment loan approval.

Check Your Credit Report: Before applying for a loan, ensure that the credit report provided is accurate. Sometimes, you may find a mistake that impacts your credit score, such as wrong information related to payments or accounts. If errors are found, dispute them with the credit bureaus to ensure they are rectified. It could boost your credit score and ensure that you qualify for the application.

Show Evidence of Steady Income: Having a steady job or earning a regular income is important. If one can make his pay stub, bank statements, or any other proof of income, it assists the lender in getting confidence that there is a possibility one might be able to pay when due. The more stable the income is, the better the chances of approval are.

Consider cosigning: If you do not have such good credit, then you will need to have someone who has better credit cosign with you on this loan. If you can't pay for a loan, then it will be his or her problem. That's the difference, and it would make all the difference in having your loan approved and even being able to get the most favorable terms with regard to your interest rate.

Start with a Lower Amount of Money: In the event that you feel you won't be approved for a certain loan, you can borrow money in small sums. There's a probability that lenders are ready to approve such loans since they run less risk as a result. Once you prove you can handle small-sized loans, you'll find it possible to apply for big ones later.

Compare Different Lenders: Do not accept the first loan deal that falls your way. The various lenders have their own criteria for approving a loan, interest rates, and so forth. Shopping around can land you a perfect deal that is ideal for you. Some lenders are more flexible or can grant you better terms due to the financial situations that you may find yourself in. Give yourself some time to compare and pick the right one that is going to fit your needs.

Conclusion

With the proper approach and lender, you may get the best installment loan for bad credit. Among the flexible options are Blue River Loan, Now Personal Loan, GetCash 4 Me, Credit Lend, and Wizzay, which cater to people who experience challenges in getting credits. In this way, you can make the best decision with respect to what would be the right choice for you according to the interest rates, terms of repaying, and charges.

FAQs

What is the difference between an installment loan and a payday loan?

An installment loan requires paying over time in fixed monthly installments, often at a lower interest rate. A payday loan is short-term, typically due on your next payday, and often comes with much higher interest rates and fees.

Is it possible to get an installment loan for bad credit?

Absolutely, many lenders provide poor-credit loans that are specifically designed for people with poor credit. However, expect a higher interest rate and cost because these companies advance a higher risk in lending money.

Can I pay my installment loan early penalty-free?

Most lenders, including Now Personal Loan and Wizzay, permit the early repayment of the amount without penalty. Still, it is always advisable to check first the terms of the loan prior to its condition and whether early redemption is allowed with some added extra charge.

Will applying for an installment loan affect my credit score?

In some cases, lenders such as GetCash 4 Me will not do a hard credit inquiry when applying. This will not affect your credit score. However, some other lenders will conduct a hard credit check that might have a minor effect on your credit score.

Project Name: Loans At Last

Registered Office Address: 1095 Sugar View Dr Ste 500 Sheridan, WY 82801

Company Website: https://loansatlast.com/

Email: smith@loansatlast.com

Phone: 307-777-7311

Contact person name: Smith

Contact person email: smith@loansatlast.com

SOURCE: Loans At Last

View the original press release on ACCESS Newswire